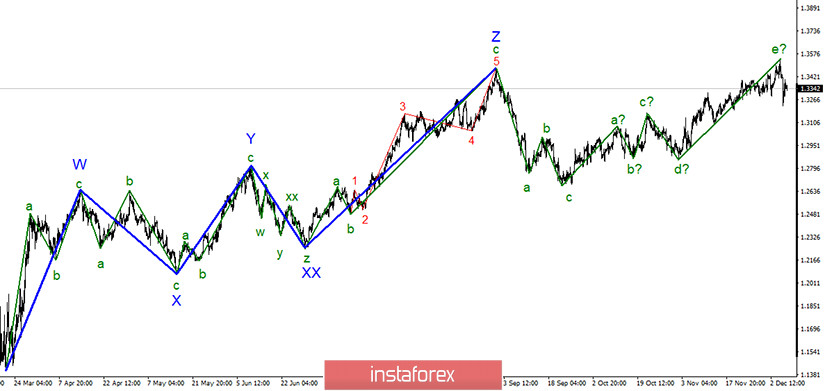

In the most global terms, the construction of an upward trend continues even though the quotes are moving away from the previously reached highs. Moreover, the wave pattern looks convincing enough to be considered complete as of this moment. Five waves are built up as part of a non-impulse section of the trend. The attempt to break the maximum of the previous global wave Z was unsuccessful. Thus, the markets now can start selling the British dollar which has been brewing for a long time.

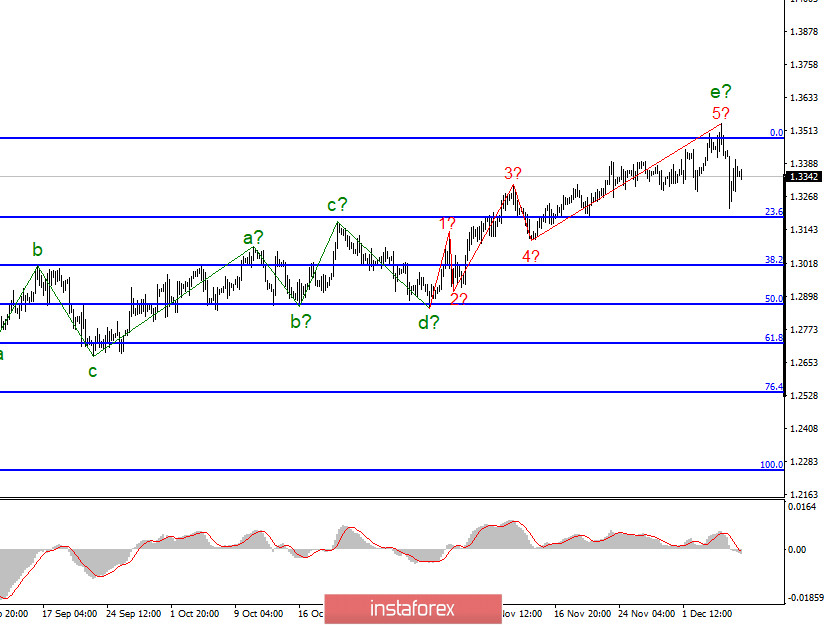

The lower chart clearly shows the a-b-c-d-e waves of the upward trend section. The assumed wave e took a five-wave form, which is also visible on the chart. However, even with this complication, it is nearing completion. As I expected, the tool started building a minimum correction three-wave section of the trend. A decline in quotes may also mean the end of the upward section and it will no longer be complicated. It depends much on the news background at this time and it remains not too favorable for the British.

There was no interesting news in America or the UK yesterday. However, the Pound / Dollar instrument was still trading very actively, in fact, it's even more active than the usual. Markets feel that the series called "brexit negotiations" is nearing its end. And the closer the end, the more worried the markets are. In the past months, the British pound has been rising quite actively. If in March this year it fell to absolute lows around 14 figures, it reached 35 figures in December. Of course, at least half of the distance traveled can not be taken into account, since initially the British dollar fell so seriously due to the panic in the foreign exchange market caused by the first wave of coronavirus and the crisis that it caused in the spring of this year. Nevertheless, the British pound was clearly in demand due to the fact that the markets believed in London and Brussels for the past weeks. Given that it is not profitable for anyone to complete Brexit without a trade agreement, markets continued to believe that a deal would be agreed. However, the parties have already exceeded all the maximum allowed terms of negotiations. Today, the negotiations were supposed to end three weeks ago according to the EU and Britain, so that the parliaments of both parties could get acquainted with the agreement and ratify it. However, there is still no agreement and judging by the latest comments of the participants in the negotiation process, the deal is again at an impasse and the issues that were unresolved a month ago remained up to this day. Boris Johnson also said once again that the UK is ready to leave the EU without a deal. Other UK Ministers and EU diplomats have previously said the same thing. Thus, the question arises, do the parties want to agree at all or they're just playing on each other's nerves?

General Conclusions and Recommendations:

The Pound-Dollar instrument is expected to have completed the construction of an upward trend section. So, now I recommend looking closely at the sales of the tool. The British man will probably be aiming for 29. I expect to build at least three wave formations for this purpose. Thus, I recommend selling at this time the instrument for each MACD signal "down" with targets located near the calculated marks of 1.3012 and 1.2866.