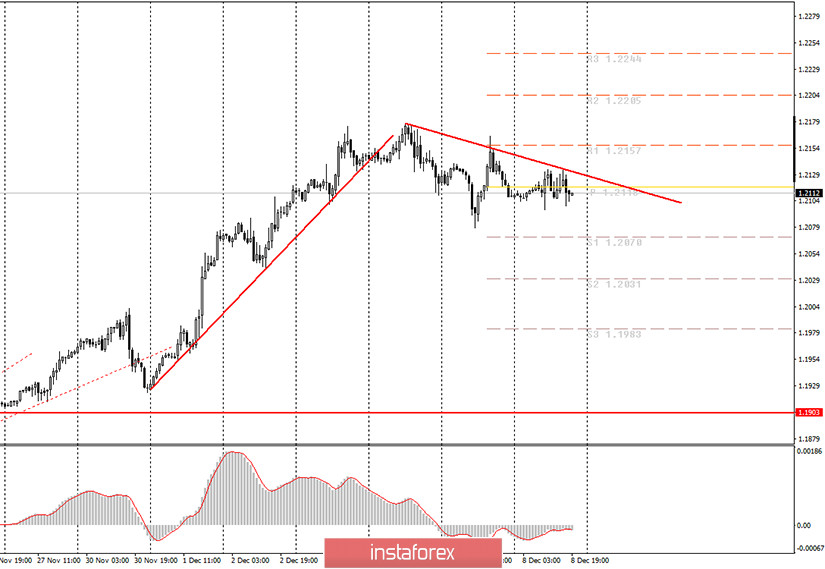

Hourly chart of the EUR/USD pair

On Tuesday, the EUR/USD pair tried with all its might to continue the downward movement it started. Yesterday evening we suggested that you should either wait for a sell signal from the MACD near the zero level, or immediately open short positions, but with a Stop Loss above 1.2162. In the first case, the signal never appeared, in the second, traders could get 10-15 points of profit, since the quotes were in a very narrow price range for most of the day. However, a new downward trend line has also appeared today, which is now showing a downward trend. The general downward movement is extremely weak and does not pretend to be more than a correction. Therefore, if sellers do not find grounds for more active trading in the coming days, then we expect the upward trend to resume and the downward trend line to be broken. As you can see, sellers have absolutely no strength now.

The EU published its third quarter GDP in its third estimate. Despite the fact that it was expected to remain unchanged compared to the second estimate, the value of GDP deteriorated to +12.5% q/q. Therefore, the markets had excellent grounds for selling the euro. But instead, as usual, they ignored the reports and continued indistinct trading all day. Naturally, with such an attitude, the report on economic sentiment from the ZEW institute did not matter at all. We did not receive any more important information today. However, this is clearly visible from the nature of the pair's movement during the day.

No macroeconomic report from the EU and the US on Wednesday. But we are gradually approaching the European Central Bank meeting and the EU summit, where the fate of the budget allocation for 2021-2027 will be decided, as well as the allocation of the 750 billion euro recovery fund. We wrote about these events yesterday. Despite the fact that we do not expect any positive (hawkish) information either from the first event, or from the second, the euro can still rise in price, since markets are still ignoring both macroeconomic and fundamental background. The euro's recent growth still best fits the meaning of the word speculative.

Possible scenarios for December 9:

1) Long positions are no longer relevant at the moment, since there is a weak downward trend supported by the trend line. Thus, for long deals on the pair, it is necessary for you to wait until the price settles above the trend line and in this case to trade upward while aiming for 1.2157 and 1.2205.

2) Trading down on Tuesday-Wednesday would be more appropriate. We believe that the EUR/USD pair can make a new downward spurt. Thus, taking into account the rebound from the trend line, we advise you to open short positions while aiming for 1.2070 and 1.2031. However, at the same time, we warn novice traders that the likelihood that the euro would fall today or tomorrow is not that high. Therefore, in this case, it is better to set a Stop Loss above the trend line.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.