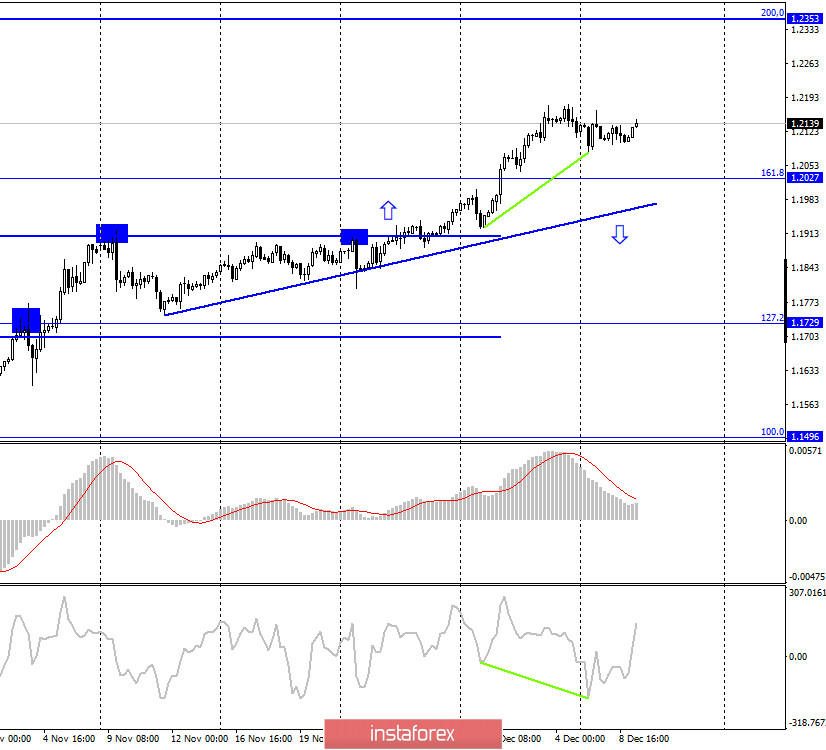

EUR/USD – 1H.

On December 8, the EUR/USD pair fell to the ascending trend line, rebounded from it, and turned in favor of the European currency. Thus, at the moment, the growth process has resumed in the direction of the corrective level of 261.8% (1.2202). Closing the pair's rate under the trend line will indicate a change in traders' mood to "bearish" and increase the probability of a further fall in quotes in the direction of the Fibo level of 161.8% (1.2027). At the beginning of this trading week, there were almost no important news and events. Nothing interesting is happening in America right now. All major government departments are preparing for the transfer of power. There has been talk that Democrats and Republicans will return to the negotiating table for a new package of assistance to the American unemployed, small businesses, and all those in need of about $ 1 trillion, however, they are still just talk. The situation in the European Union is more interesting. This week, the ECB meeting will be held and the European Union summit will also start tomorrow, where many important issues will be resolved. In particular, the issue of the recovery fund and the EU budget, which were blocked by Poland and Hungary, will be resolved. Thus, the issue of preserving the integrity of the EU will be resolved. The whole process can end with anything. Sanctions against Poland and Hungary, their removal from the fund and budget, and the EU's failed attempt to circumvent the veto. This is a very interesting process, and it is very important for the euro currency.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes, after the formation of a bullish divergence in the CCI indicator, attempt to resume the growth process in the direction of the corrective level of 200.0% (1.2353). Closing the pair's exchange rate under the low divergence will work in favor of the US currency and continue to fall in the direction of the upward trend line.

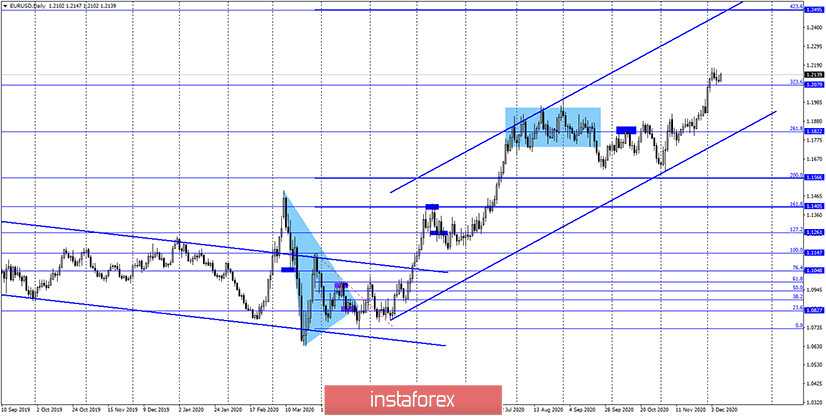

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079). Thus, the probability of continuing growth in the direction of the next corrective level of 423.6% (1.2495) increased. And until the pair completes the consolidation below the level of 323.6%, there are still high chances of continued growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 8, the European Union released a report on GDP in the third quarter, which showed an increase of 12.5% q/q and a fall of 4.3% y/y. Traders did not find anything interesting in this report.

News calendar for the US and the EU:

On December 9, the EU and US calendars are empty. Therefore, the information background will still be absent today. News will start arriving tomorrow, and very interesting news.

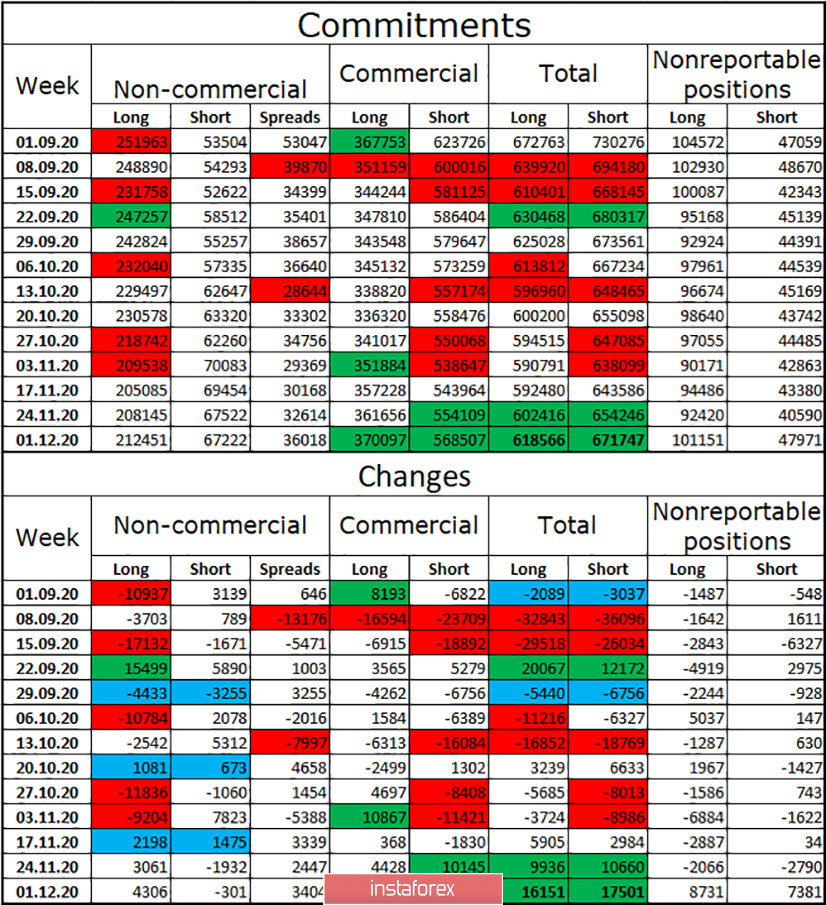

COT (Commitments of Traders) report:

For the third week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. During the reporting week, speculators opened 4306 new long contracts and closed 301 short contracts. However, I would like to draw your attention to the fact that in the last two weeks, traders of the "Commercial" category have become very active, who have opened a total of 35 thousand contracts, most of which are short. But I still pay more attention to speculators. Their activity has been low in recent weeks, and purchases of the euro currency are extremely cautious as if forced. I still believe that the uptrend in the euro is nearing its end.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with the target of the Fibo level of 161.8% (1.2027), if the close is made under the trend line on the hourly chart. Purchases of the pair should have been opened with the target of a corrective level of 261.8% (1.2202), as a rebound from the trend line on the hourly chart was performed. You can close them without waiting for the goal to be reached.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.