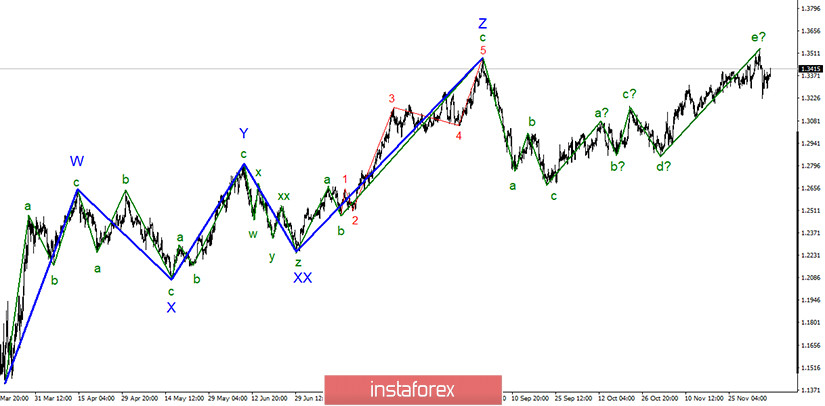

In the most global terms, the upward section of the trend continues to be formed, even despite the departure of quotes from the previously reached highs. Moreover, the wave pattern currently looks quite convincing to be considered complete. The upward wave 5 serves as part of the non-impulse trend section. On the other hand, there was a failed attempt to break through the high of the previous global wave Z. Thus, the markets can now begin selling the pound, which is prepared for a long time.

The quotes left the previously reached highs in the smaller time frame, however, the pound's demand is recently growing again, so the entire wave pattern of the upward trend section may become more complicated again and take on an even longer form. Despite the lack of positive news about Brexit, the markets are not in a rush to get rid of the British currency. This leads to more complications of the wave pattern. Today, the instrument has already added about 80 basis points.

The negotiating teams of Michel Barnier and David Frost failed to agree on a trade deal. Mr. Barnier, head of the EU negotiating team, said yesterday that there are still significant differences between the parties on three key issues, and he personally believes that the likelihood of a deal is low. So, Prime Minister Boris Johnson personally went to Brussels to meet European Commission's head, Ursula von der Leyen, in order to break the dilemma in the negotiations. It should be recalled that this is not the first meeting of politicians in the context of the Brexit negotiations. Given that the previous meetings did not produce much results, we do not expect that the parties will agree this time. Boris Johnson and Ursula von der Leyen will have to sort out whether there are still opportunities to reach an agreement, or whether they are all completely exhausted. However, it is possible that there will be a conversation about the possible continuation of negotiations in 2021. The EU has repeatedly made it clear that it is ready to extend the terms of negotiations in order to finally conclude an agreement without hurry, but it was Boris Johnson who refused to extend the transition period. In any case, we must now wait for the results of these negotiations. It seems that the markets continue to hope for the best, as the pound is in demand again.

All other news for the pound/dollar pair is not important now. In any case, there is no other news at the moment. No economic report was published in either the UK or the United States in the first three days of the week. Thus, the markets continue to trade exclusively on their own expectations of the negotiations' results. Tomorrow morning, several UK reports will be released. These include reports on GDP, industrial production, and trade balance. However, this is unlikely to attract markets' attention, since they will continue to focus on Brexit and trade negotiations.

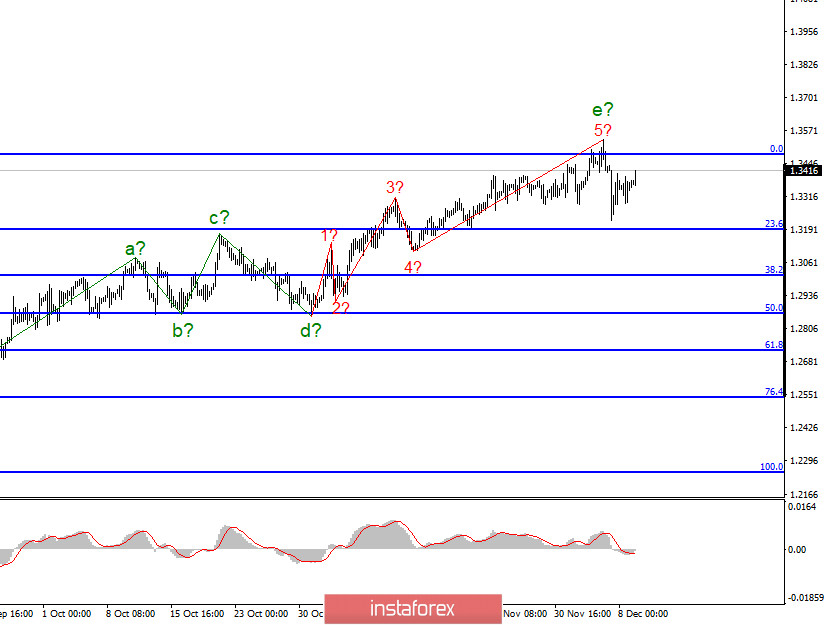

Recommendations and conclusions:

Supposedly, the pound/dollar instrument has completed the upward trend. Thus, I recommend to closely monitor the sales of this instrument. The pound is likely to target the 29th mark, so I expect to build at least a three-wave form. At the moment, I suggest to sell the instrument for each MACD sell signals with targets set near the calculated levels of 1.3012 and 1.2866. A successful attempt to break through the 0.0% Fibonacci level will complicate the upward trend and will cancel the sell option.