The growth of stock markets in the middle of the week is supported by the same factors – news about the vaccine and expectations of incentives for the US economy. Congress is still unable to agree on the amount of funding, while investors continue to hope that a compromise solution will be found between Republicans and Democrats by the end of the year. On Tuesday, major US indices hit new highs after reports that the Treasury Secretary proposed a new fiscal stimulus plan to Congress.

The dollar retreated against this background, although before the news it was seriously set to recover. The USD index tried to break up 91 points, now it is again at 90. As previously noted by analysts, this level will act as an obstacle for a long time, and the main struggle will unfold here.

Delaying the process of allocating incentives in the US and uncertainty in the Brexit negotiations may worsen investor sentiment and turn their attention back to defensive assets.

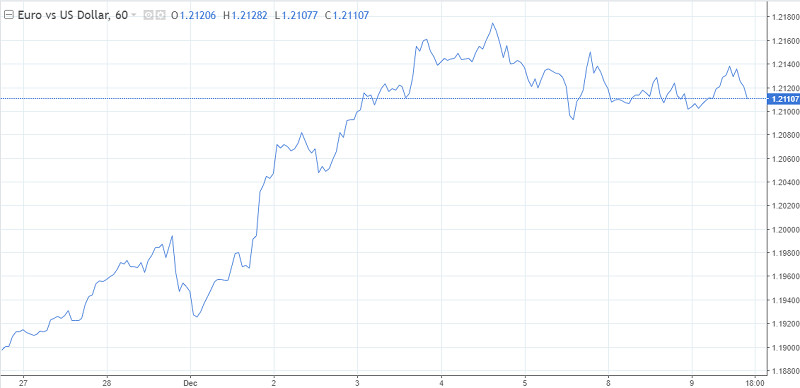

As for the euro, the correction movement has not been developed. The EUR/USD pair is still hovering around 1.2150. In principle, it is not worth waiting for something else from this pair yet.

Traders lay low ahead of the European Central Bank's meeting on Thursday. There's no point in taking any chances now. Tomorrow, the regulator will announce its decision on the rate, and at the next press conference after the meeting, officials will make some statements. It is impossible to predict them, so it is better to wait. As an option, the Central Bank may expand its quantitative easing program, but this will not come as a surprise to the markets.

The calendar of events for Wednesday is sparse, so, as in the previous two sessions, we pay attention to the technique.

The European regulator has published an updated report on changes in assets on the balance sheet – the growth rate is the highest since October. For the week, the figure increased by 39 billion euros compared to 15 billion a week earlier. This is bad news for the euro, as the growth of assets on the balance sheet is a deterrent for the euro.

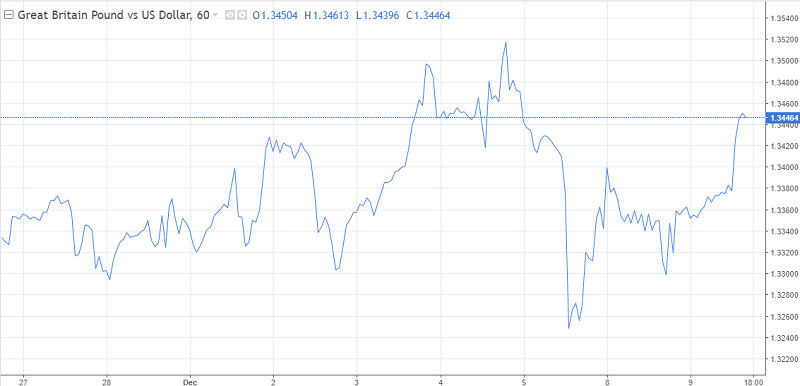

The volatility of the pound remains elevated, it easily overcomes the obstacle of one or two figures up or down against the dollar. Now traders are waiting for the next batch of news on the trade deal between Brussels and London. On Wednesday, the British Prime Minister meets with the head of the European Commission to settle some contradictions in the sphere of trade relations. Meanwhile, the risk of a disorderly Brexit is back on the agenda.

Boris Johnson continues to threaten Europe. According to him, the negotiations with the EU may end at any time, but we have already gone through this, more than once, so the markets are not in a hurry to take the Prime Minister's emotional attacks seriously.

Markets will focus on the scheduled meeting of Boris Johnson and Ursula von der Leyen in Brussels. This event is seen as the last chance to conclude a trade agreement. Sterling has stabilized above recent lows around 1.3250.