The eurozone's largest economy is suffering from the coronavirus pandemic. During the last 24 hours, 590 people were tested positive and the overall number of deaths exceeded 20 thousand.

The number of new virus cases is rising despite the quarantine measures that led to the closure of bars, gyms, and cinemas. However, it is not enough to halt the virus spread.

Tough quarantine measures is the main issue in Germany.

Angela Merkel insists on even tougher measures. She emphasizes that it is necessary to make the decision as soon as possible. The deadline is December 24.

The German government is planning to impose stricter containment measures just after Christmas from December 27 to January 3 or 10. During this period, only supermarkets will be opened. Holidays at schools may begin earlier and will be a week longer.

During the upcoming days, Angela Merkel will meet with the heads of the regions to decide on the issue.

Notably, Bavaria and Saxony have already tightened the quarantine. In Munich, additional restrictions were introduced from December 9, and in Dresden - from December 14. Saxony closes all stores except for food stores, schools, and kindergartens.

The situation is really alarming. Scientists have already developed the vaccine against this virus, but the global epidemiological situation has not changed yet.

Epidemiologists agree on the fact that the normalization of the situation will take a lot of time. Moreover, there is an allergic reaction to the Pfizer vaccine, and some people may even die. Amid this background, the V-shaped economic recovery may be replaced by the W-shaped recovery model.

The single currency reached the high logged in 2018. The euro is significantly overbought. That is why the news about tougher measures may lead to a drop in the euro.

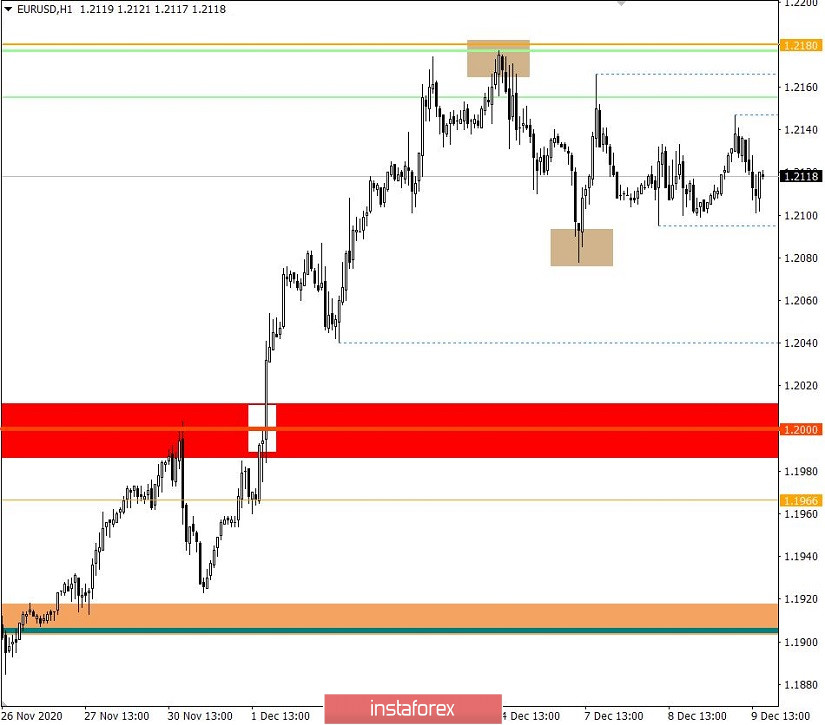

According to the technical analysis, the euro dropped just by 100 pips from the local high of 1.2177. Judging by the previous uptrend, this decline is insignificant.

The fluctuation of the price, that occured later, looks like accumulation. The quote is likely to move sideways.

On December 8, the market dynamic was just 38 pips. It is the lowest reading in 17 trading days. Such a slowdown in the activity proves the accumulation process that may lead to sharp changes in the price.

On the daily trading chart, we can see that the price is hovering at the peak of its inertial uptrend.

Today, there are no important reports from Europe. The market is waiting for tomorrow's meeting of the ECB. At the same time, the US will release the job openings figures. According to the forecast, job openings may slide to 6,400 thousand from 6,436 thousand. However, market participants may ignore the data, as it will be released at the end of the European session.

On the chart, we can see that the price is hovering in the range showing very low activity. That is why the quote may accelerate in the near future.

The local low of this week is 1.2078 and the local high is 1.2177. These levels are located far from the current range of 1.2095/1.2140.

Thus, a break of either limit will result in the acceleration.

Buy positions could be opened above 1.2180 with the targeted level at 1.2250.

Sell positions could be opened below 1.2070 with the target at 1.2000.

At the same time, traders should take into the news flow. There are two burning issues, COVID-19 and Brexit.

News about the coronavirus (restrictive measures in Germany) may be a signal of a drop in the euro. The market's reaction could be slow.

News about Brexit. At the moment, representatives of the EU and the UK are discussing the most thorny issues of the trade deal. Traders should closely monitor the latest news. Positive information will result in the euro's advance while negative news will lead to its depreciation.

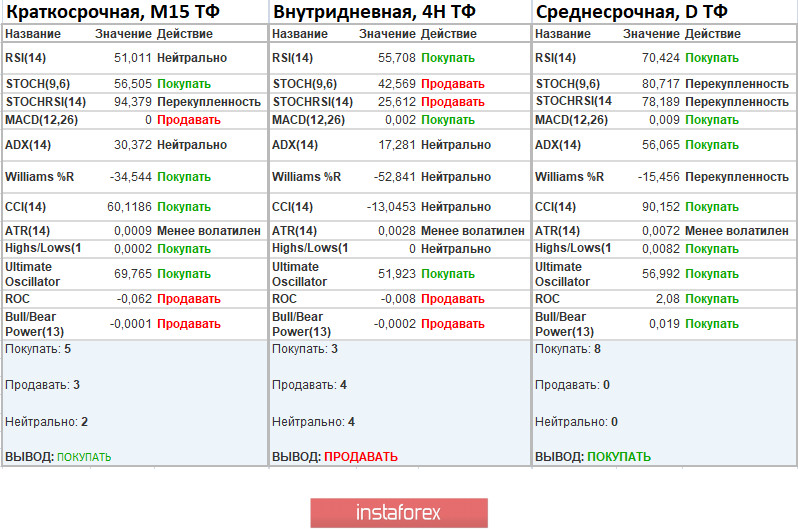

Indicator analysis

Analyzing various time frames, we can see buy signals on the one-minute chart. On the one-hour chart, there are sell signals. However, due to the prolonged sideways movement, these signals may change.

The daily chart provides us with sell signals.

Volatility for the week/Measurement of volatility: month, quarter, year

The volatility measurement reflects the average daily fluctuation calculated for a month/quarter/year.

At the moment, the market dynamics is 46 pips that is 38% below the average reading. However, it may increase due to fresh news and accumulation.

Key levels

Resistance levels: 1.2180*; 1.2450**; 1.2550; 1.2825.

Support levels: 1.2000***; 1.1 890-1.1900-1.1920**; 1.1810*; 1.1700.

* Periodic level

** Range level

***Psychological level