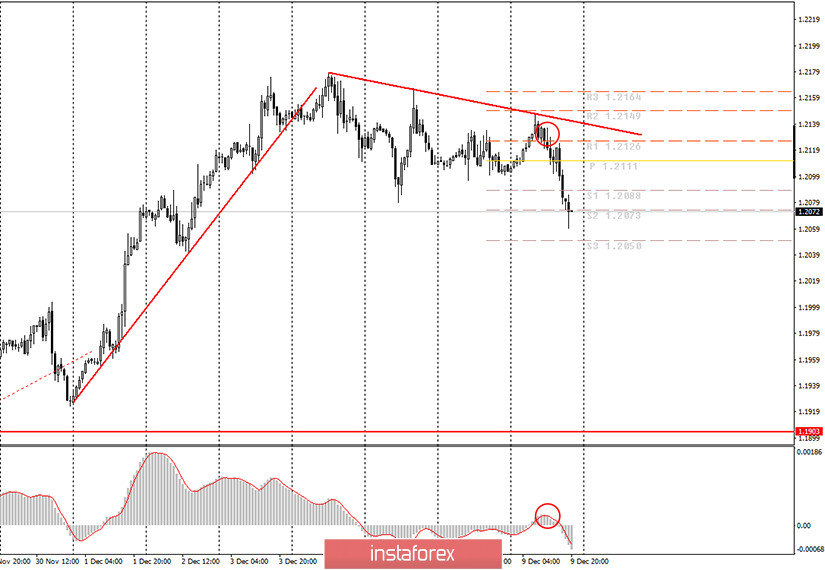

Hourly chart of the EUR/USD pair

The EUR/USD pair initially tried to move up, and then it fell and started a downward movement. The trend line had to be rebuilt, since the last price peak was perfect for this. The trend line currently passes through three peaks and is considered stronger than before. A sell signal from MACD was also generated today. This indicator was previously discharged to the zero level and even slightly higher, so the signal turned out to be quite strong. Thus, novice traders had to re-evaluate the current picture in the morning and open new short positions. At the moment, the profit is around 60 points. Even if novice traders opened long positions on the pair as it settled above the previous trend line, they could receive minimal losses on this deal. Considering the fact that it did so at night, it is unlikely that any of the novice traders rejected this false signal. In any case, the profit on the short trade exceeded the loss on the long trade.

No macroeconomic report or event from the EU and the US on Wednesday. However, as we can see now, the pair was still quite actively being traded today. The downward movement has resumed, although it still falls under the definition of a correction against the previous upward movement. We believe that the euro began to fall today because traders do not expect positive news from tomorrow's ECB meeting and, moreover, the EU summit.

As mentioned above, tomorrow, the European Union will sum up the results of the ECB meeting. The central bank will announce its decision on interest rates, but none of the market participants expects it to change. The ECB has not changed their stance in 2020. However, it is quite possible that the central bank will announce an increase in the economic stimulus program. In this case, we are talking about the PEPP program - a program to counter the economic consequences of the pandemic. The expansion of this program will mean that the central bank will buy more securities from the open market and pour cash into the economy, stimulating it to grow. Such actions of the central bank are considered dovish (aimed at supporting the economy), therefore, the euro is falling at this time and may continue to do so tomorrow. In addition, a press conference will be held by the ECB and the EU summit will also begin tomorrow, at which the issue of blocking the budget for seven years and the recovery fund by Poland and Hungary will be decided. A conflict is brewing in the EUon and this summit will be called upon to resolve it.

Possible scenarios for December 10:

1) Long positions are not relevant at the moment, since there is a weak downward trend supported by the trend line. Thus, for long deals on the pair, it is necessary for you to wait until the price settles above the trend line and in this case to trade upward while aiming for 1.2149 and 1.2164.

2) It would be more appropriate to trade on Thursday. You can continue to open short positions until the MACD indicator reverses upwards, but this can happen at night. Novice traders themselves must decide whether to close their short deals now or wait for maximum profit. You are advised to open new sell orders after an upward correction and a new MACD sell signal.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.