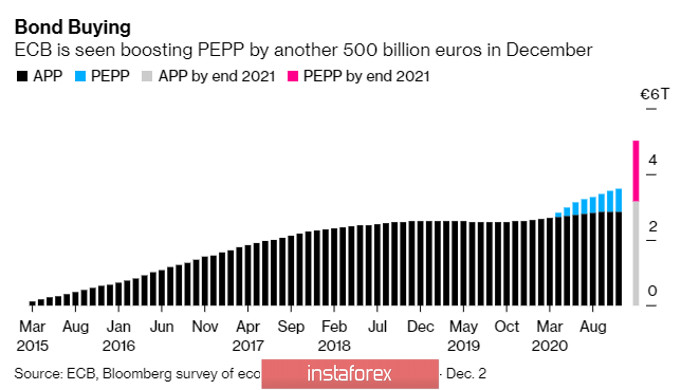

The European currency is slowly losing ground against the US dollar and this is not surprising, since the European Central Bank is expected to announce an expansion of the asset purchase program at the end of the meeting. All the money will go to help the Euro zone overcome the coronavirus pandemic crisis. The ECB is expected to announce additional asset purchases worth 500 billion euros and extend this program until at least the end of 2021. The goal of this decision is to preserve as closely as possible the financing conditions that were observed this year during the crisis caused by the economic lockdown and coronavirus. This money will be provided together with the EU's expanded budget project, which is estimated at 1.8 trillion euros. Its discussion will continue today. Also, do not forget about the EU recovery Fund, which was formed this summer for more than 900 billion euros.

Many economists also expect today that the ECB's Governing Council will provide new long-term loans to EU banks. Although this tool was tested before the pandemic, the need for it is still relevant today. Through current loans, the ECB provides cheaper credit lines to banks, which then provide loans to the population and businesses. This program is also expected to be extended.

As for interest rates, they are unlikely to change at this meeting. Economists predict that the deposit rate will remain at the level of 0.5%. The key interest rate will also remain unchanged.

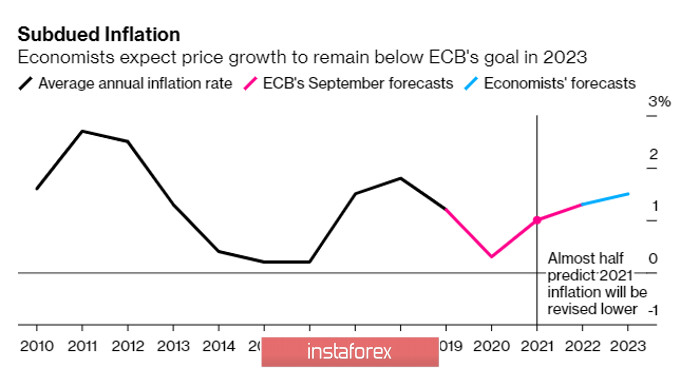

Special attention will be drawn to economic forecasts from the ECB. They are expected to be reviewed. Despite the fact that the economic recovery in the third quarter of this year was stronger than expected, the subsequent wave of coronavirus infections led to a partial lockdown of the European economy, and therefore forecasts will be revised for the worse. In her latest speech, European Central Bank President Christine Lagarde said that the recent development of a vaccine does not change the rules of the game. This year, even though a less serious decline is expected, a significant revision of forecasts will affect 2021. It is particularly important to know what the forecast for inflation will be by 2023, when it is expected to return to the target value. Economists predict that inflation will remain well below the ECB's targets, which could put serious pressure on future decisions of the regulator.

As for the prospects of strengthening the European currency in the future, one of the risks that came to the fore again was the Euro exchange rate. Many expected that the Euro is unlikely to be higher than the 20th figure, but since the summer of this year, it has significantly strengthened, practically updating the 22nd figure. This makes exports from the currency bloc less competitive and puts downward pressure on inflation through cheaper imports. In recent statements, the European Central Bank has often stressed that it does not target verbal interventions or exchange rate changes. But the observed growth creates much more difficulties in the future, which will affect the rate of recovery of the Euro zone economy in the post-crisis period.

If the impasse with the EU Recovery Fund and the expanded seven-year budget will be overcome, it will lead to a new round of demand for risky assets which will only strengthen the Euro's position against the US dollar.

As for the technical picture of the EUR USD pair, the trading instrument continues to be under pressure. If today's decisions put pressure on the Euro, then the fall will continue to the area of 1.2040 and 1.1980 lows. It will be possible to talk about the resumption of bullish momentum only after the breakout of the resistance level of 1.2145, which will open a direct path to a new annual highs in the area of 1.2250 and 1.2340.

GBPUSD

During the Asian session, the British pound reacted on a large drop in the pair with the US dollar, after the news that the dinner of British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen ended in another failure and further dialogue after the evening meal did not take place. Now, the Brexit negotiators have until the end of this week to reach an agreement. The leaders agreed that negotiations should continue in the next few days, despite the continuing serious differences between the UK and the European Union over what their future trade relationship should look like. Both sides said a firm decision on the future agreement would need to be made by December 13.

Let me remind you that the parties cannot agree on 4 key areas. One of the most pressing issues is the significant disagreement over access to fishing areas in the UK. Another stumbling block remains the principles of decision-making on the provision of state support. There are also many questions about the legal regime imposed by the EU, according to which the UK will need to strengthen standards for labor protection, the environment and social security. Well, the whole puzzle is completed by the measures that the parties can resort to in the event of a violation of the transaction by one of the parties.

The team of negotiators hoped that Boris Johnson's personal meeting with von der Leyen would give this process a new political impetus. But their meeting over a dinner of scallops and halibut didn't lead to a reboot. In a tweet, von der Leyen wrote after the meeting that "we understand each other's positions but our views are very different." Leyen said that the team should immediately meet again to resume dialogue in an attempt to resolve these issues. According to some senior UK officials, Boris Johnson wants to try out all the ways to reach an agreement on a trade deal, and it is not yet clear whether the serious obstacles that exist at the moment will be eliminated.

Today, the last EU summit of the year starts in Brussels where it is quite possible that the issue of a trade deal with the UK will be considered. At the very least, Von der Leyen should inform EU leaders about the outcome of the dinner. As noted, the dinner was quite constructive and there was a certain optimism and desire to conclude a deal between the two leaders and their officials. But as we know from the previous similar meetings, this is not enough. Although everyone is optimistic, no one wants to give in.

As for the technical picture of the GBP USD pair, it has not changed much compared to yesterday. The first goal of sellers of the trading instrument is to support 1.3340. Its breakout will quickly push the pound to the lows of this week in the area of 1.2390 and 1.3220. It will be possible to talk about the resumption of the bull market only after a breakout and consolidation above the resistance of 1.3380, which will push risk lovers to build up long positions with the main goal of updating the highs of 1.3440 and 1.3490.