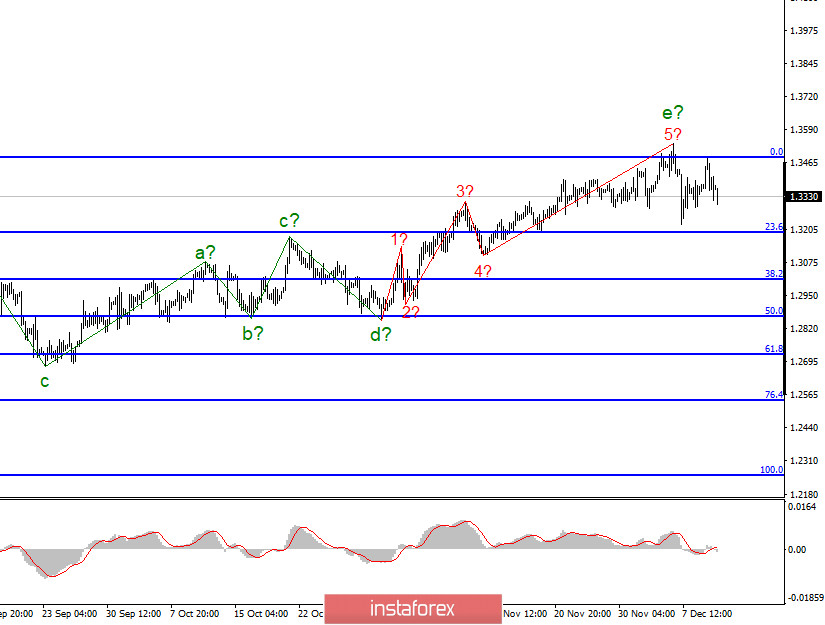

In the most global terms, the construction of an upward trend continues, even though the quotes are moving away from the previously reached highs. Moreover, at the moment, the wave pattern looks convincing enough to be considered complete. Five waves are built up as part of a non-impulse section of the trend. The attempt to break the maximum of the previous global wave Z was unsuccessful. Thus, now the markets can start selling the British dollar, which has been brewing for a long time.

On the lower chart, the same chart shows a departure of quotes from the previously reached highs, however, the entire wave marking of the upward trend section may once again become more complicated and take an even longer form. Despite the lack of positive news about Brexit, markets are in no hurry to get rid of the British currency. Thus, everything may even end up with just three small waves building down, after which the construction of the upward trend section will resume. Although with the current news background, this is hard to believe.

The negotiating teams of Michel Barnier and David Frost took a short break, and Boris Johnson and Ursula von der Leyen discussed the deal instead. However, the President of the European Commission and the British Prime Minister failed to show greater effectiveness than Barnier and Frost. After the meeting was over, both sides made a statement that no progress had been made and the differences remained very serious. And then there was information that Johnson and Leyen also decided to allow time until Sunday for the negotiating delegations to try to break the deadlock. Many analysts are already calling the whole process a pun. Every two or three days, the parties report a lack of progress, talk about a catastrophic lack of time, and extend the negotiations for several more days. What's the point? When will London and Brussels simply announce that they failed to reach an agreement? "Our friends in the EU insist that they have the right to punish us or take retaliatory measures if they adopt a new law in the future, and we in our country do not comply with it or do not adopt the same one. They are demanding that Britain is the only country in the world that does not have sovereign rights over their fishing grounds. I think no Prime Minister of our country would agree to such conditions," Boris Johnson said. So, given the nature of the disagreement, I believe that a deal cannot be reached in principle. London wants to maintain access to the European market as if the UK remained in the EU, which in itself sounds absurd. But it does not want to make concessions to maintain access to the huge European market. The differences are insurmountable.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward trend section. Thus, now I recommend looking closely at the sales of the tool. The Briton will probably be aiming for the 29th figure now. I expect to build at least three wave formations for this purpose. Thus, at this time, I recommend selling the instrument for each MACD signal "down" with targets located near the calculated marks of 1.3012 and 1.2866. A successful attempt to break through the 0.0% Fibonacci level will indicate a new complication of the upward trend section and cancel the sales option.