Bitcoin falls below the psychological level of 40,000, due to the uncertainty of what the Fed will do at its nearest meeting. There are no signs of a recent recovery and overall market sentiment is notoriously bearish. The price of Bitcoin fell as a result of another surge in the consumer price in the US.

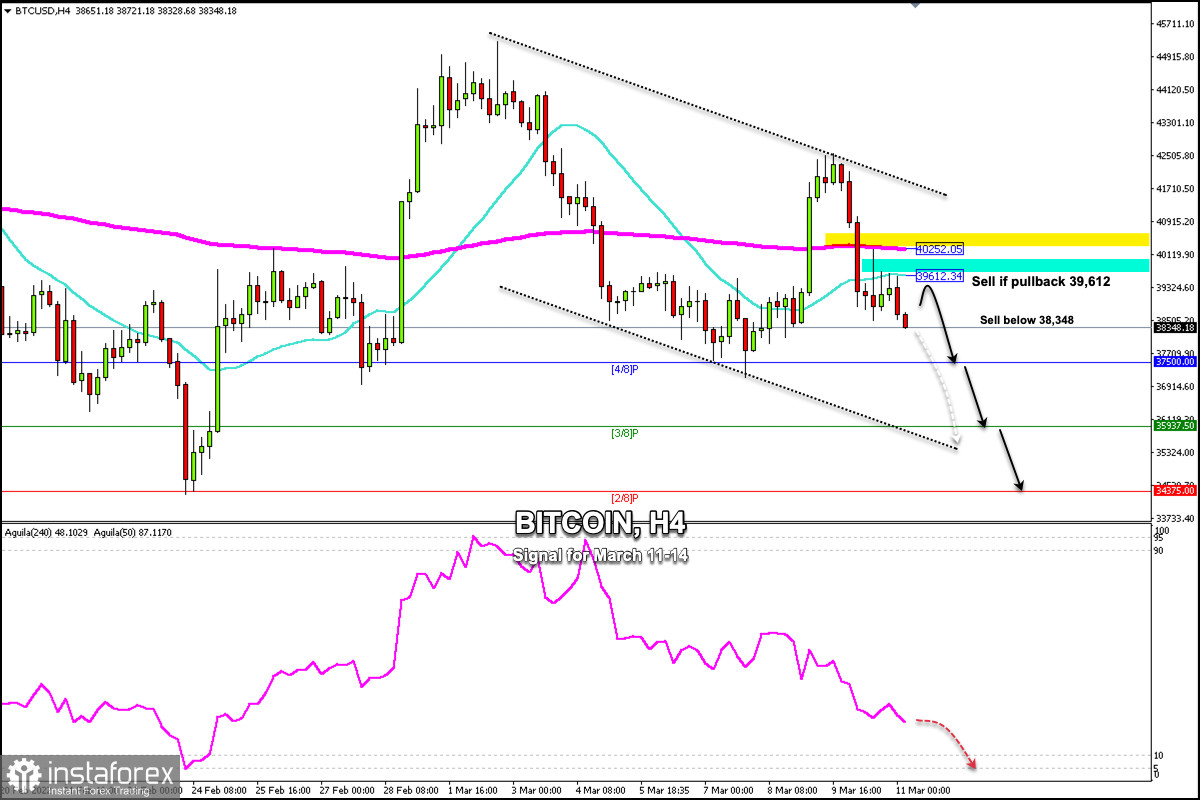

Yesterday in the European session, Bitcoin made a rally towards the 200 EMA around 40,252. However, it failed to break and hold above it, then started a drop to levels below the 21 SMA falling to 38,348.

This weakness in BTC is due to investors taking a cautious stance on US inflation data. If the Fed raises its interest rate by around 50 basis points, it could pressure BTC and it will fall to the level $25,000.

The increase in inflation has been negative for BTC in recent months, since BTC has always been a risky asset. Investors now prefer to take refuge in gold and the US dollar.

Since March 8, the top 10 altcoins including Ethereum, Ripple, and Cardano have lost over 15%. Besides, since yesterday, the total market capitalization has shrunk.

Recent sanctions against Russia for its invasion of Ukraine are likely to push up inflation this year. Rising food and energy prices will affect the ability of retail traders to invest in cryptocurrencies that will negatively affect the cryptocurrency market.

There is also speculation that rising costs could trigger a recession this year, an extremely unfavorable factor for risk assets. This scenario means that BTC and altcoins could be heading for a downtrend until the end of the year.

Our trading plan for the next few hours is to sell BTC below the 21 SMA or below the psychological level of 40,000 (200 EMA) with targets at 4/8 Murray around 37,500 and towards the support 2/8 Murray at 34,375.