What is needed to open long positions on GBP/USD

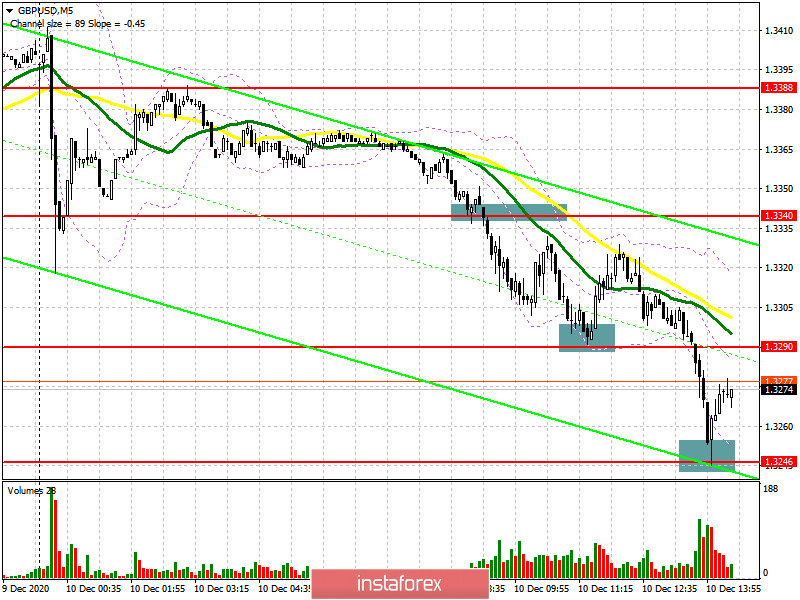

In the first half of the day, traders received a lot of signals to enter the market. The sharp fall in the pound sterling was due to lower expectations for a positive outcome of the negotiations over the trade agreement. The parties set a Sunday deadline to decide on the Brexit deal. If you look at the 5-minute chart, you can see how the bears managed to break through the 1.3340 level, and then the quote returned to this range from top to bottom. This is a good signal to open short positions. However, someone may argue that the pair failed to test the level of 1.3340 just because it lacked only 5 pips. This is why it is recommended no to react to this movement. Nevertheless, it was possible to earn money at the first test of the 1.3290 level where it was certainly recommended to open long positions. The upward movement from this level was more than 30 pips. By the beginning of the US session, the bears have pushed the pair down to the 1.3290 level without forming an entry point for short positions. Yet, investors are well aware that they could always make a profit if the pair rebounds from the low of 1.3246. An upward correction from this level was unfolding at the time of writing this article.

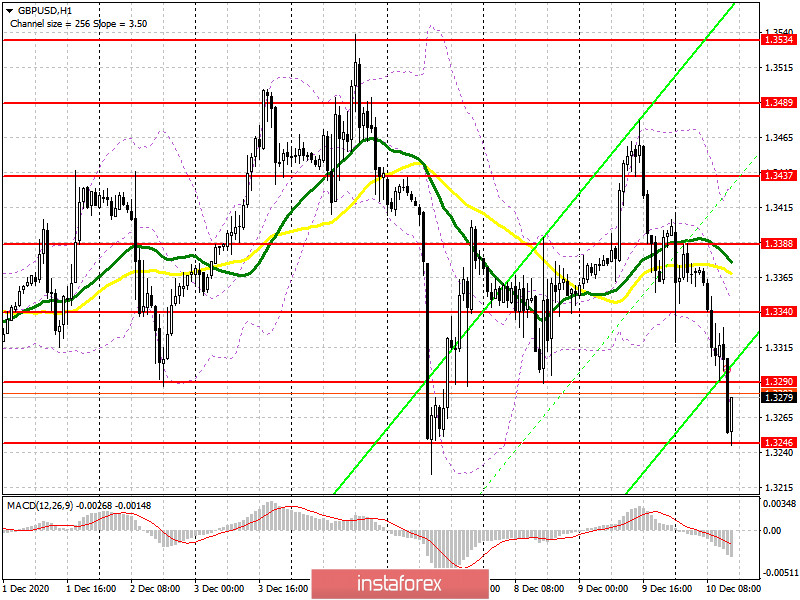

Currently, the bulls are trying to hold at the support level of 1.3246 and consolidate at this level. The pound sterling may rise only after the formation of a false breakout in the second half of the day. An equally important goal for buyers is a breakout and consolidation above the resistance level of 1.3290 where the stop orders are located. A top-down test of this level provides an excellent opportunity to open long positions. In this case, we can count on a more powerful bullish momentum in the area of 1.3340. However, only positive news on the agreement will boost the pair to the resistance level of 1.3388 and to the 1.3437 level. At these levels, it is recommended to place a Take-Profit order. Important fundamental data on the US economy will be released this afternoon. In case of negative figures, the pound sterling pound may spread its wings, which will lead to an increase of the pair. Investors will also continue to monitor the Brexit news. If the pair breaks 1.3246 and bulls lack steam, it is best to refrain from opening long positions until the pair hits the low of 1.3198. Long positions can be opened if a false breakout is formed in the support area of 1.3114.

What is needed to open short positions on GBP/USD

Now, the bears should pay attention to the resistance level of 1.3290. Only the formation of a false breakout there will be a signal to sell the pound in the second half of the day. The main goal of the pair will be to break through and consolidate below the support level of 1.3246. If this scenario comes true, it will lead to another wave of sell-off of the pound sterling. The pair may reach the lows of 1.3198 and 1.3114 where it is recommended to place a Take Profit order. If US inflation data tops up expectations, the pound sterling may assert strength. In this case, the pair may halt its downward movement near the levels of 1.2976 and 1.2856. If bears do not try to push the pair to the 1.3290 level, it is best to refrain from opening short positions before the pair tests the resistance level of 1.3340. At the same time, in the event of good news on Brexit, the pound sterling can quickly recover to the highs of 1.3393 and 1.3436 where short positions can be opened.

Click on the link to watch today's video forecast

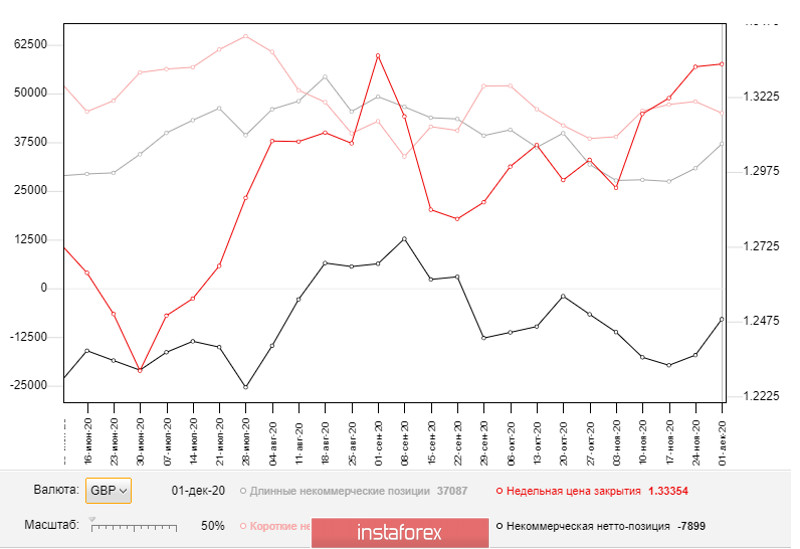

According to the COT reports (Commitment of Traders) for December 1, there was a high demand for the pound sterling as many traders were betting on a positive outcome of the negotiations. Long non-commercial long positions increased from level 30, 838 to 37,087. At the same time, short non-commercial positions dropped from the level of 47, 968 to 44,986. As a result, the negative non-commercial net positions came in at -7,899 against -17,130 from a week earlier. This indicates that GBP sellers are still holding the upper hand in the market. Nevertheless, traders are regaining appetite for risk and the trade deal will cement it if it is eventually signed.

Indicators:

Moving Average

The pair is trading below 30- and 50-period moving averages. It indicates further growth of GBP in the short term.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

Bollinger Bands

In case GBP/USD trades higher, a median indicator's line of 1.3340 will serve as support.

If the pair grows, a median indicator's line will act as a resistance in the area of 1.3340 where short deals on the pair can be opened with a possibility of a rebound.

Definitions of technical indicators

Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

Non-commercial long positions represent the total long open position of non-commercial traders.

Non-commercial short positions represent the total short open position of non-commercial traders.

The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.