US consumer inflation rose by 0.2% last month, which is in line with forecasts. On annual terms, it rose higher than forecasted – 1.2% instead of 1.1%, but there were no changes relative to October. A rising inflation usually indicates an increase in purchasing activity, but the current effect is unlikely to be sustainable, since there was a significant growth in unemployment claims again as per the last reporting week. Secondary applications increased by 5.757 million instead of the expected 5.335 million, while the primary one rose by 853 thousand, against the expected 725 thousand.

It is clear that the recovery of the labor market in the near future will not be possible, if the stagnating economy will not be supported by another stimulus package. Congressional negotiations have stalled again, with key differences unresolved over waiving legal liability for businesses and state aid.

Therefore, strong movements until December 16 are unlikely to be observed, which continues to wait for the results of the Fed meeting.

EUR/USD

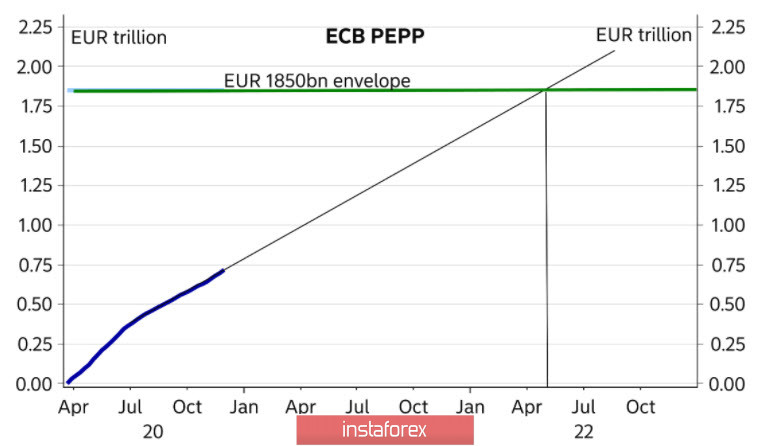

The ECB left the base rate at 0% during its regular meeting. The marginal refinancing rate was at 0.25%, while deposits at -0.5%. At the same time, a number of steps have been taken to support the recovery in the eurozone until 2023, primarily an increase in the volume of the Pandemic Emergency Procurement Program (PEPP) by 500 billion euros to 1.85 trillion. This means that the PEPP program will easily last until March 2022. Previously, the term ended in June 2021.

Next year, there will be a number of additional measures, but they are not as huge as the expansion of PEPP. Their main task is to extend the easing of conditions for banks and restrain the growth of yields. Despite the fact that vaccination is about to be widely used, the expansion of PEPP actually looks somewhat redundant in the fight against the pandemic, but it is easily explained as a tool to curb the growth of yields, since the ECB will be able to buy additional volumes of bonds from the market under this program.

It is also noteworthy that ECB's expected stimulus package did not lead to a decline in the exchange rate of the euro; on the contrary, the euro approached its recent high by the end of the day. This indicates that the markets are waiting for Fed's more ambitious actions, which will change the yield spread in euro's favor. They will not wait for too long, since the results of the Fed meeting will be announced on December 16.

Technically, the EUR/USD pair is around the resistance level of 1.2177. An attack to this level and further growth in view of the traditional New Year rally looks likely. The nearest target is 1.2254, but strong movements are not expected until the announcement of the results of the Fed meeting.

GBP/USD

The latest comments from EU-UK negotiators led to the collapse of the pound on Thursday morning. EU's President, Ursula von der Leyen, said the both parties were far apart from each other, while British Prime Minister Johnson said that the deal will most likely fail.

The next deadline is Sunday, wherein a firm decision on the future of the negotiations must be made, although in fact, the negotiations could last until December 31. In any case, we must consider that there is a low probability of a reached agreement.

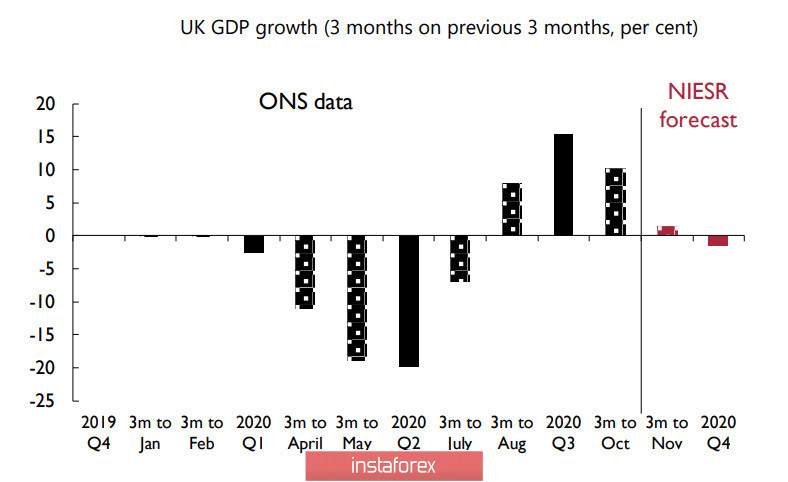

Meanwhile, NIESR has updated its GDP forecast. The UK economy is expected to contract by 8.5% by the end of 2020 compared to 2019. In November, economic activity declined by 9.3%. The recovery will stop, and even the start of vaccinations will not have a clear effect in the coming months.

The pound remains within the borders of the upward channel despite the deep pullback, and since hope dies last, players have no choice but to wait for the results of negotiations over the weekend. The situation has not changed – in case of breakdown, the high will certainly be updated. The short-term momentum may well reach the level of 1.40. On the contrary, if optimism will not appear, then another wave of decline is likely. In this case, the target is 1.31 (lower limit of the channel). A decline below this level will increase the probability of a long-term reversal.