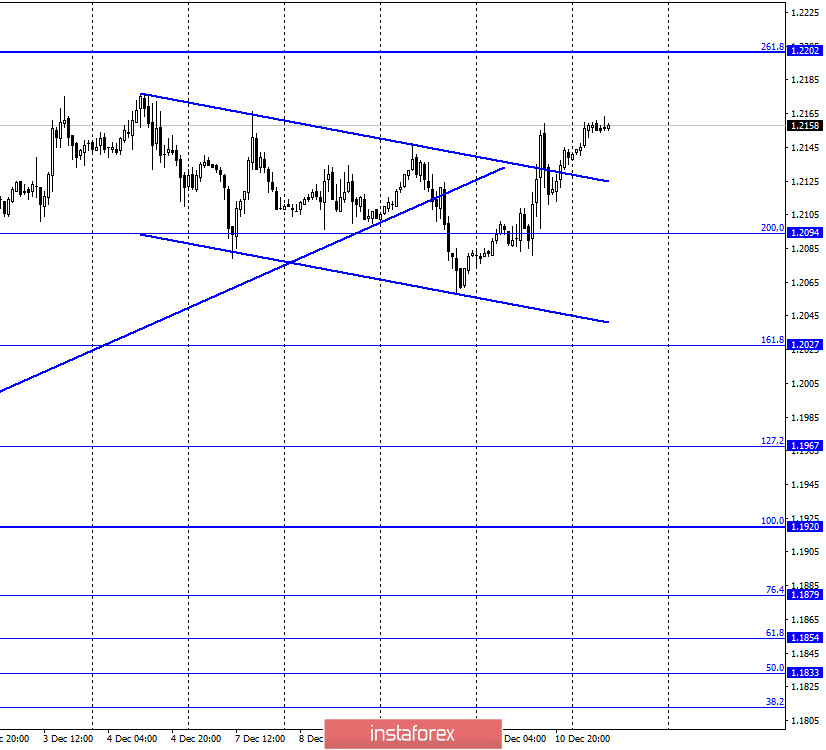

EUR/USD – 1H.

On December 10, the EUR/USD pair resumed the growth process and completed consolidation over the downward trend corridor. As a result, the process of growth of quotes can be continued in the direction of the corrective level of 261.8% (1.2202). There are no other options for the development of the movement now. The most important event of the day was the ECB meeting. Key, deposit, and credit rates were expected to remain unchanged. But the ECB announced the expansion of the PEPP (Pandemic Emergency Purchase program) program by another 500 billion euros and its extension for 9 months. Thus, on the one hand, this means that the EU economy is still experiencing problems, which is why it needs additional incentives with an already super-soft monetary policy. On the other hand, this means that the ECB will print another 500 billion to pour into the economy. Both sides say that the demand for the euro currency should fall, and its supply will increase. However, in practice, it is the euro currency that continues the growth process. The ECB also said that in the fourth quarter of 2020, the EU economy will lose about 2.2% of GDP and a total of 7.3% for the entire year. Lagarde's rhetoric was familiar. She said that rates will continue to remain low until inflation stabilizes (to the target 2%), and the current exchange rate of the European currency will put pressure on inflation. Vicious circle. Currently, inflation is negative, -0.4% y/y.

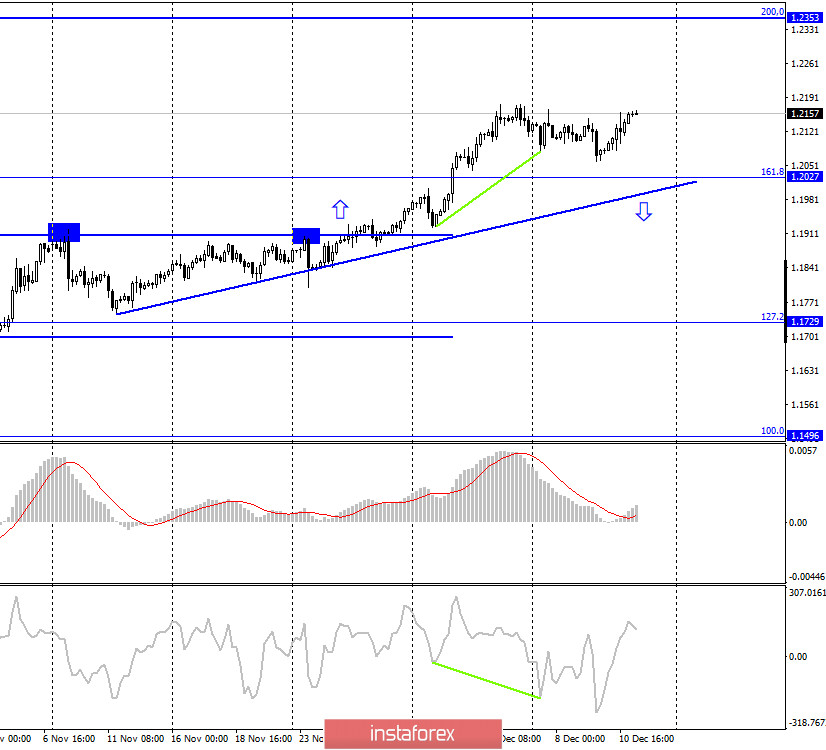

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency and resumed the growth process in the direction of the corrective level of 200.0% (1.2353). The upward trend line still characterizes the current mood of traders as "bullish". As long as the quotes do not consolidate under this trend line, we should not expect a strong fall in the pair.

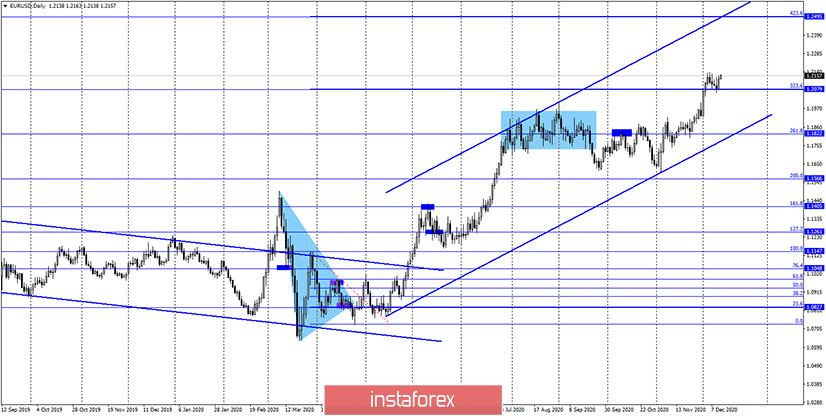

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079), which allows traders to expect continued growth in the direction of the next corrective level of 423.6% (1.2495). And until the pair completes the consolidation below the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 10, the results of the ECB meeting were summed up in the European Union, and an inflation report was released in America, which did not disappoint traders, but still did not help the US currency. The information background was quite strong, but not in favor of the euro. However, the euro currency was growing again.

The news calendar for the United States and the European Union:

On December 11, the calendars of economic events in the European Union and America are almost empty. There will only be a couple of non-important reports that are much less likely to affect the pair than yesterday's events that were ignored.

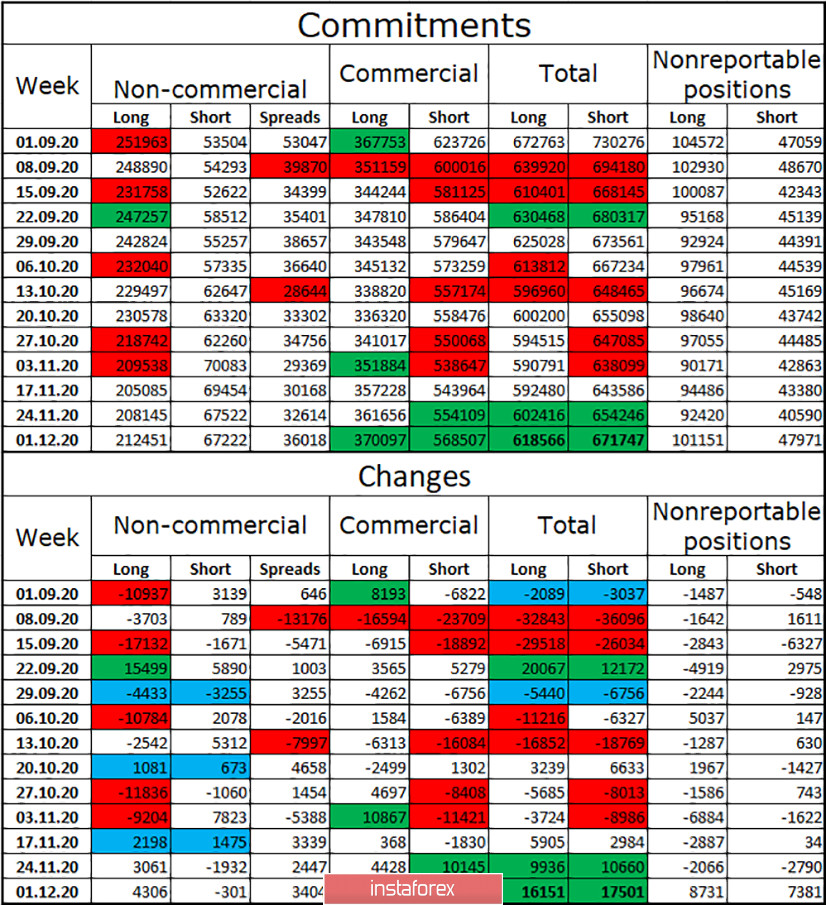

COT (Commitments of Traders) report:

For the third week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. During the reporting week, speculators opened 4306 new long contracts and closed 301 short contracts. However, I would like to draw your attention to the fact that in the last two weeks, traders of the "Commercial" category have become very active, who have opened a total of 35 thousand contracts, most of which are short. But I still pay more attention to speculators. Their activity has been low in recent weeks, and purchases of the euro currency are extremely cautious as if forced. I still believe that the upward trend in the euro is nearing its end.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro currency with the target of the Fibo level of 200.0% (1.2094), if the rebound from the level of 261.8% (1.2202) is performed on the hourly chart. Purchases of the pair could be opened by fixing quotes above the descending corridor with the target of 1.2175 and 1.2202. But you need to be prepared for a new fall in the euro, as this week's trading takes place without a clear advantage of bulls or bears.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.