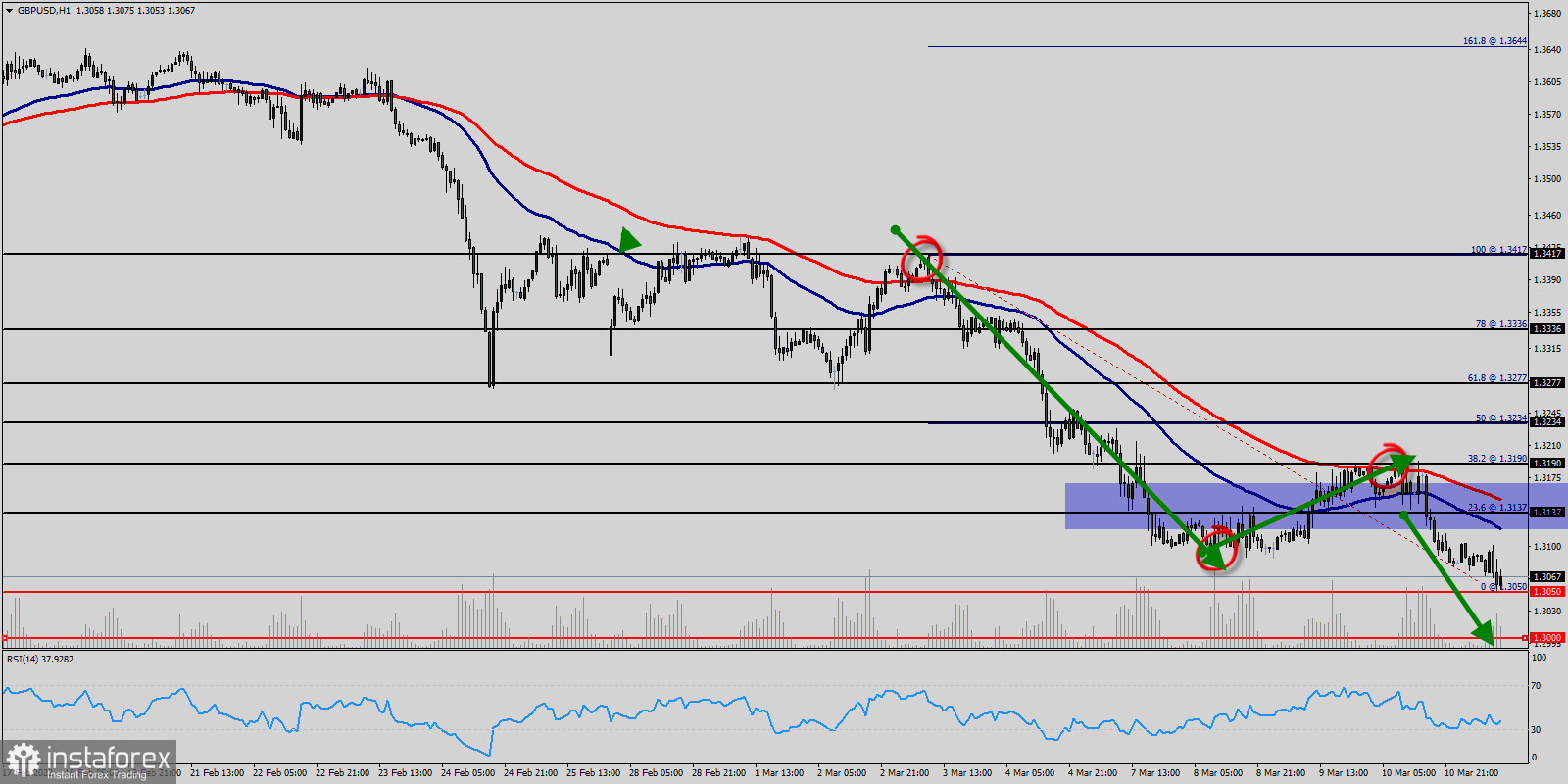

The GBP/USD pair has extended its gains after dropping to its lowest level since last week. The GBP/USD pair was trading lower and closed the day in the blue zone near the price of 1.3190. Today it was trading in a narrow range of 1.3190 and 1.3000, staying close to yesterday's closing price.

The GBP/USD pair settled below the 1.3190 pivot zone and is now consolidating near the 1.3137 zone. If the price stays below the levels of 1.3190 and 1.3137, the bears might attempt a fresh decrease below the 1.3137 level.

RSI (14 days) sees a bearish exit of our ascending support-turned-resistance line signalling that we'll likely be seeing some bearish momentum from the area of 1.3190 and 1.3737.

Therefore, The GBP/USD pair declined and tested the1.3050 level. If the bears remain in action, the price might even test the USD 0.112 level. Conversely, the price might start a steady increase towards 1.3137 in order to try to rebound again.

The short-term range is 1.3137 to 1.3000. The GBP/USD is trading on the strong side of its retracement zone at 1.3050 to 1.3000, making it support.

We are still Look for the intraday downside bias to continue as long as the GBP/USD holds below the price of 1.3190 and 1.3137. If this move creates enough late session downside momentum then look for a wave into 1.3000, followed closely by 1.3050. Hence, the descending movement is likely to begin from the level 1.3137 with 1.3050 and 1.3000 seen as targets.