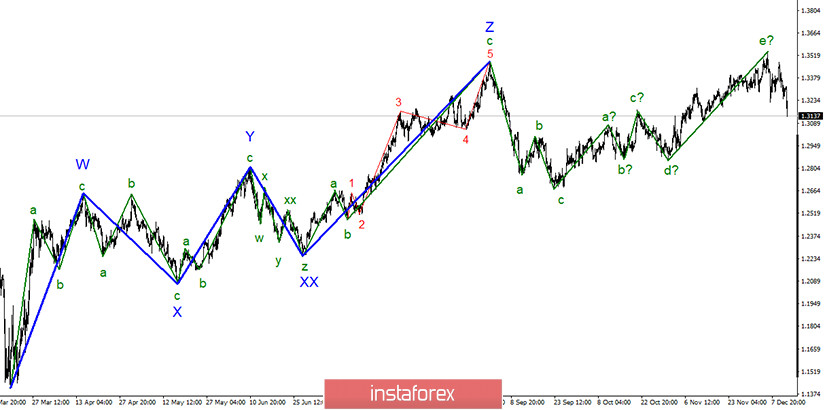

In the most global terms, the wave pattern looks as if the upward section of the trend is completed, which fully corresponds to the markup. A five-wave upward trend section was constructed. Thus, now I expect to build at least three waves down. Although, most likely, a more complex downward trend section will be built. Especially if the news background still supports the US currency.

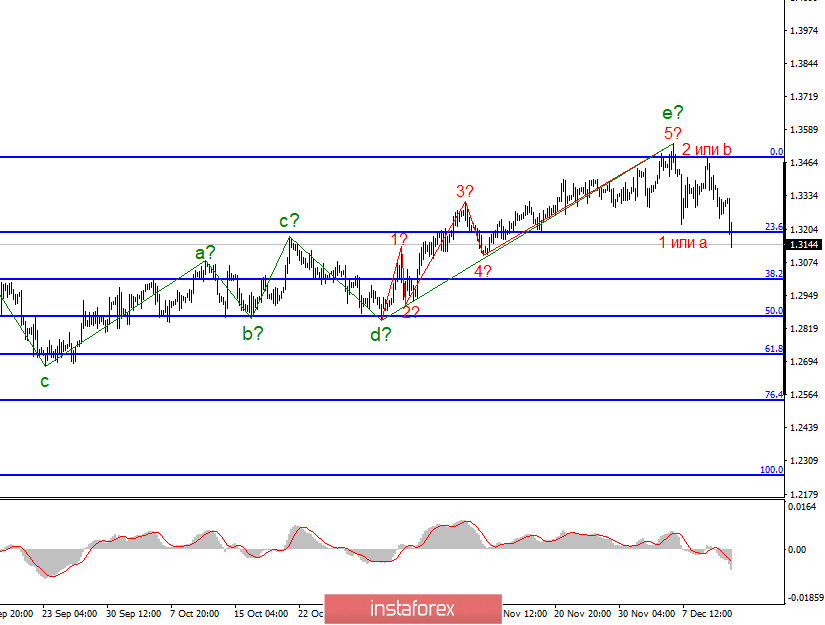

The lower chart also shows a departure of quotes from the previously reached highs and an unsuccessful attempt to break the 0.0% Fibonacci level, which almost coincides with the previous maximum - wave Z. Thus, the probability of starting to build a new downward section of the trend is growing. If this assumption is correct, as well as the wave markup, then the decline in quotes will continue with targets located around the 29th figure and possibly much lower.

Negotiations will continue until Sunday, December 13. This is the result of the dialogue between Ursula von der Leyen and Boris Johnson. The parties noted that differences in the most important issues (fishing, dispute resolution, state support, EU regulations) remain insurmountable, but at the same time, the delegations of Michel Barnier and David Frost will still try to break the deadlock. However, the British finally stopped rising by leaps and bounds, for no particular reason. Markets have finally taken into account the fact that it is December 11, and there is still no breakthrough in the negotiations. Both the EU and the UK are calling for a no-deal Brexit and are giving very little chance of a deal being agreed. Boris Johnson said that the demands made by the European Union are impossible and contradict the desire of Britain to be a fully sovereign and independent state. Thus, at the moment, we can conclude that nothing has changed in recent weeks or even months of negotiations. The British pound has lost almost 300 basis points over the past two days and this may be just the beginning of its new fall. I have already said that without a deal, the British economy will suffer huge losses, so the pound may suffer huge losses.

There were no economic reports on Friday. On Thursday, data on GDP and industrial production were released in Britain, which did not interest the markets at all, although they did not show negative dynamics. Everyone is now focused on the negotiations between London and Brussels. Thus, now the markets will wait again, however, there is less and less faith in the conclusion of an agreement.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward trend section. I expect to build at least three wave formations and recommend selling the instrument for each MACD signal "down" with targets located near the calculated marks of 1.3012 and 1.2866, which is equal to 38.2% and 50.0% for Fibonacci. A successful attempt to break through the 0.0% Fibonacci level will indicate a new complication of the upward trend section and cancel the sales option.