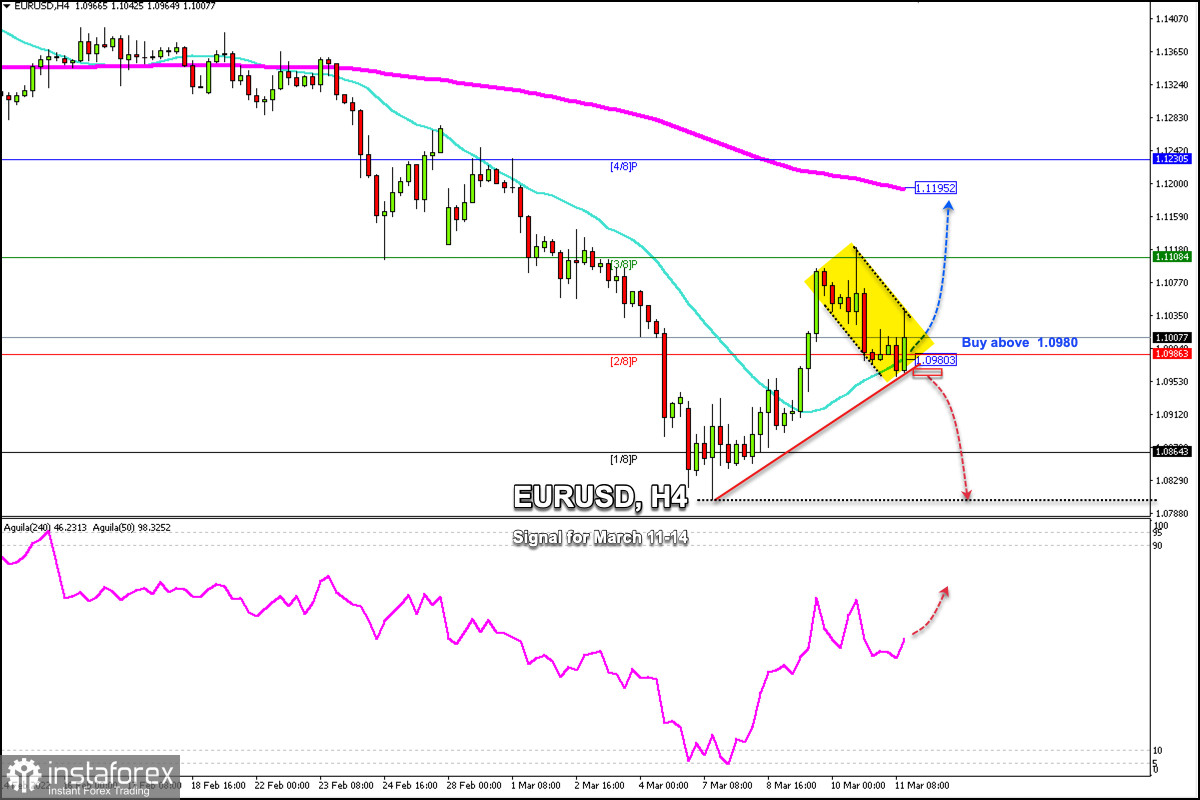

On Wednesday, the euro reached the zone 3/8 Murray around 1.1120. Since this level, it has been forming a downtrend channel and now is consolidating above the 21 SMA located at 1.0980.

It looks like the market has found resistance at the 1.1084 level (3/8 Murray). So, if the euro breaks sharply below 1.0980, a return to lows March 7 around 1.08 is more likely.

There are external factors that affect the European currency, such as the slowdown in economic growth in Germany and the war in Ukraine.

If conditions do not change, we think it will still be profitable to sell on rallies, especially if the price approaches the level at 1.1195, where the 200 EMA is located and a little higher where there is the 4/8 Murray at 1.1230 which acts as a strong resistance.

On March 7, the euro started a bullish rally from 1.0805 to 1.1220, which was seen as a technical correction. This move left the formation of a bullish pennant, which if is confirmed, has its target at the resistance 200 EMA in 1.1200.

In the coming hours, if the euro consolidates above 2/8 Murray and above the SMA 21, there is likely to be a strong bullish move towards 3/8 Murray at 1.1084 and 1.1195 (200 EMA). The eagle indicator is giving a positive signal which supports our strategy.