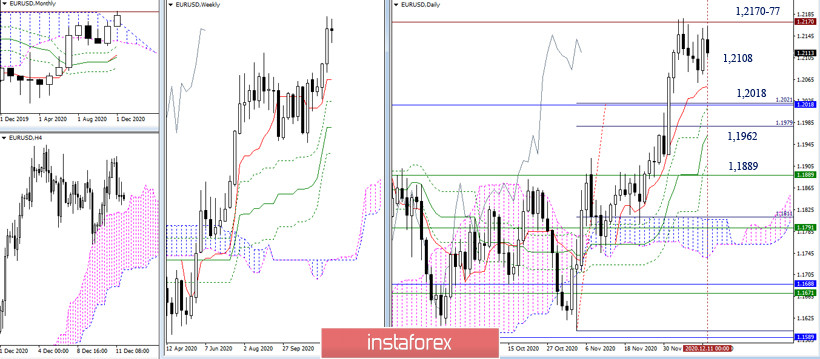

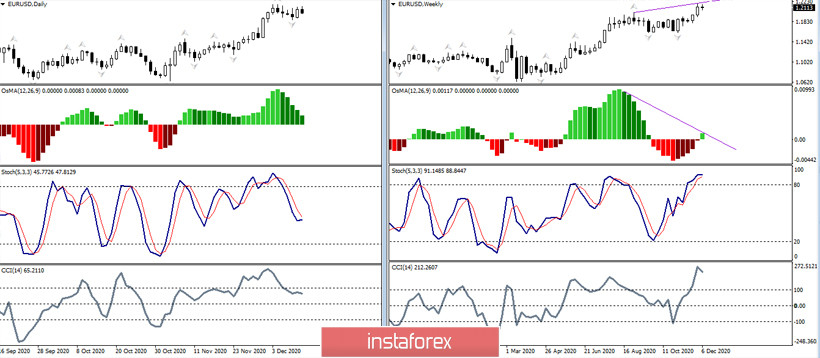

EUR/USD

The pair spent the entire week in the area of a downward correction under the resistance of 1.2170 (record level). As a result, a small candle of uncertainty appeared. Perhaps, next week, the bearish players will continue to develop the correction. In this case, downward targets will serve as support for the daily short-term trend, on Monday it will be at 1.2108, the connection of the upper border of the monthly cloud and the daily Fibo Kijun (1.2018), the daily mid-term trend (1.1962) and the weekly short-term (1.1889). Since the weekly candle does not have a pronounced bearish character and bearish traders failed to produce a full-fledged rebound, the current corrective hitch can be interpreted as a pause and of bullish traders condensing forces for the next stage of the upward development. Therefore, you can expect players to push the upward movement upon overcoming the 1.2170-77 resistances. The next upward reference point will be 1.2555 (previous high of the month).

The analyzed technical indicators in the current movement do not form the prerequisites for forming a divergence. The only exception is the OsMA indicator on the weekly timeframe, a rather impressive discrepancy between the indicator and the price chart is indicated here.

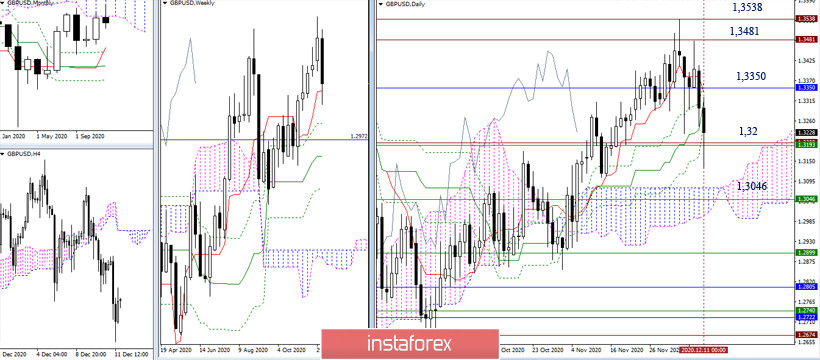

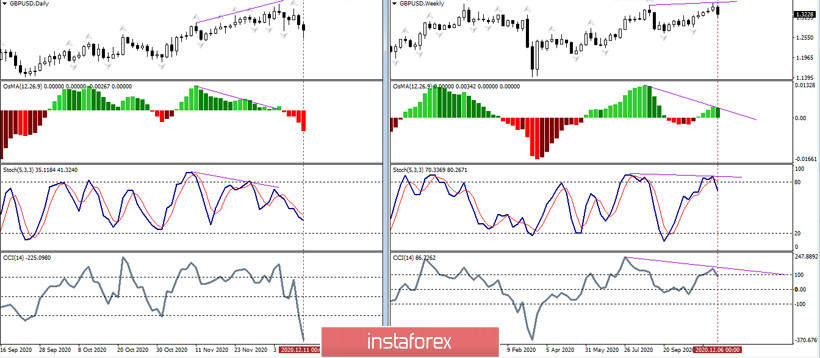

GBP/USD

Bears had an advantage during the week, although it was difficult for them. However, the weekly candlestick is bearish. The pair retested the historic 1.32 milestone, which is now joining forces with the weekly short-term trend (1.3196), and closed below the daily Ichimoku gold cross. Eliminating the day's cross and overcoming 1.32 is now the top priority for bearish traders. Passing the daily cloud, strengthened by the weekly Fibo Kijun (1.3046), will be important. Failure to overcome the support could trigger another consolidation. Bullish players need to restore their positions in order to regain their initial advantage, taking possession of a cluster of levels around 1.3350 (lower border of the monthly cloud + daily cross). Only then will the question surface about testing the 1.3481-1.3538 area and bringing back the upward trend.

Indicators have long shown how they are opposed to players trading to push the pair upward, despite the recent rally. As a result, divergences and bearish divergences appeared, and were formed at the current corrective decline. The development of a correction and a breakdown of the support trend line will lead to an increase in bearish sentiment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)