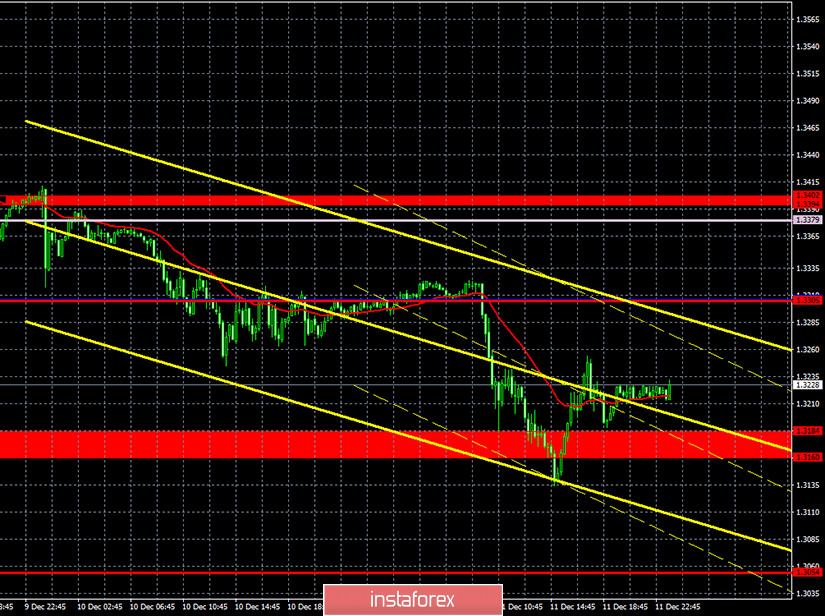

GBP/USD 15M

Both linear regression channels are directed downward on the 15-minute timeframe. The pair failed to surpass the support area of 1.3160-1.3184 the first time, so now a correction is expected, however, in general, a downward trend has appeared.

GBP/USD 1H

The GBP/USD currency pair fell on Friday within a new, rather wide downward channel. Thus, a downward trend has now formed for the pair, but the size of the first pullback within it suggests that subsequent pullbacks will be no less strong. This suggests that the bears are only accelerating, but are still weak and at any moment they can release the initiative from their hands. Strange as it may seem, but bulls still rule the show. Despite the disappointing foundation for the pound. At the moment, the quotes have reached the support area of 1.3160-1.3184 and could not surpass it, at the same time it rebounded from the lower line of the downward channel. Thus, the correction has already begun and may reach the critical Kijun-sen line, a rebound from which may provoke a resumption of the downward trend. Buyers need to return the pair above the downward channel and the Senkou Span B line in order to regain the initiative.

COT report

The GBP/USD pair rose by 60 points in the last reporting week (December 1-7). A little, but it's still growth. Although, according to the latest Commitment of Traders (COT) report, such an increase is quite reasonable. A group of non-commercial traders opened 2,866 new Buy-contracts (longs) and closed 9,189 Sell-contracts (shorts) during the reporting week. Thus, the net position for non-commercial traders has increased by 12,000 contracts, which is a lot for the pound, given that the total number of contracts for the "non-commercial" group is approximately 90,000. Therefore, professional traders have increasingly become more bullish, and the total number of contracts has decreased. This suggests that a very small number of large players still want to deal with the pound. This is not surprising given the uncertainty surrounding the future of the UK and its economy. As for the indicators, they have not shown any trend for several months. That is, professional traders do not increase purchases and sales in the long term. Therefore, long-term conclusions cannot be drawn from the COT reports.

No fundamental background for the pound on Friday and Saturday. Markets wait for statements from Ursula von der Leyen, Boris Johnson, Michel Barnier and David Frost. Let us remind you that earlier the parties agreed to extend the negotiation process until December 13. We, in turn, assumed that if both parties do not reach an agreement by this date, the negotiations will continue anyway. We also made a forecast that the negotiations would continue in any case, even in 2021. So far, everything is going exactly as expected. Because there is no point in parting without an agreement. But at the same time, neither side wants to concede, so these talks can last at least a couple of years. In any case, it is better to agree conditionally in a year on trade relations without duties than not to agree at all. Therefore, we believe that the negotiations will continue as long as necessary. As a result, the option is absolutely not excluded, in which the transition period will be continued retroactively. It is time for the pound to emerge from a parallel reality, in which there is already a trade deal.

There are no major events scheduled for Monday in the UK, nor in the US. Brexit and trade negotiations is still the main topic for the pound, however, it seems that traders are already tired of waiting for the results. The credibility of Johnson, von der Leyen and other participants in the negotiation process is already as great as the words of Donald Trump. Both sides regularly declare that "the next few days will be decisive" and "everything is about to be decided", but nothing has been decided, and negotiations just go on. What then is the point of expecting positive results every day? Better to just trade, ignore the topic and react to specific facts.

We have two trading ideas for December 14:

1) Buyers for the pound/dollar pair, one might say, took a break for now. They still need to return the pair above the resistance area of 1.3394-1.3402, and at the same time above the downward trend line, and only after that will it be possible to count on an upward movement with the target of the resistance level 1.3556, which is very far away. Take Profit in this case will be up to 120 points. You can also try to play bullish if the pair surpasses the Kijun-sen line (1.3306) with the target Senkou Span B line (1.3379).

2) Sellers made a tangible step towards the new downward trend, but stopped near the support area of 1.3160-1.3184. Thus, we recommend selling the pound/dollar pair again while aiming for the support area of 1.3160-1.3184, if a rebound follows from the critical line (1.3306). Take Profit in this case can be up to 100 points. You can also open new shorts if the price settles below the 1.3160 -1.3184 area.

Forecast and trading signals for EUR/USD

Explanations for illustrations:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group.