The euro appears to be gearing up to resume gains this week, however, an increase will only happen if Republicans and Democrats finally agree on a new US stimulus package, and if the UK and the EU signs a post-Brexit trade agreement. Last week, the deadline for negotiations was again set, and it was supposed to end this Sunday. But the leaders decided to continue their dialogue this week, the reason for which was not reported. As a result, pound bulls remained optimistic and continued to set up long positions in the GBP / USD pair.

Regarding the long-awaited US stimulus, on Friday, the US Senate approved a bill to finance the work of the government for another week, thus giving lawmakers time to agree on a new package of measures to help the economy. Last week, Treasury Secretary Steven Mnuchin proposed to House Speaker Nancy Pelosi a package worth $ 916 billion, which includes state and municipal funding. The program essentially echoes Donald Trump's proposed package which states that households would receive $ 600 per person in direct benefits, however, it lacked the $ 300 weekly unemployment benefit supplement. Nonetheless, if this package is approved, the US dollar will undergo additional pressure, thereby weakening its position against the euro.

At the moment though, the movement of the EUR / USD pair depends on whether the quote successfully breaks above 1.2165 or not. Going beyond this level will make it easier for the euro to reach 1.2250 and 1.2340, but if the quote returns and moves below 1.2060, the EUR / USD pair will collapse to 1.1980 and then to 1.1890.

Meanwhile, rather bad news emerged in Europe, when the Federal Republic of Germany (FRG) decided to tighten restrictive measures from December 16 to January 10, 2021. All shops except for those who sell food and essential goods will be closed from December 16, and selling of alcohol in public places will also be prohibited. No more than 5 people representing two households are also allowed to meet.

The service sector is seriously affected as well. Aside from the closing of salons, it is now forbidden to use dishes and other products in establishments that sell them. All that remains for public catering is to work on delivery and pickup.

The only good news related to the coronavirus was the decision of the US Food and Drug Administration to approve the application of pharmaceutical companies, Pfizer and BioNTech, to register their COVID-19 vaccine under an accelerated procedure. The US Department of Health said that there is every reason to consider the developed vaccine effective.

In another note, this week, the Federal Reserve will publish latest data on the United States, including economic forecasts from the FOMC. Last Friday, a document was released in which the regulator said it is going to provide charts indicating how much uncertainty the Fed sees in variables such as GDP, unemployment rate and inflation, which once again confirms the fact that forecasting these main indicators is now a rather complicated process, especially considering the many risk factors. The Central Bank has decided to allow investors to draw their own conclusions.

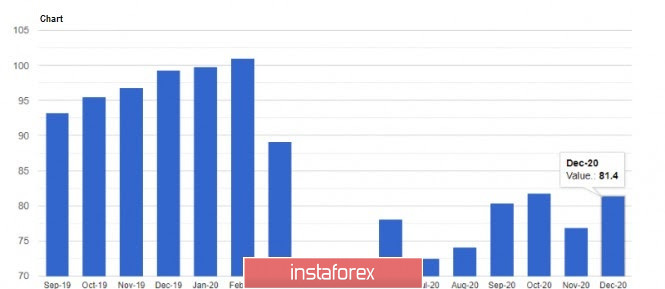

At the moment though, US consumer sentiment came out much better than expected. The report published by the University of Michigan said the preliminary index of consumer sentiment jumped immediately to 81.4 points this early December, while economists had expected it to reach only 75.5 points. Unsurprisingly, much of the growth was driven by news about the vaccine, as well as on more positive sentiments about economic recovery. Household personal finance expectations also remained unchanged, which is a plus in this situation.

As for the data on inflation, US PPI rose by 0.1% this November, while the underlying index, which excludes volatile categories, also gained 0.1%. The annual growth of the PPI was 0.8%.

GBP/USD

On Friday, the Bank of England said its current banking system is resilient in the face of downward risks associated with the pandemic. Therefore, it expects that risks of financial instability due to Brexit will not have serious pressure on the functioning of the entire system. During his speech, Governor Andrew Bailey reiterated that banks will remain strong even in the event of a more negative than expected economic situation. He said that most of the risks associated with Brexit have been mitigated, but failures in providing services to customers in the EU will occur at the very beginning of the period of adaptation of the banking system to new conditions.

With regards to Brexit and negotiations, which were supposed to end last Sunday, the parties once again agreed to continue negotiations this week, and now many market participants expect the intervention of key European leaders - German Chancellor Angela Merkel or French President Emmanuel Macron. Many expect a trade deal to be signed at the last moment, which gives confidence to pound bulls, thereby keeping the currency at its current high price levels.

But at the moment, movement of the GBP/USD pair depends on whether the quote breaks out of 1.3340, as only by that will the pound be able to reach levels 1.3390 and 1.3490. But if the quote returns and moves below 1.3245, the GBP/USD pair will collapse to 1.3190, and then to 1.3140.