The market found a secured position again in the hopes that the Fed may consider additional measures this week to stimulate the US economy, unlike the Congress.

As the recent events after the US presidential election have shown, the continuing political tension between Democrats and Republicans does not allow them to agree on new previously promised fiscal stimulus measures or so-called anti-COVID aid. This is the reason why investors focused all their attention again and hopes on the FRS, whose leader has repeatedly stated the need for further support for the US economy. In view of this, this week's most important event will be the Fed's last monetary policy meeting of the year.

On Monday, futures for major US stock indices rose significantly. It seems that their growth is based on the fact that today's electoral vote in the United States will declare Mr. J. Biden as the new president, which is very popular with the markets. On the other hand, investors are hoping again for the Fed's decision to expand fiscal stimulus, which supports today's positive sentiment in the futures market.

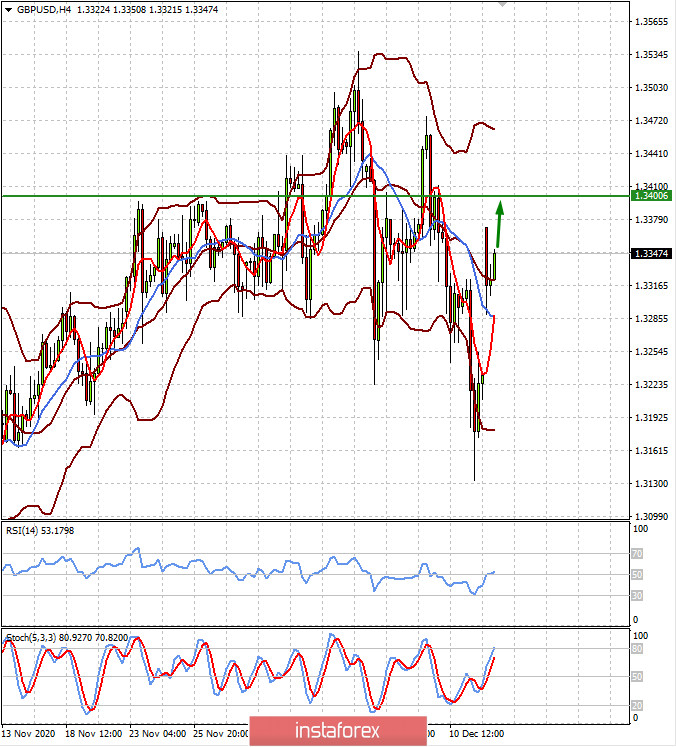

Meanwhile, regular negotiations were held yesterday on the terms of Britain's exit from the EU. It was decided to conclude a free trade agreement after the decision to extend negotiations beyond Sunday's deadline. This news supported the pound, which sharply rose against the US dollar at the opening of trading on Monday.

However, it is not necessary to say that the problems of Brexit have been solved, since this is just another truce before a new battle. No one seems to know when it will end, so we continue to expect nervous and unpredictable movements of the British currency.

Assessing the overall prospects of the currency market, we believe that the Fed's adoption of some support measures will weaken the US currency. This can only be hindered by the negative news flow about the worsening political tension between representatives of the Democratic and Republican parties, as well as various delays in vaccination of the population or new significant outbreaks of virus and deaths, while the market is on the sidelines and is trying to ignore it. But if everything dramatically changes, then we may witness another local strengthening of the US dollar at the beginning of the new year.

Forecast of the day:

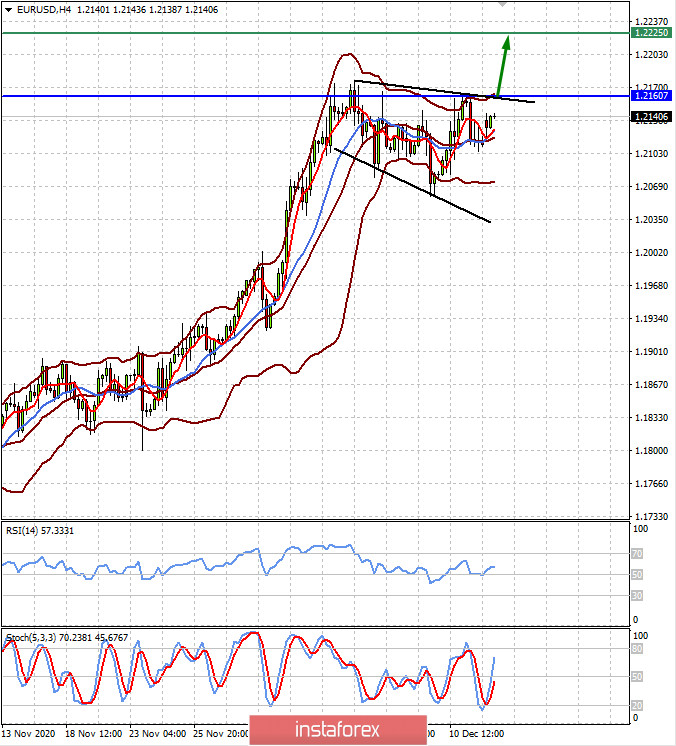

The EUR/USD pair is forming a "horn" or "expanding triangle" trend continuation pattern. The expectation of Fed's new easing measures may lead to a breakout of the level of 1.2160 and the pair's growth to 1.2225.

The GBP/USD pair added more than one figure today amid another truce between the EU and the UK. If the positive mood continues, it could push the pair up towards the level of 1.3400.