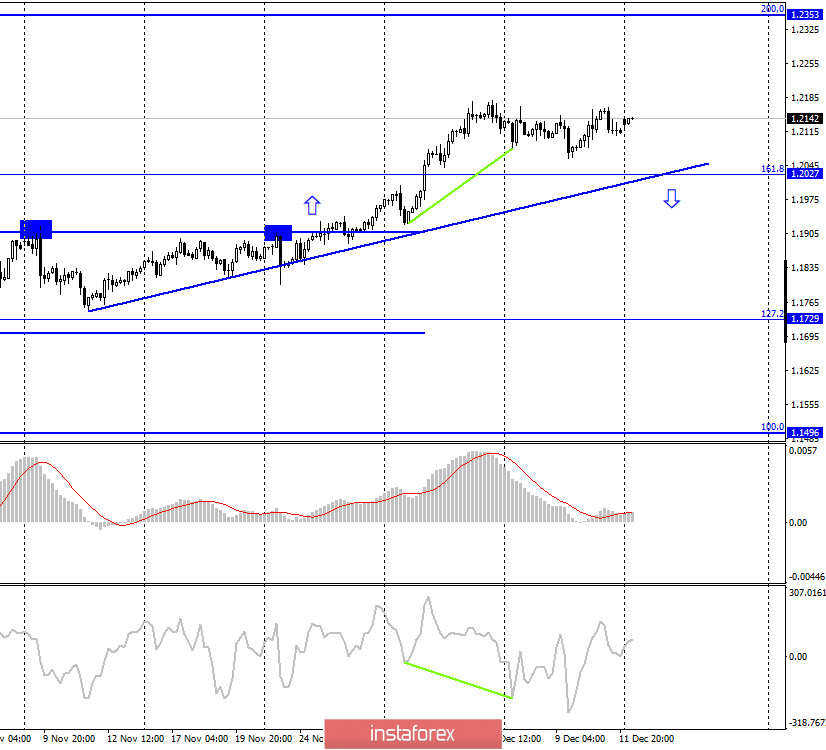

EUR/USD – 1H.

On December 11, the EUR/USD pair performed a fall in the direction of the corrective level of 200.0% (1.2094), but this morning it turned in favor of the European currency and seeks to resume the growth process in the direction of the Fibo level of 261.8% (1.2201). Although all the traffic of the last week passes almost in a side corridor. Nevertheless, the rising trend line (new) characterizes the mood of traders now as "bullish". Last week ended more than boring. There were no reports or important news that day. However, there were plenty of them on Thursday. Traders again interpreted all the information received in their own way, so there were no sharp changes in the dynamics of the pair. Nevertheless, both positive and negative news came from the European Union. Let me remind you that the European Central Bank has decided to expand the PEPP program (countering the economic consequences of the pandemic) by another 500 billion euros (previously it had already done this for 600 billion), and also extended its validity for 9 months. And this is bad for the euro. On the other hand, Poland and Hungary withdrew their vetoes concerning the 750 billion euro economic recovery fund and the 1.1 trillion euro budget for 2021-2027. Thus, all beneficiaries will now receive their funds. And this is good for the euro. However, in general, the pair continued to trade in a very limited range, despite all these reports.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency and resumed the growth process in the direction of the corrective level of 200.0% (1.2353). The upward trend line still characterizes the current mood of traders as "bullish". As long as the quotes do not consolidate under this trend line, you should not expect a strong fall in the pair.

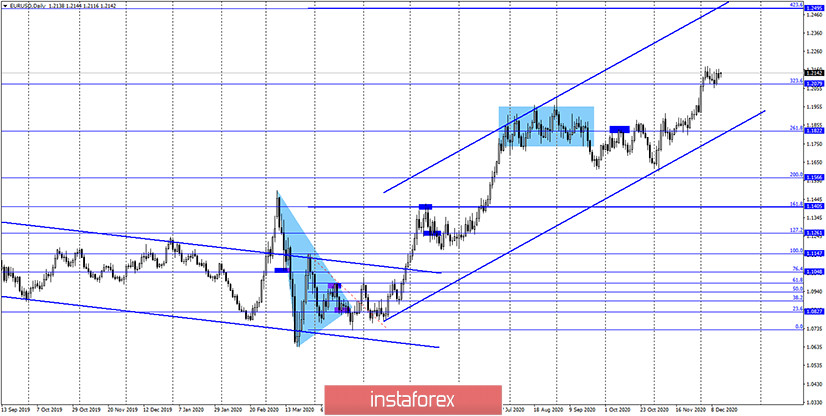

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079), which allows traders to expect continued growth in the direction of the next corrective level of 423.6% (1.2495). And until the pair completes the consolidation below the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 11, in the European Union and America, the calendars of economic events were completely empty. Thus, the information background was zero.

The news calendar for the United States and the European Union:

On December 14, the calendars of economic events in the European Union and America are almost empty. There will only be a couple of non-important reports, such as industrial production in the European Union, which are unlikely to interest traders.

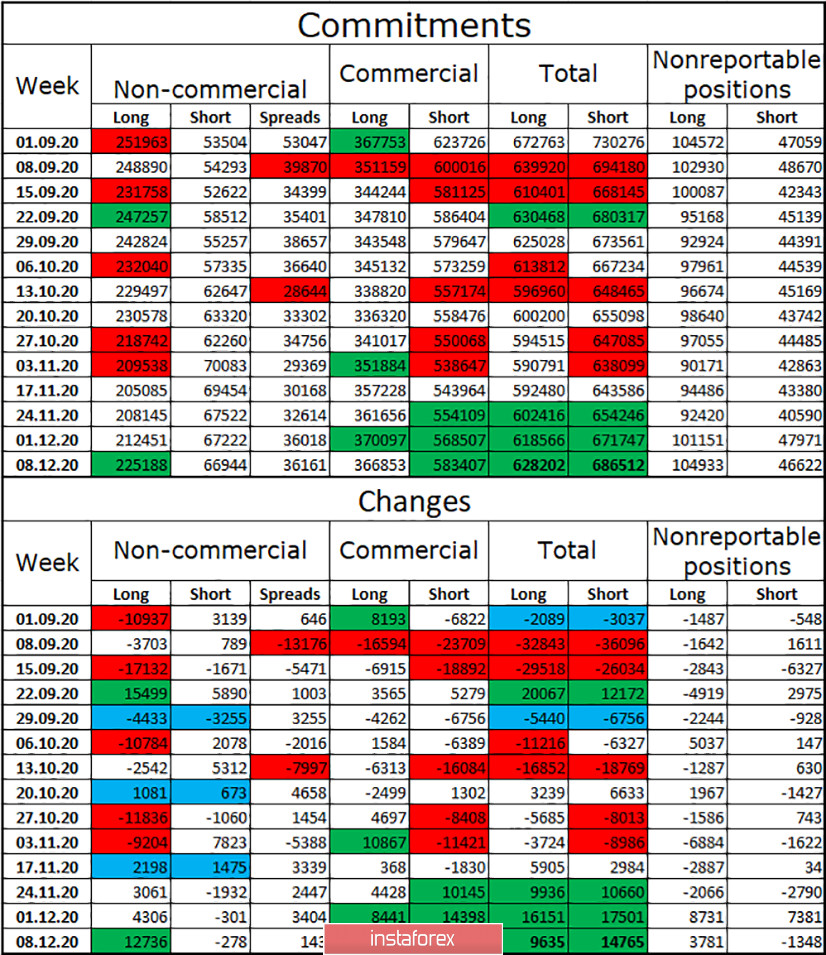

COT (Commitments of Traders) report:

For the fourth week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. During the reporting week, speculators opened as many as 13,000 new long contracts (more than in the previous three weeks), and also got rid of 300 short contracts. Thus, they significantly increased their "bullish" mood. The gap between the total number of long and short contracts in the hands of the "Non-commercial" category is growing again. Therefore, the European currency now continues to maintain high chances of continuing growth, although a month ago it was preparing for a powerful fall. The "Commercial" category of traders, on the contrary, opened short contracts, but it always trades against speculators. And we pay attention primarily to them.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with a target of 1.2060, if the consolidation is made under the trend line on the hourly chart. Purchases of the pair could be opened by fixing quotes above the descending corridor with the goal of 1.2175 and 1.2201. Trades have been held recently without a clear advantage of bulls or bears, but the 4-hour and daily charts keep high chances of growth with their signals.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.