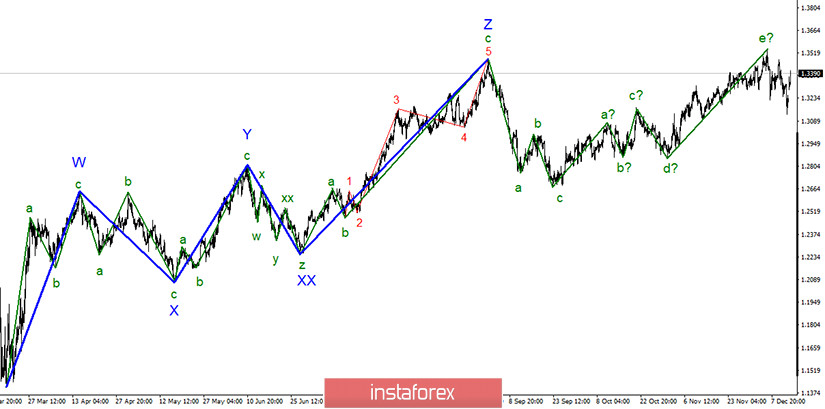

It seems that the upward section of the trend is complete according to the chart. As a result, a five-wave ascending structure of the trend was formed. At the moment, I expect the global descending section of the trend to begin its formation. Meanwhile, three downward waves have already been built. In fact, the formation of the upward section of the trend may start even from the current positions. Consequently, the entire wave pattern may become complex.

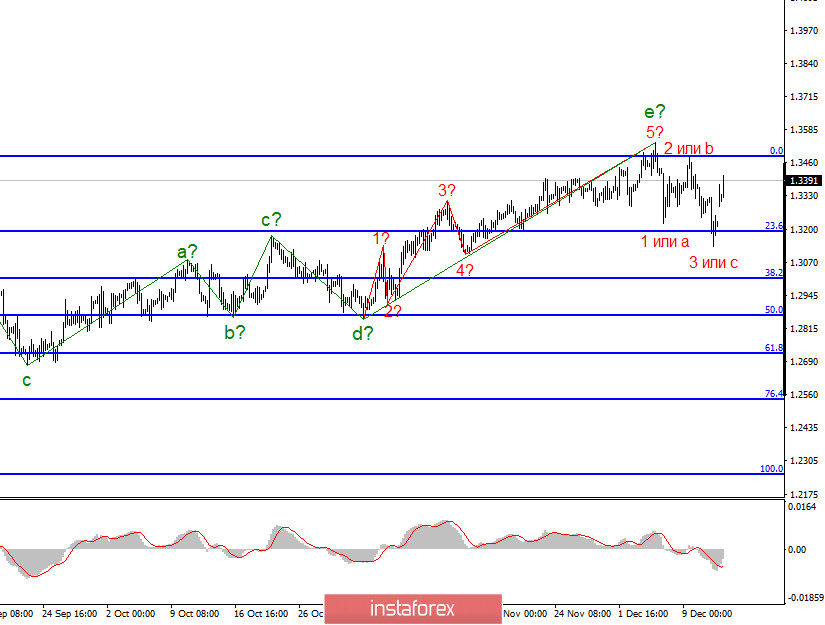

The wave pattern in a lower time frame clearly shows the three-wave section of the trend, which formed after the completion of wave 'e'. After that, the instrument resumed its strong upward movement, adding almost 300 pips. As a result, the formation of the ascending section of the trend may resume despite the fact that the trade agreement is still not signed. Meanwhile, the corrective section of the trend may turn into a five-wave structure after the completion of wave 'e'. In this case, from the current positions, the instrument can start building wave 'e' with targets located near the 38.2% Fibonacci level.

Last week Ursula von der Leyen, President of the European Commission, and UK Prime Minister Boris Johnson, announced that the trade talks would continue until December 13. However, the majority of analysts predicted that the next deadline would have exactly the same meaning as all the previous ones. In fact, it happened as they had forecast. On Sunday, the parties agreed to continue the negotiations further. Boris Johnson also stated that London and Brussels remained apart on fundamental issues and told the UK to prepare for a no-deal Brexit. "There's a strong possibility that we will have a solution much more like Australian relationship with the EU than a Canadian relationship with the EU," he said. However, despite these statements, the parties still continue negotiations, causing optimism in the market. This is the only explanation of a stronger pound. Moreover, at the Monday open, the pair gapped up. That fact indicated how much the markets wanted to buy more pounds. It seems that the market reacts this way only to the news about the continuation of the negotiations. At moments like that, the British pound resumes its bullish trend. The question is: how long are the parties going to extend the trade talks? There are only 16 days left until December 31. What will happen after the end of the transition period? Will the sides continue negotiations in the same way? So far, it is highly unlikely.

General conclusion and recommendations:

The pound-dollar pair has supposedly completed the formation of the uptrend section. At the same time, a three-wave downward formation has already been built. Before a successful attempt to break through the 0.0% Fibonacci level or the high of wave 'e', I recommend that you sell the instrument following each new MACD sell signal with targets located near the levels of 1.3190 and 1.3008, which corresponds to the 23.6% and 38.2% Fibonacci levels. A successful attempt to break through the 0.0% Fibonacci level will indicate that the uptrend section of the trend will become complex and the scenario where you sell the instrument will no longer be relevant.