The pound sterling has been trading on a roller coaster over the last couple of days. First, GBP/USD tumbled to nearly 1.31 and jumped to the level above 1.34 in light of the Brexit news. Boris Johnson was disappointed by the dinner with President of the European Commission Ursula von der Leyen. Commenting on the gridlock in the talks, the British Premier stated that there was a strong likelihood that the UK would exit the EU without a trade deal. However, a day later both sides again sat down at the negotiating table. They came up with the idea of how to meet each other's requirements. The sterling skyrocketed in response.

Over a few months in a row, investors were fretted that London and Brussels were not able to come to the common denominator in three major issues such as fisheries, government aid, and the UK readiness to stick to the same principles as the EU. In fact, the Kingdom was on defensive, pushing ahead with its sovereignty, but the EU insisted on following the rules of fair competition. They sides found out a solution. If one of the sides voices concerns that its rights are violated, this claim shall be settled through consultations. A tough penalty shall entail tariffs imposed on a unilateral basis. Any form of a Brexit deal is bullish for the pound sterling. So, hopes for any deal opened the door for a stunning rally of the British currency. In this context, GBP/USD soared by 300 pips in a flash.Still, it is too early to say that the sterling has overcome the challenge. Experts warn traders of its extreme volatility and the opposite risks against the US dollar and the euro. So, GBP could fall against USD and rise against EUR. Analysts at Barclays predict that GBP/USD might slump as low as 1.25 in case of the disorderly Brexit. In the post-Brexit reality, analysts expect a modest growth of GBP. So, that GBP/USD could rebound to 1.35 as investors have already priced in good news in the currency pair. Goldman Sachs projects GBP/USD to fall 2% in case London and Brussels will be able to settle differences and sign the last-minute deal.

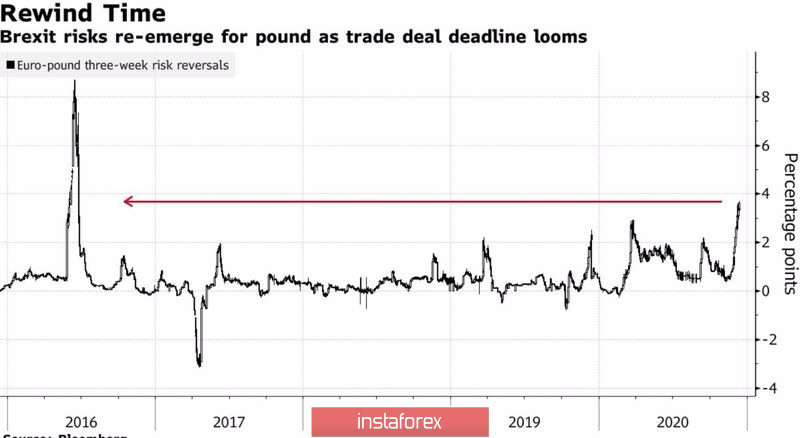

Here are risks of EUR reversal against GBP

Oddly enough, investors seem to neglect the fact that sides have already missed important deadlines. Citing the Brexit negotiators, the talks could continue until Christmas. Both the UK and European Parliaments have been warned that they would have to work in an emergency schedule.

According to Bloomberg, the disorderly Brexit could extract 1.5% from the UK GDP in the nearest 3-6 months. Besides, experts say that the Bank of England will have to lower the repo rate below zero. This will be bearish for the sterling, though it will be good news for the government. The Budget Responsibility Office forecasts that the British public debt is set to swell to 109% of GDP in 2023-2024 from 34% in 2008-2009. At the same time, expenses on the debt service, on the contrary, will decline to 1% from 2%.

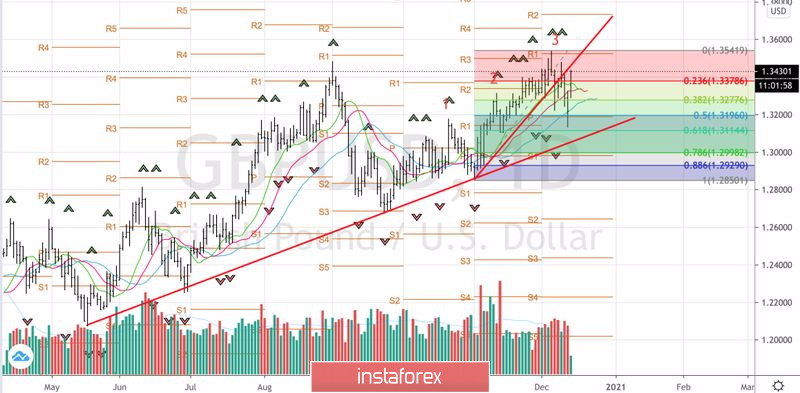

From the technical viewpoint, no trend reversal has happened. In the previous market review, I recommended the strategy of buying GBP/USD on price dips. This trading idea has been implemented perfectly. Now traders are recommended to keep long positions which were opened from the levels of 1.3195, 1.3275, and 1.3375. It would be a good idea to expand such positions on retracements. The pivot levels of 1.353 and 1.366 act as initial upward targets.

Daily chart for GBP/USD