RBA's minutes of their last meeting, which was released today, forced AUD/USD buyers to leave from their gained price highs. Yesterday, the Australian dollar updated its two and a half year high, reaching the level of 0.7579. The last time the price was at such heights was last June 2018. Now, traders are gradually approaching the borders of the level 0.76, but the changed fundamental picture prevented the pair's bulls to impulsively break through the resistance level of 0.7600. However, the current situation can be viewed from the other side, as the downward pullback provides an opportunity to open long positions at a better price. At the same time, the upward trend remains effective, and the current correctional price movements must be viewed through this spectrum.

It should be recalled that the final meeting of the Reserve Bank of Australia this year just faded into the background, since the members of the regulator expectedly did not change the parameters of monetary policy and did not announce any steps in this direction. Therefore, traders did not consider the accompanying statement that the Central Bank is ready to expand QE, if necessary. At the same time, the minutes of this meeting published today made investors return to the topic of expanding the incentive program.

During their last meeting this year, RBA members focused on the Australian labor market. On the one hand, they noted that Australia's labor market is recovering faster than expected, due to lifted quarantine restrictions and recovery in consumer spending. On the other hand, Central Bank members expressed concern that indicators are recovering at an imbalance pace. Based on the calculations of the Central Bank's economists, the country will need years for unemployment to fall to the "pre-crisis" level, that is, in the range of 4.5-5.2%, even with such optimistic rates. In addition, RBA members were concerned about the growth of part-time employment.

According to the latest data, it should be recalled that with the actual increase in the unemployment rate (up to 7.0%), the growth rate of the number of employed in October unexpectedly soared. The number of employed increased by almost 130 thousand, instead of the pessimistic forecasted decline of 30 thousand. However, the part-time component was practically equal with the full-time component (in a ratio of 82/97 thousand).

Thus, RBA indicated that if the labor market does not show signs of sustainable recovery in the near future, the regulator will consider expanding QE (without specifying possible targets for expansion).

Against this background, it is worth recalling that the key data from November's growth in Australian labor market will be released this Thursday. The rhetoric in the minutes of the RBA's December meeting will be particularly important for AUD/USD traders. According to preliminary forecasts, the unemployment rate will remain at 7%, while the number of employed will rise by 40 thousand. Here, the intrigue about the breakdown into full and part-time employment remains. This release will surely provoke increased volatility for the pair.

In any case, the downward pullbacks of this pair should be used as a reason to open long positions. And although RBA's minute was published today, which actually announced the expansion of QE, it failed to pull the pair below the level of 0.7500. This suggests that such a scenario will not surprise traders. Moreover, the regulator, allowing the expansion of the incentive program, ruled out once again the option of lowering the interest rate to the negative area. This fact serves as a kind of pillar to the upward trend of the AUD/USD pair.

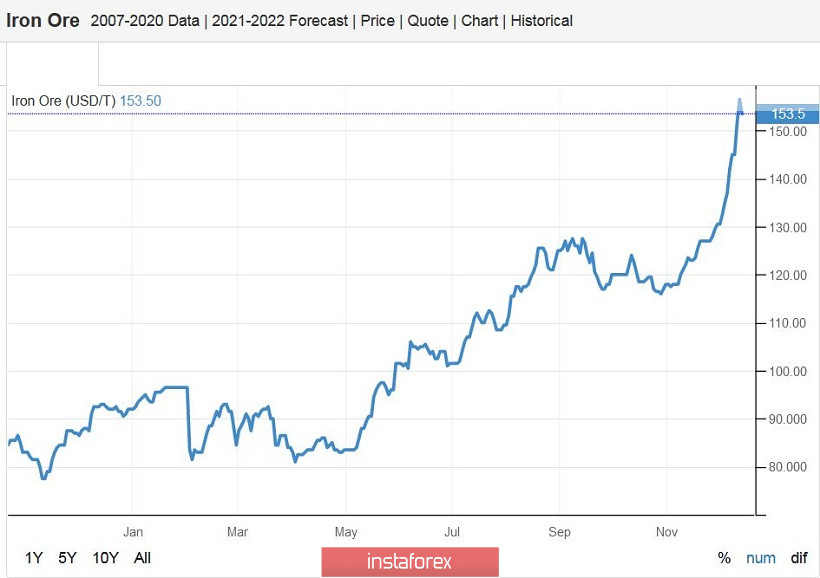

The AUD is also supported by the commodity market. China's iron ore prices continue to rise amid strong demand (in November, China increased its imports of iron ore by 8.3%). The cost of a ton of this raw product on the Dalian Commodity Exchange has already approached $ 150 (for comparison, the price fluctuated around $ 80 six months ago). Amid such trends, UBS investment bank raised its forecast for iron ore prices next year by almost 20%. The strategically important commodity product for the Australian economy is becoming more expensive not only due to demand from China. It also recently became known that Indian steel mills are seeking a government ban on the export of iron ore.

Therefore, buying the Australian dollar is still relevant, even despite the "dovish" rhetoric from the minutes of RBA's December meeting. At the same time, longs can be considered with the first target at 0.7570 (upper Bollinger Bands line on the daily chart), followed by the next target at the "round" level of 0.7600. On D1, the price is between the middle and upper lines of this indicator, as well as above all the lines of the Ichimoku trend indicator. Everything indicates the priority of the upward scenario.