World markets started to take a closer look at the COVID-19 situation once again. In addition, the much-anticipated stimulus measure for the US economy is still in focus.

America's electoral vote showed that Mr. Biden won the presidential election, which is already completely considered in the dollar's quotes and US stocks. At the same time, the market cannot stay calm on the issue of much-anticipated fiscal stimulus, which led to the strongest rally in the US stock market since the late 80s, along with the current news of the invention of effective vaccines against COVID-19. So now, investors do not know what to expect. On the one hand, a financial bubble has blown up in the stock market, supported by broad liquidity injections, which should scare investors and force them to be careful. On the other hand, the unstoppable topic of a likely new incentives after the trade between Democrats and Republicans in Congress, along with the beginning of vaccination of the population in the US and in Europe, continues to support stock indices at local highs.

The uncertainty factor, in turn, leads to an increase in asset volatility. This is clearly manifested in the dynamics of the US major stock indices, which simply rise and decline during the trading day with a fairly wide amplitude.

Like the stock market and other assets, the currency market completely relies on what is happening. The US dollar as a whole continues to be under pressure on the wave of continued general demand for US stocks, hopes for new stimulus and that vaccinations in the States will lead to a full recovery in economic activity.

Today marks the start of the Fed's last two-day monetary policy meeting of the year, which investors are holding high hopes on. Without receiving real incentives from Congress, which is involved in political tensions, the markets are eagerly looking at the Fed. They hope that its final decision will be some new measures to support the economy, which will demonstrate itself as another financial boost, which, in turn, stock market players will use for new purchases of shares, driving the indices to new historical peaks.

In our opinion, it is unlikely that the US regulator will be able to radically change the situation, unless it decides to accept negative interest rates, which is not possible. In any case, Mr. J. Powell and his colleagues at the Central Bank, previously denied this possibility. If the decision is made, it will push up American companies' shares and hit the dollar. However, this will only have a temporary effect and is unlikely to change the situation dramatically. If the outcome of the meeting remains only words and promises, this may lead to a noticeable drop in US stock indices and an increase in the dollar exchange rate on the entire front of the currency market.

Forecast of the day:

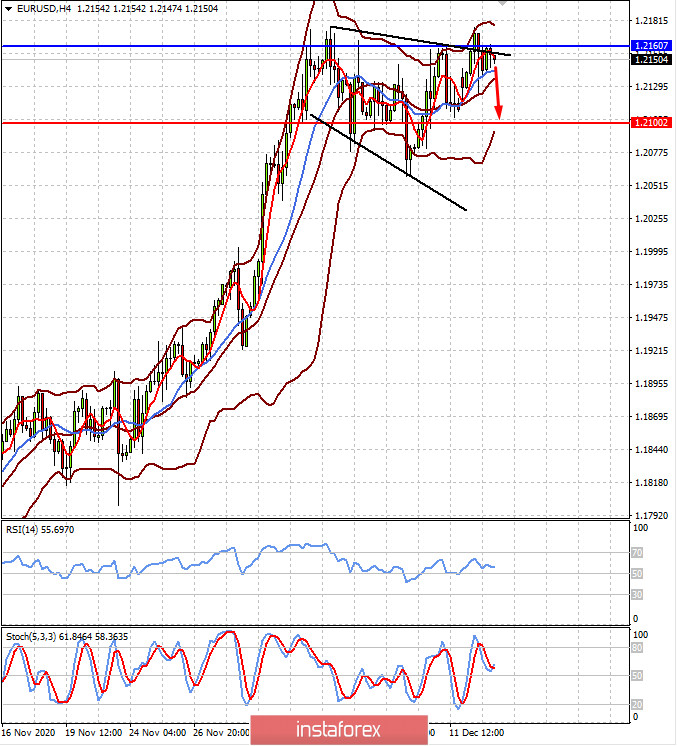

The EUR/USD pair is trading below the level of 1.2160. If the pair fails to break through this level and does not consolidate above it, further decline is likely to 1.2100.

The USD/JPY is above the level of 104.00. A decline below it amid expectations of the results of the Fed meeting may lead to a price decline to 103.55.