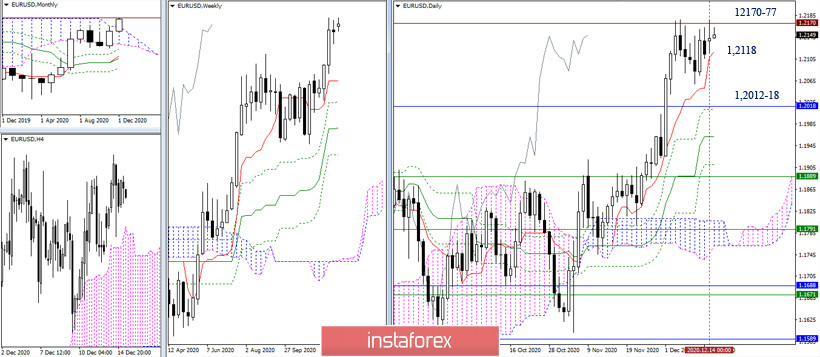

EUR/USD

The pair tested the previous high (1.2177) at the beginning of a new trading week, however, even a good upward gap at the opening did not help to reach a successful result. Now, the upward trend can continue if the high will be updated and there will be a reliable consolidation above. On the other hand, a downward correction will develop in case of failure, loss of the daily short-term trend (1.2118) and a decline below last week's low (1.2059). The next support for strengthening the bearish mood is now located at 1.2012-18 (daily Fibo Kijun + monthly Senkou Span B).

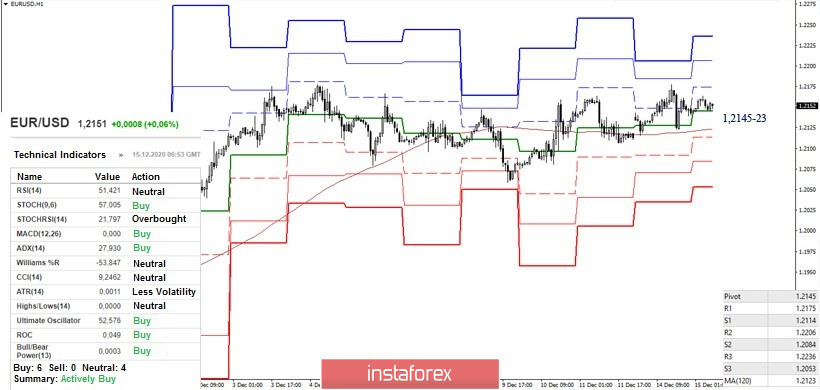

In turn, the bulls retain the key levels in the smaller time frames, which are currently located at 1.2145 (central pivot level) and 1.2123 (weekly long-term trend). At the same time, the support of the analyzed technical indicators also belongs to bullish players at this stage. Their main task is to update the high (1.2177) then R2 (1.2206) and R3 (1.2236) will act as targets within the day.

However, losing the key levels (1.2145-23) and consolidating below will switch the favor towards the bears' side. It will be important for them to leave the previous daily consolidation and correction (low 1.2059) zone.

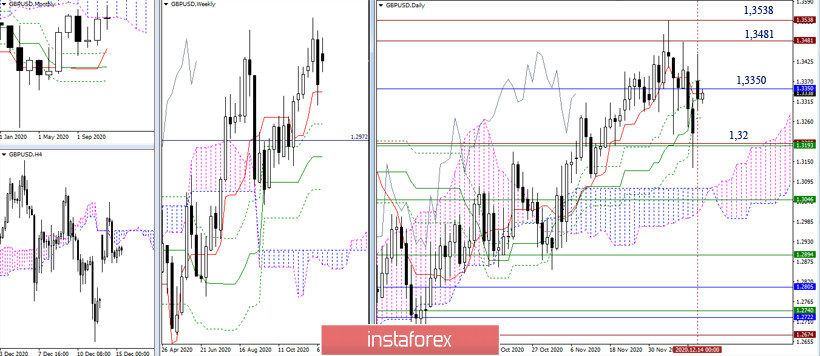

GBP/USD

The previously indicated time frames still determine the pair's movement. Rivals are alternately testing the resistance levels (1.3481 - 1.3538) and support (1.32), returning to the middle ground – 1.3350 (lower limit of the monthly cloud). In case of new scenarios and prospects, the pound must leave the existing borders, move beyond them and securely consolidate.

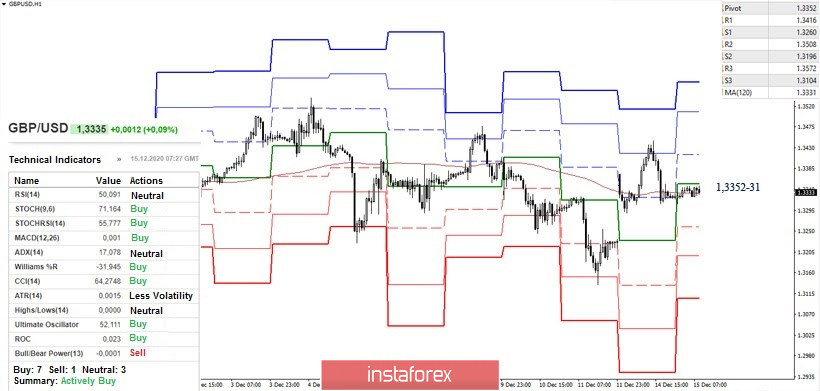

The pair is currently in the attraction zone for the key levels 1.3352-31 (central pivot level + weekly long-term trend) in the smaller time frames. An important level (1.3350) in the higher time frame strengthened this zone, so it is difficult to talk about long-term benefits. Currently, uncertainty dominates. Nevertheless, the pair's movement below the levels (1.3351-31) on one-hour chart gives bears an advantage. They will be guided by the support of classic pivot levels (1.3260 - 1.3196 - 1.3104) for the intraday.

Bullish traders, in turn, will be strengthened by the location and pair's movement above the key levels (1.3351-31). The pivot points for this growth are located today at 1.3416 (S1) - 1.3508 (S2) - 1.3572 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)