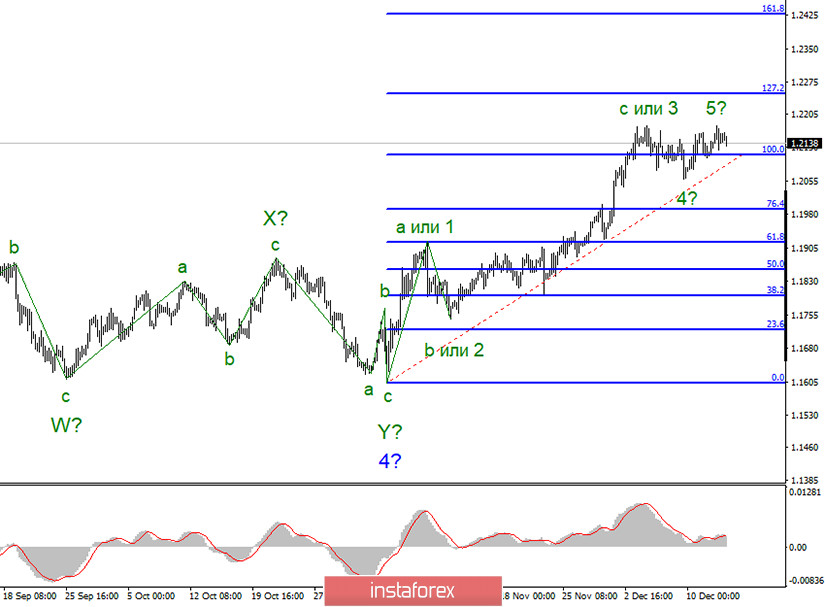

Wave marking of the euro/dollar pair is still pointing to the formation of an uptrend. The rising wave, which now is determined as c, is still under formation. It made an attempt to break the highest level of waves 3 and C. The current uptrend section may change into a five-wave structure. The fact is that three waves have been already formed. In this case, the wave marking could become a bit more complicated. However, it will still point to the upcoming reverse.

A smaller wave marking also points to the formation of the uptrend section. It is also possible that the wave marking of the trend section, which began on November 4, will turn into a five-wave structure. At the moment, a slight drop from the early highs and a further rise proves the readiness of market participants to continue buying the euro. Thus, I added waves 4 and 5.

In recent weeks, the wave pattern has been quite clear. At the same time, the recent news has caused a lot of questions. Demand for the euro is very high. The currency is still trading near its 2.5-year highs. Consequently, in the eurozone, the overall situation is quite favorable whereas in the US, it is not that good. However, in fact, the eurozone and the US have almost the same problems.

Economic reports do not reflect that European economy is recovering much faster than the US one. However, lockdowns in some European countries will have a negative effect on the eurozone's GDP in the fourth quarter. However, markets are ignoring these facts. It seems that market participants do not pay attention even to the most important events.

This week, the US Fed's meeting will take place. It is a really significant event. Most analysts suppose that the regulator will hardly make any fateful decision. The key rates are already at the zero levels. The QE program has been largely extended. Thus, traders are likely to focus on the FOMC statement, as it will contain forecasts of GDP, inflation, and unemployment rate for the next few years.

At the same time, Jerome Powell will provide speech. In recent months, his rhetoric has been dovish. The Fed's Chairman goes on insisting on additional stimulus measures and calling on the US Congress to agree on the aid package. He also emphasizes a possibility of a slower recovery in the fourth quarter. That is why he will hardly change his stance at the last meeting of the year.

Conclusion and recommendations

The euro/dollar pair continues forming its uptrend. This could be proved by a slight drop from the early highs. Thus, I recommend traders remain cautious buying this trading instrument. At the moment, there are no signals that the upward waves formation is complete. If the wave 5 is under formation, it will take little time to complete it. Nevertheless, it is still possible to buy the trading instrument for each new upward MACD signal with targets located near the level of 1.2250, which is equal to 127.2% of Fibonacci.