The correction of US stock indices, the worsening forecasts of global demand from the IEA, and Iran's intention to double production contributed to the pullback of Brent and WTI quotes. Nevertheless, there is no reason to doubt the strength of the upward trend, and the drop in oil prices will most likely be used for new purchases, which suggests a limited potential for a corrective movement.

Despite the fact that the North Sea grade is still far from the $ 65 per barrel level at which it started 2020, reaching the psychologically important $ 50 mark is an important milestone in the history of the black gold market. From the level of the March bottom, it has grown by 213% and is ready to continue the rally in 2021. If this year the main driver of growth was the expectations of a rapid recovery of the world economy and global demand, then next year the bulls in Brent and WTI expect a boom in the tourism business in The United States and Europe, which will spur demand for energy products.

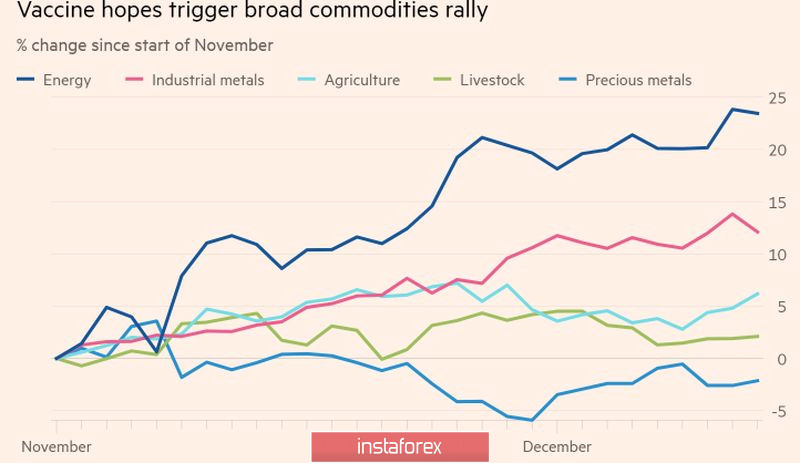

Oil is growing alongside other commodity assets and stocks in hopes of defeating the pandemic. At the same time, the success of the energy sector (+ 24% since the beginning of November) outperforms the results of the composite index S&P GSCI (+ 14%), industrial metals (+ 14%), and agricultural commodities (+ 5 %).

Dynamics of commodity market assets:

Brent and WTI bulls are supported not only by the bright prospects for global demand but also by the high interest in black gold from China, as well as the intention of OPEC + to maintain control over the market. At their last meeting, the cartel, Russia, and other producing countries agreed to a slower return of production to pre-crisis levels, which is good news for oil. Its fans are not particularly embarrassed by the decrease in the IEA's forecasts for global demand for 2021 to 96.4 million b / d to 96.2 million b / d. The reputable organization bases its decision on a slower exit from the lockdown than previously anticipated and the associated slow return of the aviation industry to pre-pandemic levels. At the same time, the current estimate for next year is higher than for 2020 (91.2 million b / d),

Another important asset of black gold is the weak US dollar. Standard Chartered predicts that the USD index will fall 15% in 2021 if Democrats and Republicans do not agree on additional fiscal stimulus, which will force the new US administration to abandon its strong dollar policy and force the Treasury, led by Janet Yellen, to seriously weaken it.

Of course, there is a fly in the ointment in a barrel of honey, and the intention of Iran, which expects to improve relations with the United States after Joe Biden came to power, to double production to 4.5 million barrels per day, is a deterrent for black gold.

Technically, on the monthly Brent chart, the Wolfe Waves pattern was formed and activated, according to which the potential for an upward movement is huge. The long-term target is located near the level of $93.65 per barrel, so we continue to buy the North Sea variety in line with the previously announced strategy.

Brent monthly chart: