USD/JPY continues the strong rise of the last few days. Since the opening of the Asian session, the pair has risen some 75 pips to reach its highest level in five years in the European session at 118.05.

Maintaining the strong bullish bias early in the American session, USD/JPY is trading below 7/8 Murray at 117.90 at the time of writing, although there is a possibility of a further upward movement.

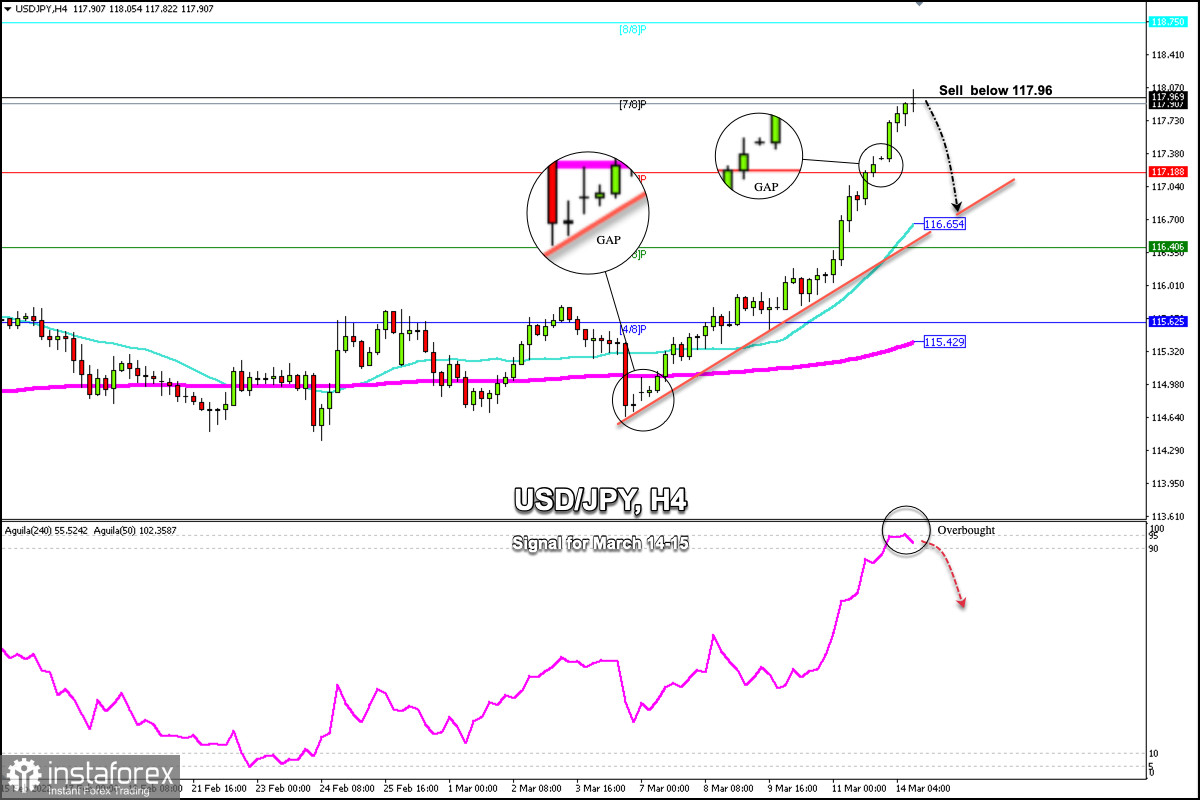

In case of breaking the psychological zone of 118.00 and a consolidating on 4-hour charts above this level, the pair will have a new route to advance without limitations towards the zone of 118.75 where 8/8 of Murray is located and where the highs of January 2017 and December 2016 converge, respectively.

Since last week, Gold has been making a technical correction that has assured investors to return to risky assets. The rising risk-on mood weaekned USD/JPY.

However, technically it is in the overbought zone where 7/8 Murray represents a reversal level. If it continues to trade below this level, a correction could occur in the coming days.

At the opening of trading this week, the yen left a GAP around 6/8 Murray at 117.18. If the pair trades below 7/8 Murray (117.96) in the next few hours, it could fall and cover this gap.

Early in the European session, the Eagle indicator reached the extremely overbought level at 95-points, which represents an imminent bearish correction. If this happens, it will be a good opportunity to sell below 117.96 with targets at 117.18 and up to the 21 SMA at 116.65.

With a sharp break below 116.65 (21 SMA) and a daily close below this level, the trend could change to bearish and USD/JPY may fall towards the 114.75 where it left a gap on Mar 07.