The volatility in global stock markets remains quite high. At the same time, the currency market shows the process of the US dollar's continuous decline, which has somewhat stopped recently.

Investors are still focusing their attention on the topic of mass vaccination in Western countries, as well as the resumed negotiations in the Congress about the stimulus measures to help the US economy. In addition, there are strong hopes that the economy will manage to make a sharp growth at the start of the incoming year, although the excitement around the prospect of a widespread vaccination has somewhat faded into the background together with the expectations of a speedy recovery of the economies of Western countries.

The stock market is supported by the statement of the House Minority Leader, Mr. McCarthy. He said that the parties are close to an agreement, which is similar to what already happened in October, and in November, and now already in December. However, it is doubtful that the markets will fully believe these statements, since a result is already necessary and not just a soulless comment on this topic. All this is strongly reminiscent of the situation that was almost six months ago, when media reports that vaccines were about to be invented supported the demand for company shares, but the market got tired after a while and demanded the very fact of their discovery and start of production. So in this case, we believe that there will now be some kind of reaction about the concluded agreement.

Against this background, the US dollar remains under pressure, since the continuing demand for company shares, paired with the expectations of new financial injections into the country's economy, support the wide supply of the dollar as a funding currency. As a result, its value weakens in relation to other currencies in the currency market.

The pound, in turn, is still dependent on the Brexit situation. The market also seems to be waiting for its result, regardless of the statements (whether optimistic or not). On this wave, the pound exchange rate against the dollar moves in a fairly wide range, swinging up and down, being completely influenced by speculative sentiment.

On the other hand, currencies such as the euro and franc, have fallen into very narrow price ranges, while commodity currencies continue to grow slowly against the US dollar due to the growing demand for commodity and raw materials assets. Here, the vital role is being played by China's demand for these assets, which is not weakening.

Overall, we believe that the current situation on the markets will remain until the Fed makes their final decision on monetary policy, which will become known today. After that, it is possible that the regulator will not make any decisions on expanding fiscal stimulus.

Forecast of the day:

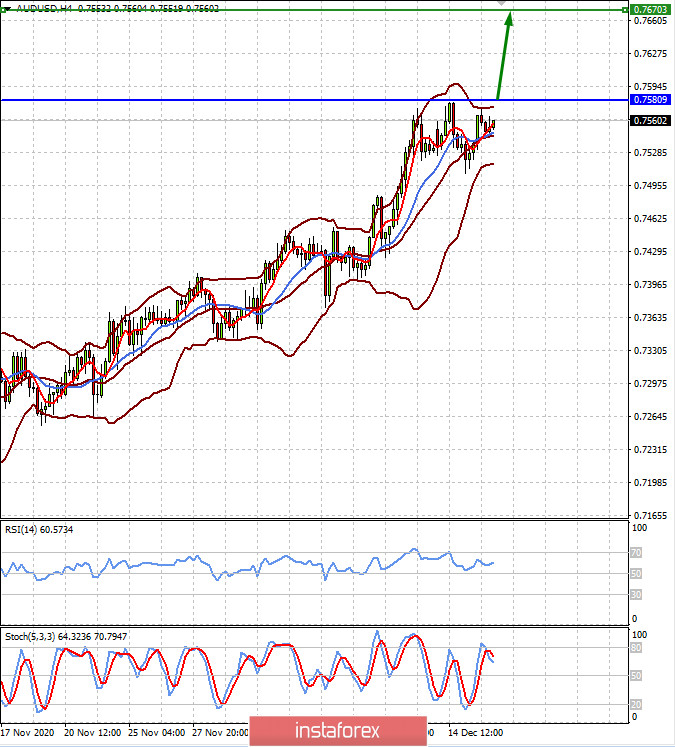

The AUD/USD pair is trading below the level of 0.7580. If the pair breaks through this level and consolidates above it, there is a chance of resuming its growth to 0.7670.

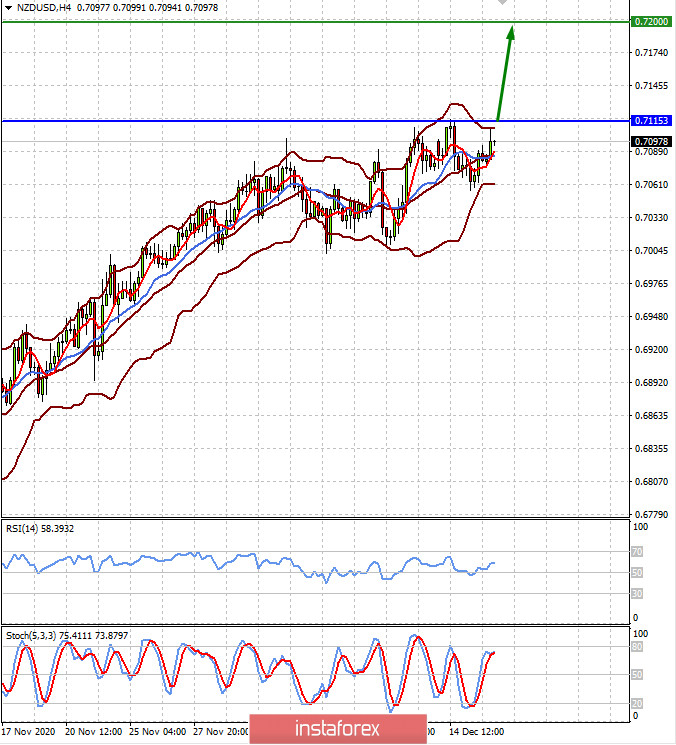

The NZD/USD pair is below the level of 0.7115. If the pair rise above this level, it can further move upwards to 0.7200.