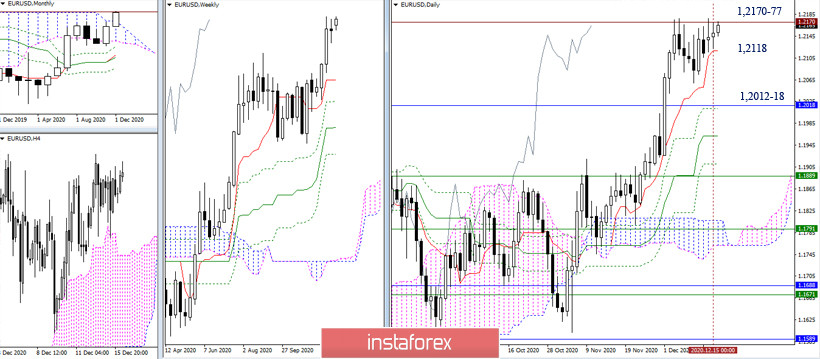

EUR/USD

The pair stayed in a small range yesterday, without showing any strong priorities. But at the same time, it maintains its position directly below the resistance levels of 1.2170-77. If these levels are broken, it can lead to the bulls' new upward activity and then followed by the continuation of the upward trend.

On the contrary, the bulls will be forced to retreat if they do not have enough strength. As a result, the bears will take the advantage, who seek to implement a deeper correction. In this case, the pivot points will be the daily short-term trend (1.2118), last week's low (1.2059) and the combination of support for the daily Fibo Kijun and the upper limit of the monthly cloud at 1.2012-18.

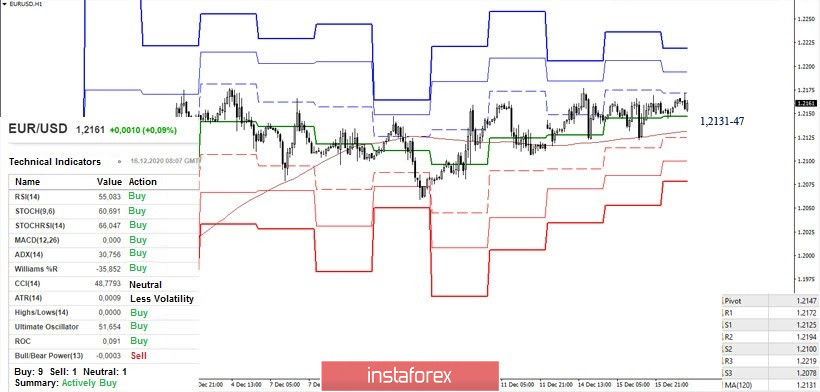

The key levels of 1.2131-47 (central pivot level + weekly long-term trend) keep the bulls advantage in the smaller time frame. After updating the high, the next pivot points are the resistances of the classic pivot levels 1.2194 and 1.2219. A price consolidation below 1.2131-47 will change the current balance of forces and open the direction towards the support levels of 1.2100 (S2) - 1.2078 (S3).

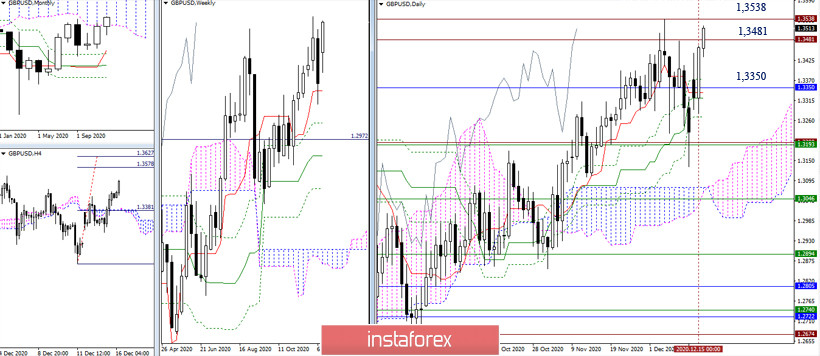

GBP/USD

The bulls moved upwards and started testing the resistance levels of 1.3481 - 1.3538 once again. If they securely settle above these levels, it will allow us to consider new prospects. In case of a rebound, the pair will return to the attraction zone of the monthly cloud (1.3350). On the other hand, a movement below which can compromise the pair's entry and consolidation in the Ichimoku cloud of the higher time frame. The bulls have a great opportunity to consider these plans up to this point.

The development of an upward trend can be noticed in the smaller time frame. The bulls are being supported by all analyzed technical instruments. The upward pivot points of 1.3523 (R1) - 1.3587 (R2) - 1.3709 (R3) can be noted today. Meanwhile, the key supports are located at 1.3401 (central pivot level) and 1.3344 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)