Until recently, the US Fed supposed that inflation would hardly reach the targeted level of 2% in the next two years. However, prices of food and real estate are rising and oil is gaining in value. Notably, inflation expectations are also advancing. That is why investors should know how to protect their money from devaluation. Of course, they may buy stocks, which are likely to continue their rally due to inflationary components of corporate income. However, according to history, investments in securities is not the best way to cope with soaring consumer prices. The current conditions made the Fed raise key rates. This, in turn, led to the downward correction in the S&P 500. That is why gold is the best way to save money.

Investors returned to gold when the stimulus package issue turned out to be on the top of the agenda for the US Congress. When the likelihood of the "blue wave" declined, bulls of XAU/USD lost their control. Nevertheless, both Democrats and Republicans understand that the slumping US economy needs money. That is why they are ready to come to a consensus. Senate majority leader Mitch McConnell is not satisfied with the package of $908 billion. The coalition is ready to reduce it to $748 billion, excluding such thorny issues as financing of local authorities and protection of responsibility. The aid package is likely to be approved until the end of 2020. This is really good news for traders of gold.

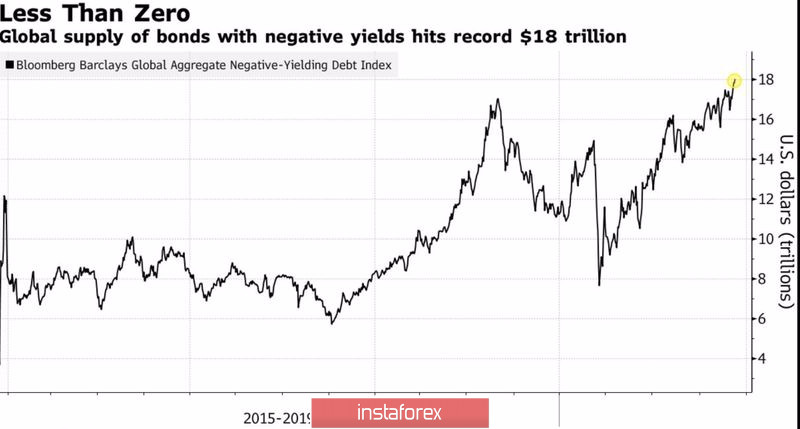

The precious metal is gaining in value amid the growth of the global debt market with negative yields to a record high of more than $18 trillion. Despite the fact that the share of the debt in the aggregate indicator declined to 27% in 2020 from 30% in 2019, the pandemic is forcing governments to increase money supply. That is why most currencies are depreciating thus pushing XAU/USD higher.

Global Negative Yielding Debt Index

Under such conditions, the Fed's policy is extremely important for the gold market. After the successful vaccine trials and launch of mass vaccination, the US mid- and long-term economic prospects have improved. This fact is likely to be reflected in the FOMC's forecast for GDP. At the moment, the US GDP is expected to decline by 3.7% in 2020 and to grow by 4% in 2021. If the indicator quickly returns to pre-crisis levels and inflation accelerates, the Fed will have to revise its key interest rate. However, now, the regulator is not planning to raise rates until 2023. If the Fed keeps its ultra-loose monetary policy unchanged, the bullish sentiment will improve. At the same time, hawkish policy may lead to a slump in gold prices.

From the technical point of view, there is a Wolf Waves pattern on the chart. The formation of this pattern predicts a rise to $1,990 per troy ounce. If the price breaks lines 2-4, it is possible to open long positions. However, a more aggressive strategy is based on a break of the resistance level of $1,875-1,880. As a result, model AB=CD will be seen with the target of 200%.

Gold, daily chart