The Bank of England will meet today to discuss its further action on interest rates. However, the decision should be made in the face of the face of which, since it is not completely uncertain whether the negotiators will succeed in bringing out a trade deal with the UK. The inaction of the central bank, which we have witnessed recently, could seriously hit the economy if a deal was not concluded.

GBP: Many predict that the monetary policy will remain unchanged, but the Bank of England could signal an adjustment if a trade deal was not reached. The central bank last increased its bond purchase program six weeks ago, but according to the statements of Andrew Bailey, it still has the capability to further increase the volume of its bond purchases and pump money into the financial system. But sadly, this would not prevent long queues of trucks if borders are closed on January 1 and a trade agreement is never signed.

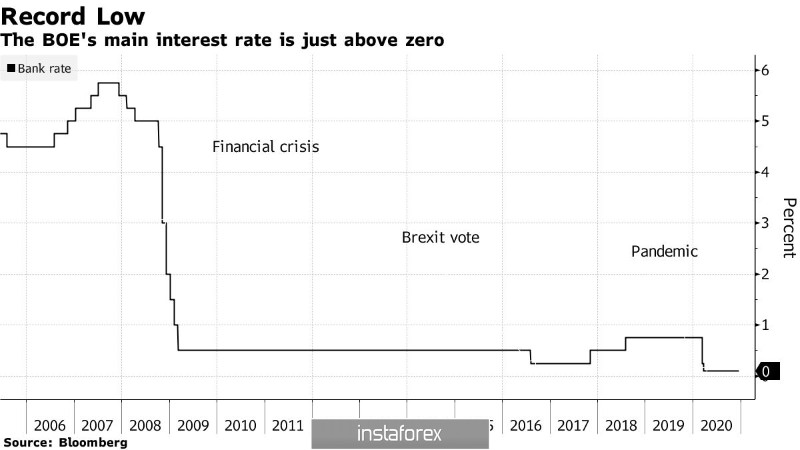

At the moment, like the central banks of other countries, the Bank of England is focused on keeping the cost of borrowing as low as possible. Its base interest rate is at an all-time low of 0.1%, and the bond purchase program has increased to £ 895 billion ($ 1.2 trillion).

Regarding Brexit, the failure to conclude a free trade agreement would mean the immediate imposition of duties and customs checks on goods at the borders, which will only worsen the economic components and hit the supply chain. According to a number of economists, the failure of the parties to conclude a trade deal will lead to a decrease in UK GDP by 1.5% in 2021.

Based on Bailey's statements, the first step that the Bank of England could do is to raise the volume of its bond purchases and extend the quantitative easing programs. The second solution, though it is only by theory, will be the introduction of negative interest rates, which the central bank is in no hurry to resort to. Only a serious deterioration in economic activity can force it to make such changes.

With regards to the GBP / USD pair, pound bulls are aiming for a breakout at 1.3550, as going beyond which will make it easier for the quote to reach the 36th figure. But if there is bad news on Brexit, the GBP / USD pair will return to 1.3475 and 1.3405. The inaction of the Bank of England may also put some pressure on the pound, but this is unlikely to lead to a major sell-off.

EUR: The euro is ready to reach a new local high, especially since yesterday, the policy decisions of the US Fed led to a temporary strengthening of the US dollar, which fueled the risk appetite of traders.

The Fed has kept interest rates at zero levels and the volume of bond purchases at $ 120 billion per month, and they projected that fund rates will reach 0.1% by the end of 2022. Only one Fed chief expects a rate hike in 2022, while five of his colleagues expect a change by 2023.

The central bank also announced that the US GDP will contract by 2.4% for 2020, but will grow by 4.2% in 2021 and 3.2% in 2022. As for the unemployment rate, the Fed predicts it will reach around 6.7% in 2020, and then fall to 5% in 2021. Then, in 2022, it will reach 4.2%.

Fed Chairman Jerome Powell said economic activity continues to recover, but it was the virus, not the financial conditions, that put pressure on the service sector. He also noted that significant difficulties remain with the vaccine, and therefore the pace of improvement in the labor market has seriously slowed down. Powell then stressed the importance of fiscal support, as such will sustain strong growth dynamics next year. According to him, economic activity will only rise if the US finally achieves massive immunity by mid-2021. If necessary, the Fed will further increase its bond purchase program.

Since all these statements were quite expected, the demand for the US dollar did not last as long as it could have under other, more normal circumstances.

Therefore, in the EUR / USD pair, after the breakout from 1.2165, there was a large increase in the euro, towards the target level of 1.2250. Reaching this area will strengthen the positions of euro bulls, and will enable the pair to reach the level of 1.2340. But if the quote moves below 1.2160, the euro will collapse to 1.2110 and then to 1.2060.

With regards to the state of the US economy, the report published by the IHS Markit confirmed the Fed's statements that economic activity is starting to slow in the US. Business activity has declined in December amid a record rise in COVID-19 infections. In particular, composite PMI came out at 55.7 points, while in the previous month, the index was at 58.6 points. Nonetheless, a value above 50 means an increase in activity.

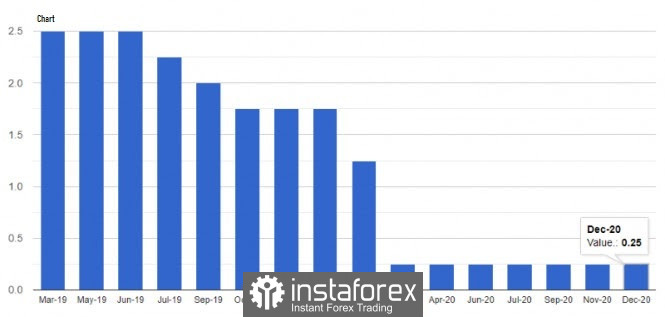

As for the Service PMI, it reached only 55.3 points in December, while in November it was at 58.4 points. Economists expected the indicator to come out at 56.5 points.

Manufacturing PMI, meanwhile, reached 56.5 points, while in the previous month it was at 56.7 points.

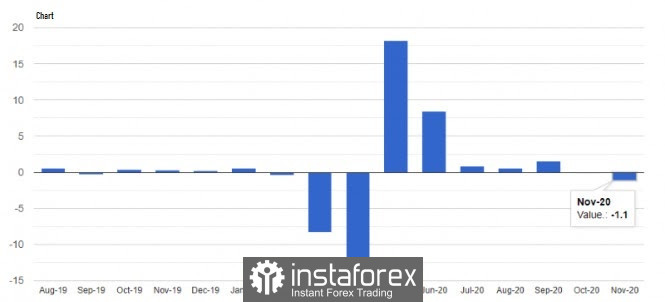

Data on US retail sales also indicated that the US economy is still suffering. Its figure dropped by 1.1% this November, which suggests that American consumers are clearly spending less amid the second pandemic wave.