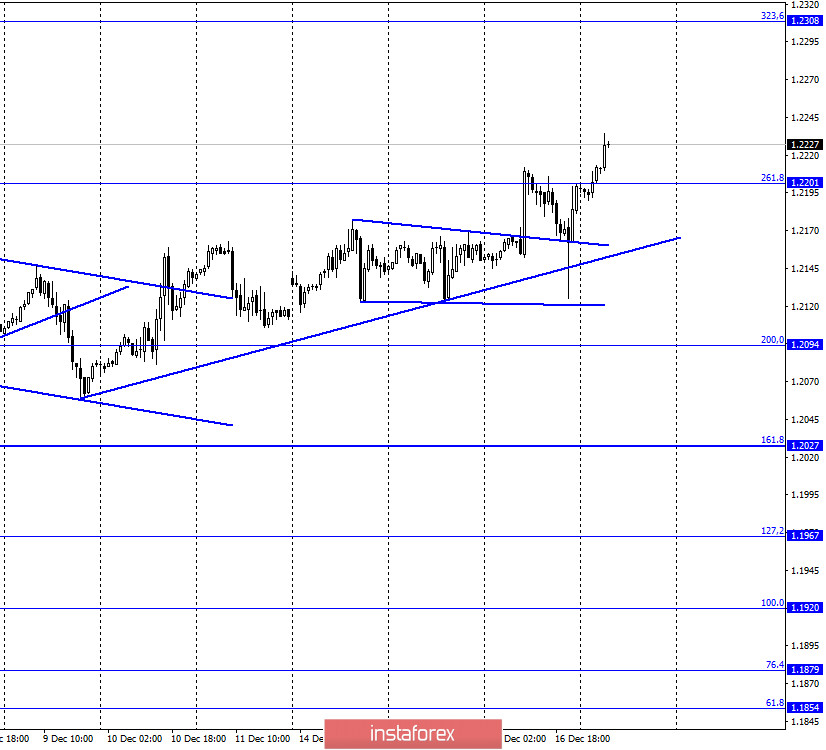

EUR/USD – 1H.

On December 16, the EUR/USD pair first performed a consolidation over the narrowing channel and began a new growth process. However, it significantly decreased late in the afternoon. Further, after the Fed meeting and the price rebound from the rebuilt ascending trend line, it resumed the growth process and performed a consolidation above the corrective level of 261.8% (1.2201). Thus, now the growth process can be continued in the direction of the next Fibo level of 323.6% (1.2308). As I said, last night, the results of the next and last meeting of the Fed this year were summed up. As expected by traders, the rates remained unchanged in the range of 0-0.25%. The monthly repurchase program also remained unchanged at a minimum of $ 120 billion per month. Thus, the data concerning forecasts for key economic indicators became more interesting. The Fed has improved its GDP forecasts for 2020 and 2021. Thus, this year is expected to fall by only 2.4% (instead of the previous 3.7%). In 2021, it is expected that the economy will grow by 4.2%, and not by 4%, as previously expected. According to the Fed's estimates, unemployment in 2020 will be 6.7% (previously the regulator expected 7.6%). In 2021, it should be reduced to 5%. Inflation is expected to reach 1.2% y/y this year and rise to 1.8% next year. As for the statements of the Fed representatives, they were no different from the statements at previous meetings. Jerome Powell and other members of the monetary committee believe that the further recovery of the economy depends entirely on the epidemiological situation. The regulator will continue to strive for maximum employment and an inflation rate of 2.0% y/y. Monetary policy will not be tightened until these goals are achieved.

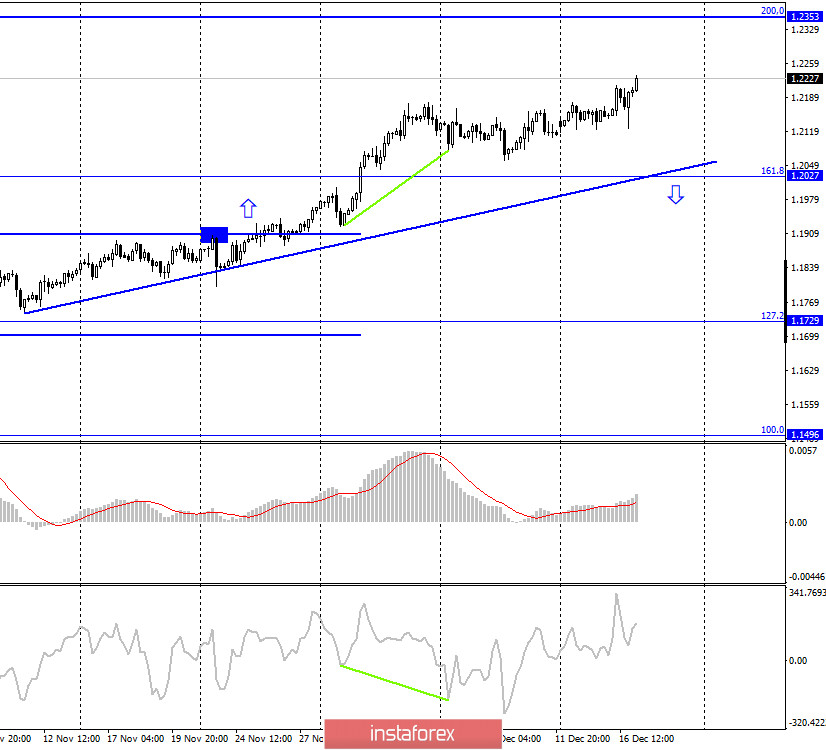

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes continue to grow slightly in the direction of the corrective level of 200.0% (1.2353). The upward trend line still characterizes the current mood of traders as "bullish" and increases the probability of further growth. As long as the quotes do not consolidate under the trend line, you should not expect the pair to fall.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair also continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 16, the European Union released business activity indices in the manufacturing and services sectors, each of which exceeded traders' expectations. Reports on retail sales and business activity in the United States, by contrast, were worse than expected. During the day, the US dollar showed growth for a while, but then it still fell.

News calendar for the United States and the European Union:

EU - consumer price index (10:00 GMT).

US - number of initial applications for unemployment benefits (13:30 GMT).

On December 17, the most interesting report will be on inflation in the EU. However, now traders do not pay attention to all the statistics. The euro currency simply continues to grow regardless of the nature of news and reports.

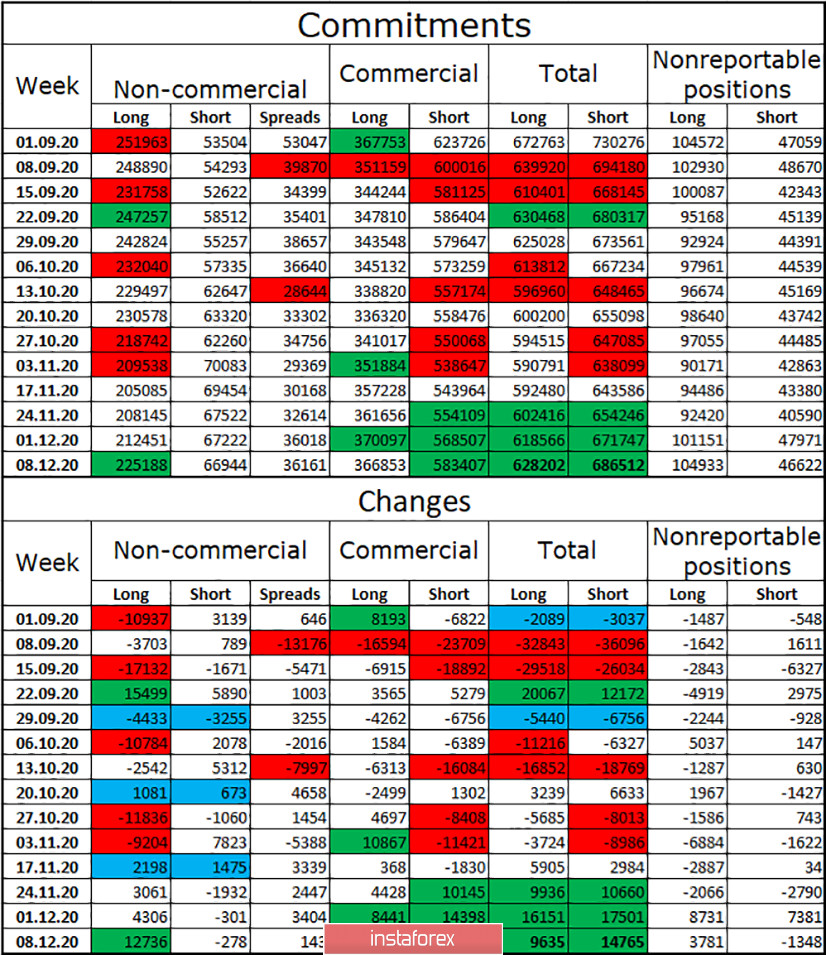

COT (Commitments of Traders) Report:

For the fourth week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports, and it coincides with what is happening now for the euro/dollar pair. In the reporting week, speculators opened as many as 13 thousand new long-contracts (more than in the previous three weeks), and also got rid of 300 short-contracts. Thus, they significantly increased their "bullish" mood. The gap between the total number of long and short contracts in the hands of the "Non-commercial" category is growing again. Therefore, the European currency now continues to maintain high chances of continuing growth, although a month ago it was preparing for a powerful fall. The "Commercial" category of traders, on the contrary, opened short contracts, however, it always trades against speculators. And we pay attention primarily to them.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with a target of 1.2094, if the consolidation is made under the trend line on the hourly chart. Purchases of the pair could be opened by fixing quotes over a narrowing corridor. The first target has already been worked out (1.2201), and closing above it allowed buying the pair with a target of 1.2308.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.