Key US stock indexes opened higher in anticipation of big money. Federal Reserve Chairman Jerome Powell beamed with optimism yesterday, promising extensive support for the country's economy. Powell also instilled hope that vaccinations should play a big role in the recovery of the US economy. Risk appetite is high, and the S&P 500 has conquered the next high, thereby punishing stubborn sellers.

However, the growth of the stock markets may gradually exhaust itself, and closer to the new year, investors will probably want to take profits on long positions. Now there is growth, the key factor of which is stimulation.

"Any assistance to the economy at this stage is already good, especially when we are going through a difficult year. This will speed up the economic recovery a little," Pine Bridge Investments said.

The dollar has no other choice but to fall in the current environment. The weakness is gradually gaining momentum, pushing market players into other assets. Rush demand is in stocks, euros, gold, as well as cryptocurrencies.

The US central bank has promised to continue buying assets on the balance sheet at 120 billion per month. This will continue until inflation approaches the desired 2%. Such comments kept the upward trend of investors and put even more pressure on the positions of the dollar. Not only does the Fed play against the US currency, but so do macroeconomic reports. Retail sales declined in November for the second consecutive month. The stock positive about the vaccine, as we can see, did not spread to the ordinary American man in the street, who continues to worry about the pandemic in the country and does not dare to spend money yet.

The April financial cushion with a check of $1,200, as practice shows, is quickly depleted. The legislators' new plans call for a $600 handout, which is half that. However, these plans have not yet been implemented. The economy is left without support, and the only potential savior is the Fed, which is providing support through low rates and QE. This is a disaster for the national currency, and there are no chances for recovery now.

Today, investors are evaluating a new piece of statistics from the United States. The negative news came from the labor market. The number of initial applications for unemployment benefits increased over the week by 23,000, to 885,000 applications. On the other hand, analysts had expected it to decrease by 53,000, to 800,000. Meanwhile, the number of new buildings in the country increased by 1.2% in November, while market players had expected it to remain unchanged since October.

Today, the dollar index broke down the level of 90 points, which for a relatively long time resisted the attack of sellers. During the session, there were no attempts to restore positions. The dollar continued to decline against a basket of its main competitors in the US session, the indicator reached 89.7. Judging by the directed downward movement, the downward trend will continue.

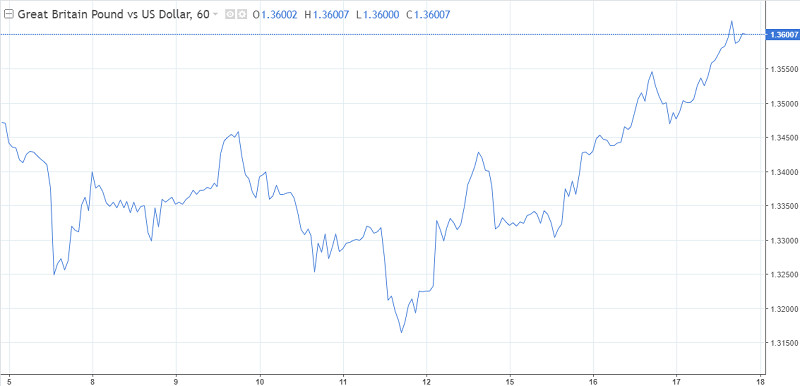

The euro and the pound, which rose above 1.2230 and 1.3550, respectively, showed impressive dynamics, mainly due to the fall in the dollar. The pound broke through the 1.36 mark. The contrast with the US was strengthened by PMI estimates, which indicated a fairly confident recovery in manufacturing in both the EU and the UK.

The pound's positions largely depend on how the dialogue between Brussels and London will develop. Concerns about Brexit remain a key factor at the moment.

Meanwhile, today's rally in sterling has somewhat corrected expectations about how traders will react to any trade after Brexit. If it does take place, then the GBP/USD pair should initially go above 1.37. It is not a fact that the British currency will last long at such levels. We need to tune in to sell, as the pound, as analysts say, is facing unsteady fundamentals.

As for today's Bank of England meeting, the pound, as expected, reacted modestly to its results. The main focus is now on Brexit.