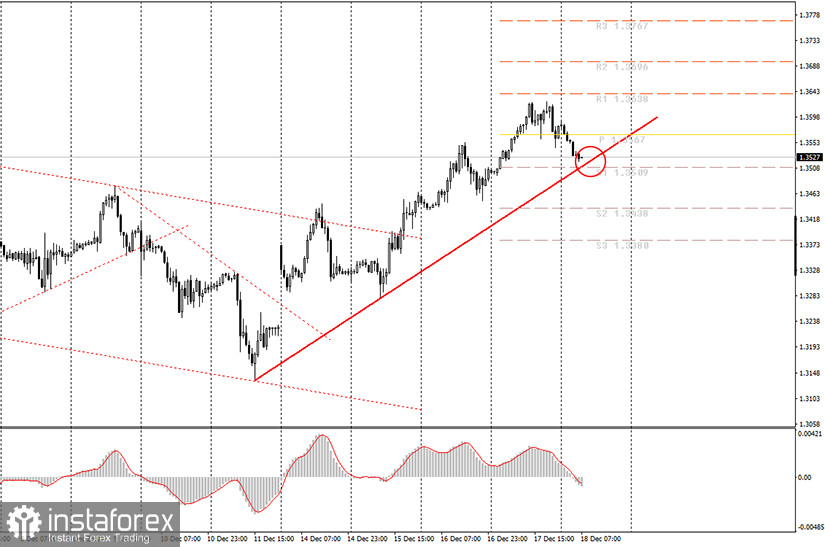

Hourly chart of the GBP/USD pair

The GBP/USD pair also continued to move up throughout the week, and it is very difficult to find an explanation for it. Yes, on the one hand, we can say that traders still believe that London and Brussels will be able to conclude a trade deal, but the pound cannot rise in price on this expectation alone and for several months? But this is exactly how it turns out. Negotiations are constantly being extended, there is no progress, the parties are constantly announcing "serious disagreements", suggesting to prepare for a hard Brexit, but traders still believe in the deal and buy the pound. Thus, we believe that the pound's growth is as speculative as the euro. And that's it. From a technical point of view, the upward trend line is still present and will do so. However, the price is currently correcting, therefore, in the near future, either the price will rebound off the trend line or it will overcome it. In the first case, beginners will receive a new buy signal, in the second - a sell signal. Therefore, the only thing to do is to wait a little and hope that the signal will not be false.

The pound continues to rise no matter what. We have been talking about this for several weeks or even months. Nevertheless, nothing changes from our bewilderment. Yesterday, the results of the Bank of England's final meeting for 2020 were summed up, and no important decisions were made. The key rate remained at the "ultra-low" level of 0.1%, and the asset repurchase program remained at 895 billion pounds. And so the Bank of England did not lower the rate and did not give any hints as to when it might take this step. Recall that the rate cut is a strong bearish factor for any currency (in our case, the pound) and the Bank of England has been considering the possibility of using this instrument to stimulate the economy for six months. But, as we can see, everyone is hesitant to introduce it or is just waiting for it to become thoroughly known about Brexit and the presence/absence of a deal between the UK and the European Union.

The UK is set to release reports on consumer confidence and retail sales for November. However, we are almost certain that traders will not react to any of these data. They are already unhappy with the current news, and we can not guarantee that the most important reports will be ignored. Therefore, technique, that is, technical signals, will be prioritized. On Friday, traders often like to lock in part of the profit on trending deals, so there is a possibility that the downward movement will continue, but the trend line must be overcome.

Possible scenarios for December 18:

1) The upward trend is still maintained, as evidenced by the fact that the price is above the trend line. So now novice traders are advised to expect that the price would rebound from the trend line and/or an upward reversal of the MACD indicator. In this case, you are advised to open new long positions while aiming for the resistance levels of 1.3638 and 1.3696.

2) Selling, from our point of view, is not advisable right now, since there is an upward trend line. Therefore, sellers need to wait until the price overcomes this line and only after that should they start trading down while aiming for 1.3438 and 1.3380 (which, however, may happen in the next few hours).

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.