The US dollar ends the week with a clear decline against the basket of major currencies, completing its second unfortunate month.

The primary reasons for such dynamics are investors' change of mood in global markets due to news reports about the invention of vaccines against COVID-19, Fed's all sorts of statements saying that the regulator will pursue a soft monetary policy as long as necessary, and expectation of new fiscal stimulus from Congress. As a result of all this, there was a strong growth in demand for risky assets, which led to a noticeable increase in US stock indices.

In fact, the two-month decline in the US currency rate has led to the fact that the basket value, expressed in terms of the dynamics of the ICE dollar index, is approaching the low values of January 2018. Technically speaking, USD is approaching oversold conditions against all major currencies, which theoretically should be a signal to buy it. However, we believe that it is an insignificant task to pay attention to technical signals now, as investors are paying more attention to the external factors or reasons mentioned above.

Considering the entire sector of reasons that affect the US dollar exchange rate, we believe that it will remain under pressure, although we should not exclude a local correction amid partial profit-taking – for example, in the stock markets, which will lead to local demand for dollars. However, if Congress does decide on new measures to support Americans and businesses, expectedly for $ 900 billion, then this may serve as another reason to increase demand for company shares, which will result in the weakening of the US currency.

It should be understood that dollar's dynamics was in direct proportion to the demand for risky assets, primarily for company shares. This is happening in recent years, when the Fed's monetary policy almost strictly regulated the inflow of liquidity to the market.

We believe that the current condition will continue until the beginning of 2021. Therefore, we consider selling the instrument if any small-scale growth is noticed in the US dollar.

Forecast of the day:

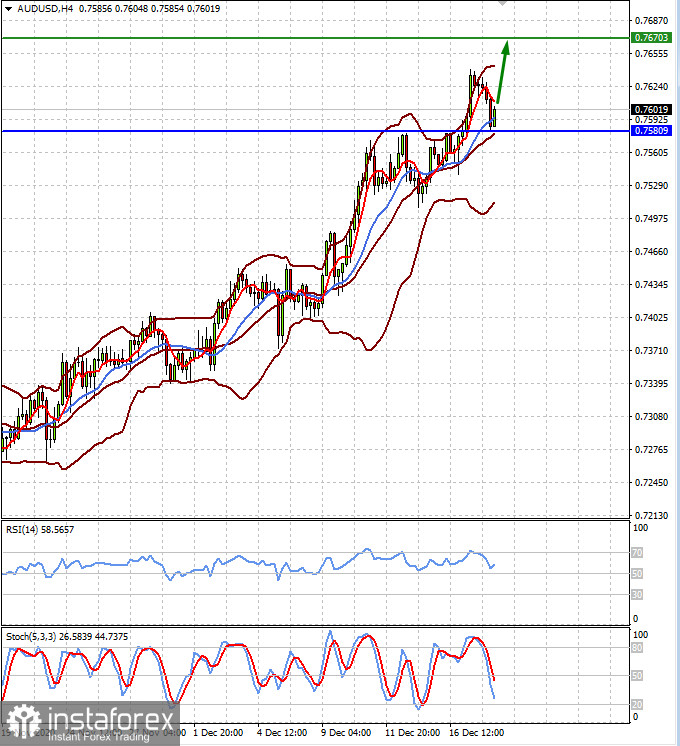

The AUD/USD pair is trading above the level of 0.7580. A price consolidation above it will lead to further growth of the pair to 0.7670.

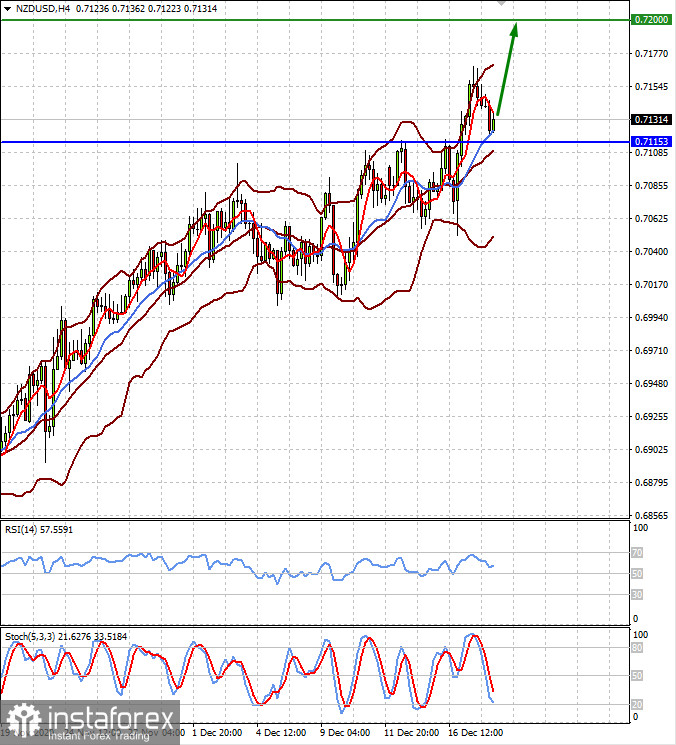

The NZD/USD pair is above the level of 0.7115. It is expected to continue rising to 0.7200.