GBP: Some details of the Brexit negotiations were revealed. They disappointed traders who were hoping for a deal to be signed this week, as they clearly suggest that such will not happen. And because of this, demand for the pound plummeted sharply, therefore, it would be risky to open long positions at the current highs. It is more rational to proceed from the technical correction, as such may intensify today.

Nonetheless, at the moment, the target of pound bulls is to return the quote to 1.3560. Then, good data on UK retail sales will pull it up even higher to 1.3620, a break of which will make it easier for the pound to reach the 37th figure, in particular, the level of 1.3760. But if the pressure on GBP / USD persists, the quote will drop to 1.3360.

Going back to the negotiations, UK Prime Minister Boris Johnson said it may fail if the EU does not soften its position on fisheries. He called the EU's demands unreasonable. As for European Commission President Ursula von der Leyen, she said it will be quite difficult to overcome the existing differences on the issue.

But despite this pessimistic rhetoric, officials in Brussels have expressed confidence that a deal could be closed before next week. They said that behind the scenes, the negotiations are moving in the right direction, and emerging negative statements from both the EU and the UK are common negotiation tactics to exert pressure.

The remaining issue that hinders the concussion of a deal is the access of European fishing vessels to UK waters. The problem has minimal economic impact - the industry accounts for only 0.12% of the UK's GDP - but has a lot of political implications. This industry employs only 24,000 workers, which, for the EU economy, is practically "nothing". However, the EU wishes to have access to the UK's rich fishing waters in the future, as more than half of the fish and shellfish caught in UK waters come from EU countries. The UK wants to regain control of its economic zone (which is about 200 nautical miles under international law) and withdraw from the EU fisheries agreement, which sets quotas on how much and what kind of fish EU countries can catch.

Political analysts said that if both parties failed to sign a deal just because of this issue, it likely means that one of them is not ready to enter an agreement from the very beginning.

In another note, the pound's growth earlier this week was driven by the rumors that a compromise has been found on the problem of equal competitive conditions for business. Then, yesterday, the European Parliament increased pressure on negotiators by setting the deadline on Sunday. Therefore, by that time, the UK and the EU must ratify an agreement.

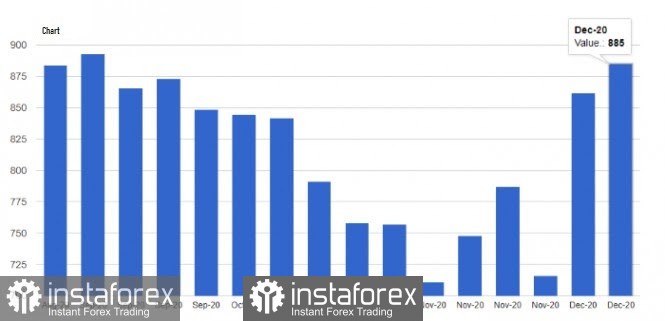

USD: The US dollar collapsed after data emerged that US jobless claims rose amid the second COVID-19 outbreak. The report published by the Department of Labor said initial jobless claims jumped 885,000 between December 6 and 12, while economists expected a drop in the figure. Secondary applications also rose to 812,500, which suggests that it is high time to start worrying about the state of employment again, because conditions will only worsen amid the continuous spread of the coronavirus. The results of the vaccination will be seen next year, but for now, restrictive measures and pressure on the service sector will force business owners to fire people to minimize costs. Current government aid programs are inadequate, and the supposed $ 900 billion new US package is once again suspended.

This weak data on jobless claims is likely to have a negative impact on the overall nonfarm payrolls report due in early January 2021.

On a positive note, housing starts in the US increased in November, as apparently, demand rose amid very low interest rates. The report published by the US Department of Commerce said they increased by 1.2% to the previous month, and compared to 1.547 million units per year. The Economists had expected the figure to drop by 0.7% and amount to only 1.52 million units per year.

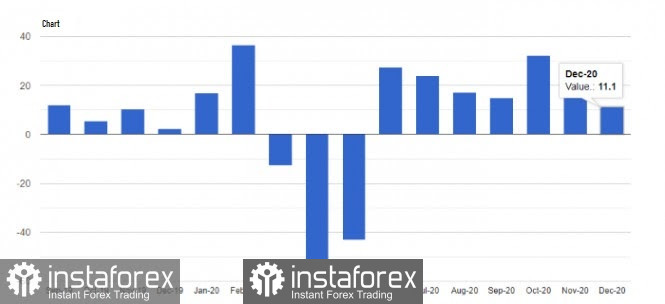

As for economic activity, Kansas City Fed said the composite index jumped to 14 points in December, while economists had expected it to be 10.0 points only. Strong growth in manufacturing activity is a sign of a healthy sector, even as the coronavirus spreads.

Meanwhile, the report from the Philadelphia Fed was not that good, as according to the data they released, business activity in the area fell to 11.1 points this December, while economists had expected it to be 20.0 points. But this slowdown in activity is not a serious problem yet, since the growth of the production sector in the region continues, albeit at a slower pace.

With regards to the EUR / USD pair, the bulls are currently trying to break the quote above 1.2271, as going beyond which will form a new and strong upward trend. If they succeed, the euro could reach the levels 1.2305 and 1.2340. But if there is no activity on the part of buyers near the yearly highs, EUR / USD may decline to 1.2225, and then to 1.2180.