A telephone conversation was held late last night between British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen. During the conversation, some progress was noted in the Brexit negotiations, however, some rather important issues have not yet been resolved, and one of these problems is fishing. It is still unclear what rules will be used to catch fish after the UK leaves the European Union. The parties cannot reach a compromise on this rather important issue. Something suggests that the issue of fishing will remain open. In the event of the UK leaving the EU without a deal, starting from January 1, 2021, four naval ships of the British navy will protect the places for catching fish.

Regarding yesterday's decision of the Bank of England on rates, as expected, the Monetary Policy Committee of the British Central Bank did not make any changes and kept the key rate at 0.10%. At the same time, it was noted that further economic prospects remain uncertain. In addition to the COVID-19 pandemic, the impact on economic activity in the UK will depend on the ability to conclude a trade agreement between the UK and the European Union in the remaining days. According to experts, the probability of concluding a trade deal is less than 50%. Thus, the Bank of England leaves for itself a field for maneuvers after leaving the EU. Already after the exit, the Bank of England will make changes to its monetary policy. Today, data on retail sales in the UK have already been released, which turned out to be very mixed. Every month, retail sales grew stronger than the forecast minus 4.2% and amounted to minus 3.8%, and on an annual basis, instead of the expected growth of 2.8%, a figure of 2.4% was recorded.

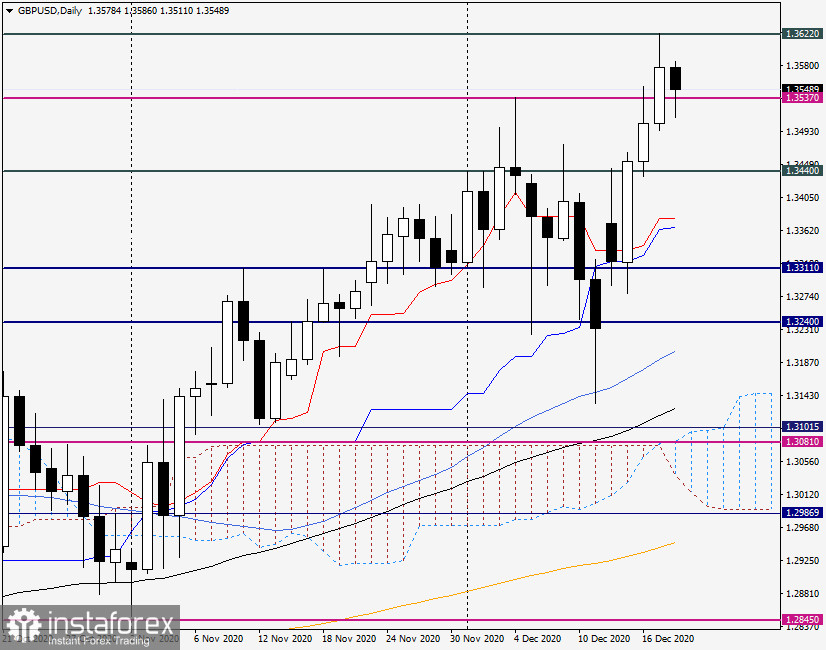

Daily

If we go to the technical picture for the pound/dollar currency pair, then after yesterday's growth and Thursday's closing price at 1.3577, today the pair rolled back to 1.3511, after which it is trying to recover. At the time of writing, the GBP/USD pair is trading near 1.3535. If the upward scenario continues, the bulls on the pound will have to once again test the strength of the resistance of sellers in the area of 1.3620. As previously expected, the price zone of 1.3600-1.3620 will be very difficult to pass, and so far this forecast is justified. After reaching the level of 1.3622 in yesterday's trading, the pair significantly bounced down, and so far the area of 1.3600-1.3620 prevents further movement of the quote in the north direction. Purchases of the GBP/USD pair are seen as relevant after a corrective decline to the area of 1.3515/20 or after a true breakdown of 1.3622 with a subsequent pullback to this level. Lower and more favorable prices for purchases of the British currency can be found in the event of the price leaving the area of 1.3510-1.3490 or after updating today's maximum values at 1.3586. At the same time, given that the Brexit negotiations have not yet been completed and new information may be received at the weekend, I do not recommend setting large goals and closing deals on the "Briton" today, before the end of trading. It is possible that on Monday, trading in the pound will open with a price gap, so you should remain vigilant and cautious.