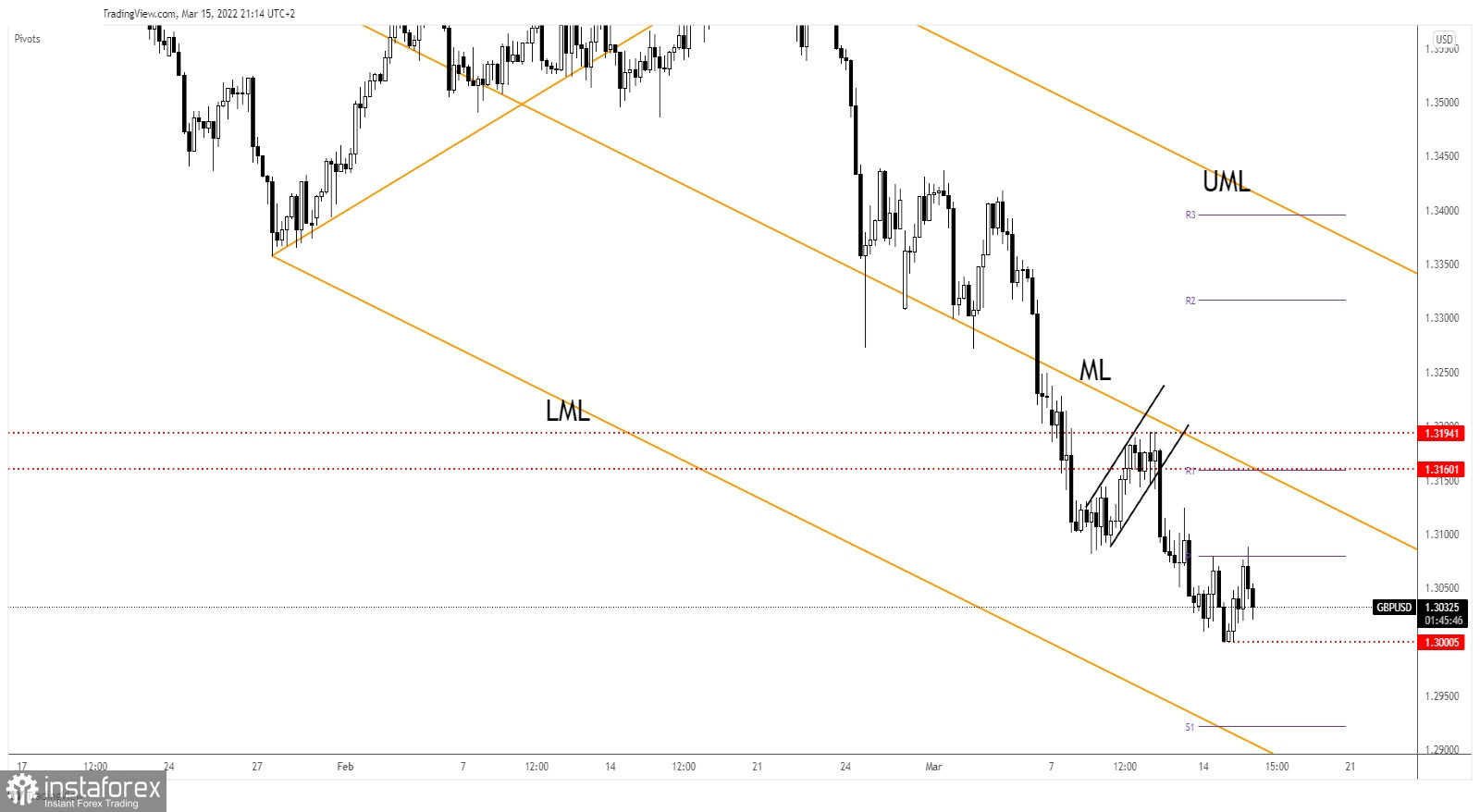

GBP/USD increased as much as 1.3088 today where it has found resistance. Now, it's trading at 1.3035. The bias remains bearish, that's why it could extend its downside movement. As you already know from my previous analysis, temporary rebounds could help the sellers to catch a new bearish momentum.

Surprisingly or not, the Pound depreciated even if the UK reported positive data. The Unemployment Rate dropped from 4.1% to 3.9% below 4.0% expected, the Average Earnings Index surged by 4.8% exceeding the 4.6% expected, while the Claimant Count Change came in at -48.1K versus 20.3K forecasts.

The GBP/USD pair lost altitude even if the US data came in below expectations. The PPI surged by 0.8% less versus 1.0% expected, while the Core PPI rose by 0.2% versus 0.6% estimates.

GBP/USD New Sell-Off!

GBP/USD pair retested the weekly pivot point of 1.3079. Its false breakout above this upside obstacle signaled that the sellers are still very strong. As you already know, the currency pair is somehow expected to register only temporary rebounds.

As long as it stays below the median line (ML), the bias is bearish, GBP/USD could drop deeper anytime. Still, technically, a larger drop could be activated by a new lower low, if the price drops and closes below 1.3000 psychological level.

GBP/USD Prediction!

In the short term, it could move somehow sideways between the pivot point of 1.3079 and the 1.3000 psychological level. The sideways movement could represent a distribution pattern. A valid breakdown below the 1.3 could open the door for a larger drop towards the weekly S1 (1.2922).