The world strongly looks forward to 2021 that it feels like it has already come. At least in the financial markets. The S&P 500 is constantly rewriting historical highs, demand for emerging market assets is off the scale, the US dollar is falling, and the EUR/USD pair has reached 1.23 at arm's length. The belief in vaccines and the victory over COVID-19 allows investors to expect that 2021 will be a year of explosive, and 2022 a consistently high growth of global GDP. These years may be boring compared to 2020, but the main thing is that they are not as sad.

Who would have guessed in early 2020 that international travel would require a health passport? That oil will trade below zero? That Germany will halt its constitution with the new Infections Act? That the richer EU countries will provide discounts to the less well-off? That social media will censor the US president's tweets? There were so many unexpected events that the dominance of the US dollar at the very beginning of the year looked like something taken for granted. Safe-haven assets are in demand in times of increased uncertainty, as soon as their degree begins to decline, they fall into disgrace. That's what happened with the USD index.

December became a kind of bridge between 2020 and 2021. It is unlikely that anyone was surprised by the pre-Christmas rally of EUR/USD. At the end of the year, the euro is traditionally popular, and that is all because of the monetary policy. At first, the ECB expanded the scope of QE but did not even mention rates. The Fed then maintained its previous forecasts for the federal funds rate, according to which it is unlikely to rise until the end of 2023. As a result, the main currency pair recoups yield spreads. And most likely, it will continue to do so in 2021.

Dynamics of EUR/USD and currency interest rate swaps:

We must admit that because of Donald Trump and the pandemic, the markets have gone out of their normal state, missed it, and will gladly return to it again. The main driver of exchange rate formation in Forex will not be the trade war and COVID-19, but the good old monetary policy. Given the fact that closer to the middle of 2021, we expect an acceleration in inflation, primarily due to the current increase in oil prices, we can count on the hawkish rhetoric of the world's leading central banks.

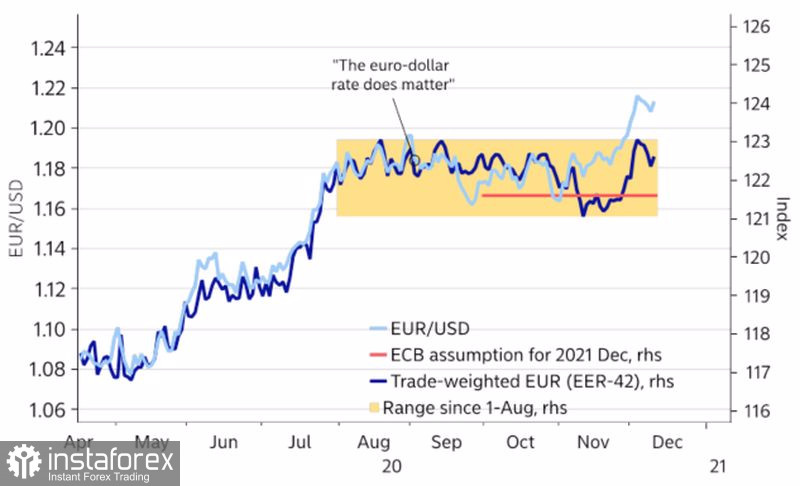

While the Fed sits on the sidelines and does not even think about raising rates, the hawks of the ECB continue to express their dissatisfaction with both the inefficiency of QE and the mechanism of direct financing of governments. It is unlikely that the European regulator is very concerned about the EURUSD rally because, given the increased demand for currencies of developing countries, the trade-weighted euro exchange rate is growing more slowly.

Dynamics of EUR/USD and the trade-weighted euro rate:

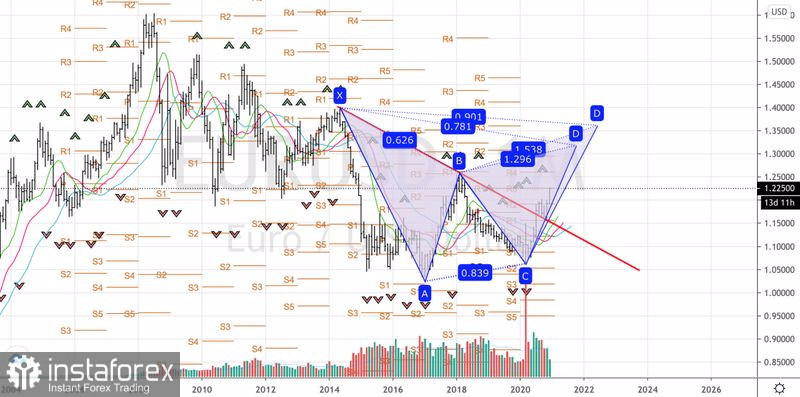

Technically, the formation of the Shark pattern continues on the monthly chart of the EUR/USD with targets at 78.6% and 88.6%, which correspond to the levels of 1.32 and 1.36. The upside potential is huge, so the strategies of buying the euro on pullbacks will probably work for a long time.

EUR/USD, monthly chart: