To open long positions on GBP/USD, you need to:

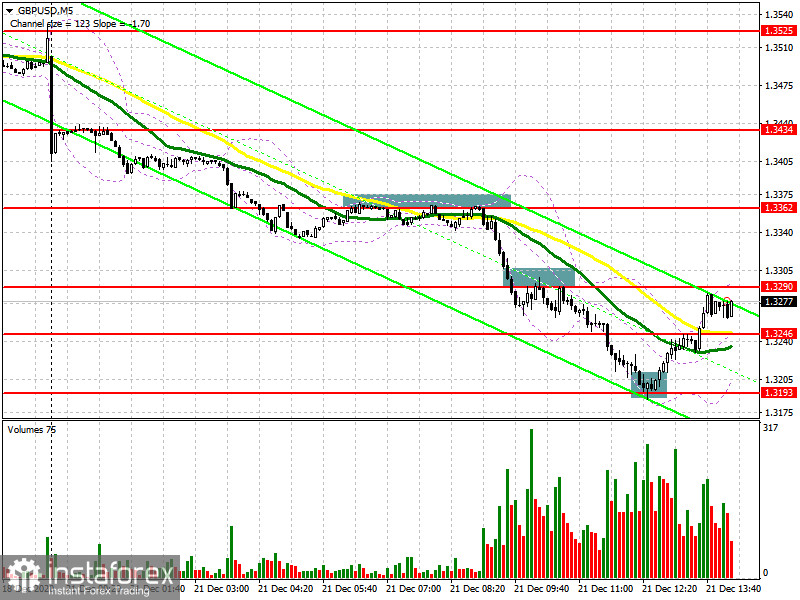

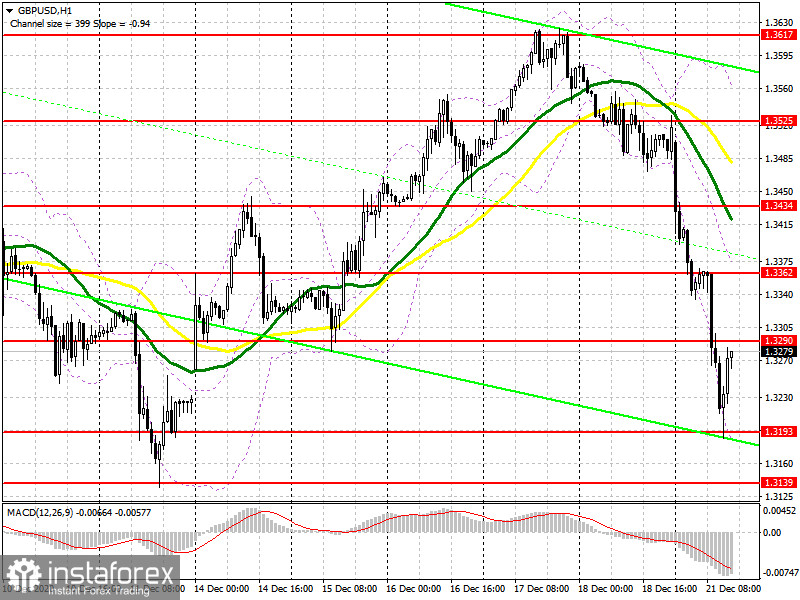

Judging by the restrictive measures applied to the UK in several European countries, the problems of the British pound are just beginning. In my morning forecast, I recommended opening short positions. In total, there were two transactions for sale, and one for purchase. Let's look at the 5-minute chart and analyze the entry points. In the morning, I advised selling the pound after forming a false breakout at 1.3362 further down the trend, which happened. The drop was more than 70 points. A breakout and consolidation below the level of 1.3290, with its reverse test, formed an additional signal to open short positions, which led to another sell-off in the area of the minimum of 1.3193. From this level, I recommended opening long positions immediately on the rebound with the expectation of an upward correction.

In the second half of the day, the main task of buyers will be to regain control over the resistance of 1.3290, to which the pair have now returned after rebounding from the low of 1.2193. Only a break and a test of the level of 1.3290 from top to bottom forms a signal to open new long positions in the expectation of the pound's recovery to the resistance area of 1.3362, from which the fall continued today during the European session. If buyers manage to gain a foothold above this range, you can expect the pound to recover in the short term, however, everything indicates more serious problems than previously expected. The aggravation of the situation with the spread of a new type of coronavirus, as well as the breakdown of trade negotiations on Brexit, may lead to a new wave of decline in the pound. If the pressure on GBP/USD continues in the second half of the day, I recommend looking at purchases from the level of 1.3193, but only if a false breakout is formed. You can buy GBP/USD immediately on the rebound from the minimum of 1.3139 in the expectation of a correction of 30-40 points within the day.

To open short positions on GBP/USD, you need to:

Bears kept the market under their control during the European session, arranging several serious sales. The risk of supply chain disruption and economic paralysis is putting a lot of pressure on buyers of the British pound, who are fleeing the market. The formation of a false breakout in the resistance area of 1.3290 will be another signal to open short positions. The nearest target in this scenario will be the support of 1.3193, where there will be another stop of the bear market. Only bad news on Brexit and the aggravation of the situation with the spread of a new virus can help sellers get to this level. In the absence of bulls at this level, most likely, the fall of the pound will continue to the area of the minimum of 1.3139, where I recommend taking the profits. If buyers manage to pick up the resistance of 1.3290, it is best to postpone sales until the update of the maximum of 1.3362, just above which the moving averages play on the side of the sellers of the pound. You can open short positions from this level immediately for a rebound, based on a correction of 35-40 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for December 15, there is a decrease in interest in the British pound, both buyers and sellers. Long non-profit positions fell from 39,344 to 35,128, while short non-profit positions fell from 33,634 to 31,060. As a result, the non-profit net position remained positive but fell to the level of 4,068 against 5,710 a week earlier. All this suggests that traders are taking a wait-and-see position, although a small preponderance of buyers, even in the current situation, continues to be observed. Given that the UK has imposed strict quarantine measures due to a new strain of coronavirus that is out of control, and for which there is no vaccine yet, counting on further strengthening of the pound at the end of this year will not be the right decision. Only good news on Brexit can bring new players back to the market, betting on the growth of GBP/USD.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily averages, which indicates that the bears are trying to maintain a downward correction in the second half of the day.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows, the average border of the indicator in the area of 1.3362 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.