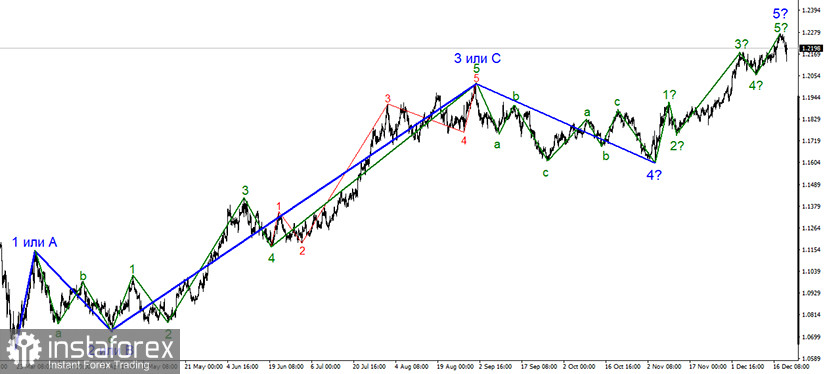

The wave layout of EUR/USD still indicates that the upward trend could be going on. Nevertheless, amid the pullback of these currency pairs from highs, we can suggest that the European currencies have exhausted the bullish momentum. Today is just one day of the euro's fall. However, any trend begins with the first day of decline. Therefore, I assume that we should be ready for a new downward trend section which could come as a correctional decline.

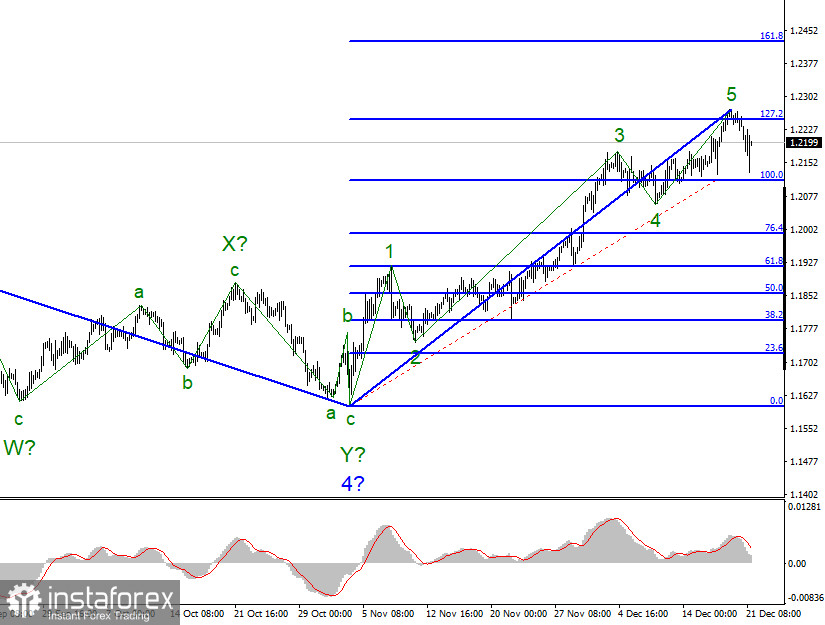

The wave layout in the chart of a shorter time frame also indicates a possible completion of the upward section. The wave structure of the supposed wave 5 looks rather convincing. So, a series of downward waves are set to be built now, at least a three-wave series. If it is true, EUR/USD is expected to continue moving downwards with targets at near 1.19 and lower.

The coronavirus headlines are setting the tone for EUR/USD on Monday. Over the weekend, the UK announced that it had identified a new strain of COVID-19. The new strain allegedly spreads 70% quicker than previous variants. The news was instantly detected by global investors, thus sending shock waves across financial markets. In a chain reaction, the oil market took a hit. If the world is set to face a new pandemic wave, this will deal a blow to oil demand. In response, oil prices went into a nosedive. Besides, a number of countries have already suspended air flights from the UK in efforts to prevent the new strain from entering their borders. This means that other countries imposed quarantine on the UK.

Third, the British government has already ordered an even stricter lockdown ahead of Christmas. British Premier Boris Johnson has made official announcements. This is sure to overshadow prospects of the British economy. Last but not least, cases of new infection have been confirmed in other countries. Thus, governments in other countries could be late to suspend travel from the UK. Indeed, the new COVID type could have already escaped from control spreading across Europe. Anyway, it is hard to contain in the Kingdom, Healthcare Minister Matt Hancock said.

To sum up, the world is on the verge of the new pandemic catastrophe. Scientists have not got an insight into the new COVID strain. So, the question is open whether available vaccines will be able to efficiently protect the human body from virus or a new vaccine is required. Anyway, the global economy is under threat of a slowdown and even a severe downturn.

A slump of the single European currency on Monday was triggered by a panic mood in the market. The same situation took place in March this year when the pandemic was logging rampant rates worldwide. Nevertheless, I guess it is a bit premature to go into a panic. So, the market is going to calm down in the nearest days. The first reason is that the world is aware of the coronavirus, thus the factor of uncertainty is out of the question. Second, to create a vaccine against a certain strain is a different than to create a vaccine from scratch.

Conclusions and trading tips

EUR/USD has supposedly completed a formation of the uptrend section. Meanwhile, I would recommend selling the instrument with downward targets at near 1.2000 and 1.1900 at every new MACD downward signal. At the same time, let me warn you that the wave structure of the uptrend section could get more complicated and lengthy picture.