Another rumor that London and Brussels are ready to make a number of mutual concessions in order to sign a full-fledged trade deal, became the reason why the pound significantly grew. Moreover, the growth was so strong that it not only won back a large-scale decline in the first half of the day, but also the gap with which these very trades opened. And it's all about fishing. More precisely, if you believe all sorts of rumors, the UK has expressed its readiness to make concessions on some other issues if the European Union agrees to reduce its requirements for fishing volumes. And these conversations are supported by the fact that according to news reports, Boris Johnson and Emmanuel Macron discussed issues related to the Brexit negotiations through a telephone conversation. And this is confirmed by both London and Paris. In general, the market has received a new hope for a successful outcome of this story. It was this optimism that caused the pound to rise.

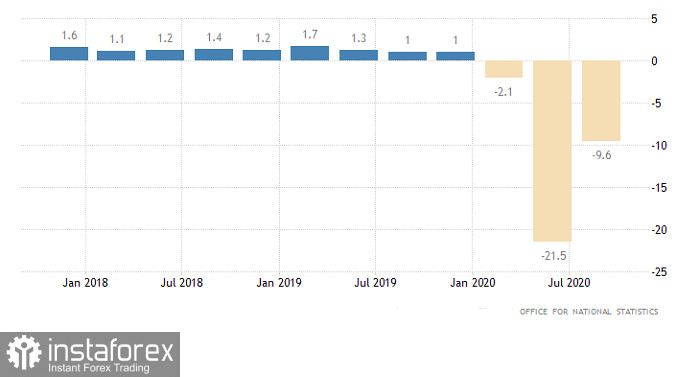

Most likely, just like yesterday, and for over the past few days, the market will only react to information regarding the course of negotiations, and they will not worry over any macroeconomic report. So the final UK GDP data for the third quarter will pass quietly and unnoticed. Moreover, they should coincide with preliminary estimates that showed a slowdown in the rate of economic decline from -21.5% to -9.6%. The point here is that not only is Brexit much more important, but that market participants have also long taken this data into account.

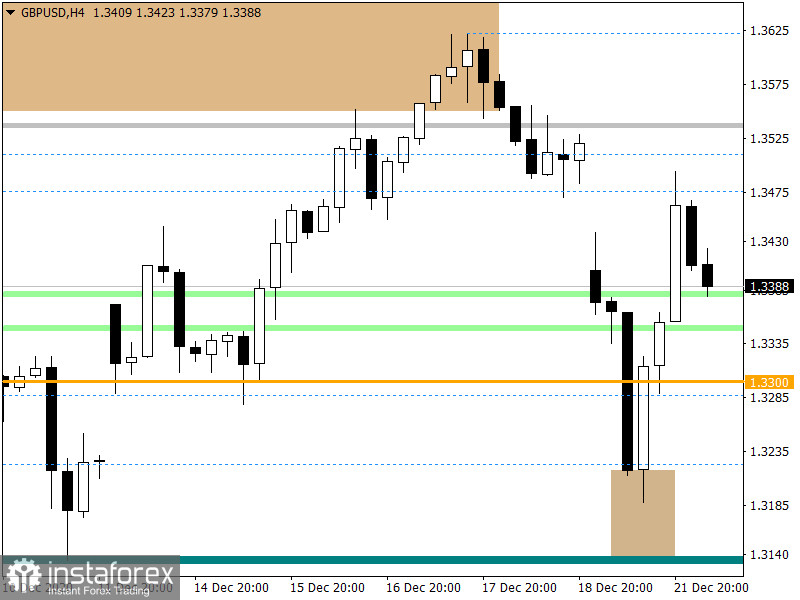

GDP growth rate (UK):

In many ways, the situation is similar with the US GDP. True, it will do without Brexit, and the whole thing will be limited to the fact that the final data must coincide with the preliminary estimate. If these very estimates are to be believed, the rate of economic decline has slowed down from -9.0% to -2.9%. And although it looks very good, the market has long ago incorporated all this into the value of the dollar.

GDP Growth Rate (United States):

After a rapid downward movement, the GBPUSD pair found stability in the 1.3200 area, where a slowdown and a recovery process occurred. At the end of the trading day, the price gap was closed, and the pound entered the positive area.

The market dynamics amounted to more than 300 points, which is considered a very high indicator and indicates speculative interest in the market.

Based on the quote's current location, you can see that traders view the recent gap as resistance, bringing the quote back to the 1.3380 level.

Looking at the trading chart in general terms, the daily period still shows a medium-term upward trend, at the peak of which a correction was formed.

We can assume that impulsive price fluctuations will continue to be present in the market due to the increased interest of speculators in the information flow. Depending on the nature of the news - Brexit - the subsequent speculative move in the market will be clear. This approach is considered as the main one in the market.

If we pay attention to the technical analysis, the key levels are the coordinates 1.3200; 1.3475; 1.3620.

From the point of view of complex indicator analysis, one can see that the minute and hour intervals signal a sale since the price rebounded from the price gap area. The daily period signals a sell due to yesterday's downward movement.