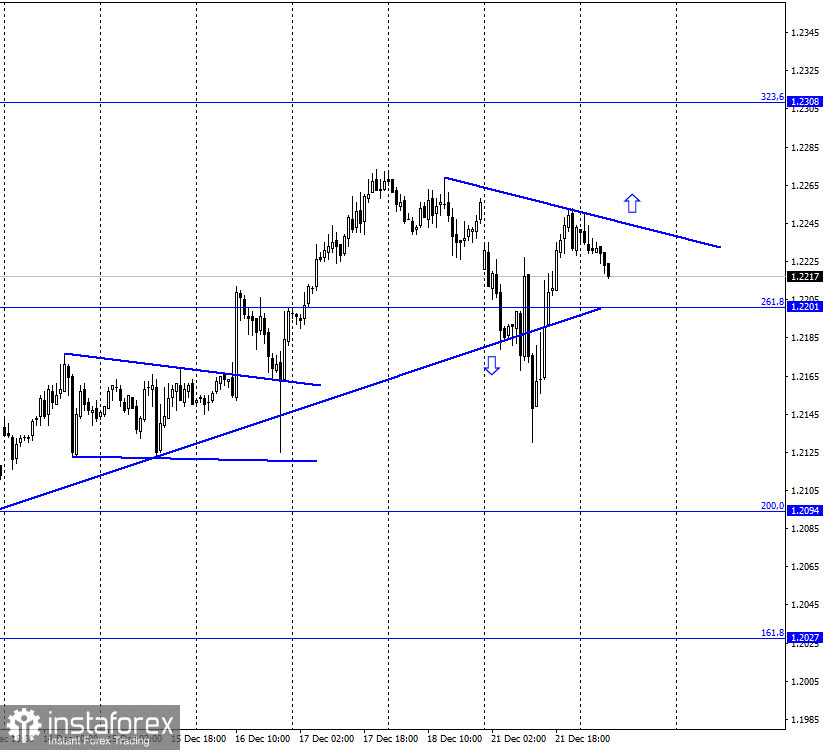

EUR/USD – 1H.

On December 21, the EUR/USD pair performed a fall under the upward trend line, followed by a reversal in favor of the EU currency and growth to the opening levels of the day, after which it again performed a reversal in favor of the US currency and began a new process of falling quotes. A new downward trend line has also formed, which characterizes the current mood of traders as "bearish". Fixing the pair's rate above it will allow us to count on a new increase in the euro's quotes in the direction of the corrective level of 323.6% (1.2308). Traders did not have time to fully digest the information about the new strain of coronavirus and all the possible consequences of a new wave of the pandemic, as news came from America about the approval by the House of Representatives of a new package of financial assistance to the US economy, which has been discussed since the beginning of August. However, Democrats and Republicans, especially in the run-up to the presidential election, could not agree on it. And so, by the end of 2020, the two main parties of the United States still agreed on a package of measures for 900 billion. This package provides for payments to Americans of $ 600 (which is twice as much as in the spring), in addition to this, unemployment benefits will be increased by $ 300. The new agreement also includes measures to help companies most vulnerable to the pandemic and the resulting crisis. This applies to the service sector, airlines, and so on. About $ 300 billion will be spent on lending to small businesses. This news caused the fall of the US currency, as it means a sharp increase in the number of dollars in circulation. Also, this package of measures will have to spur inflation in the United States.

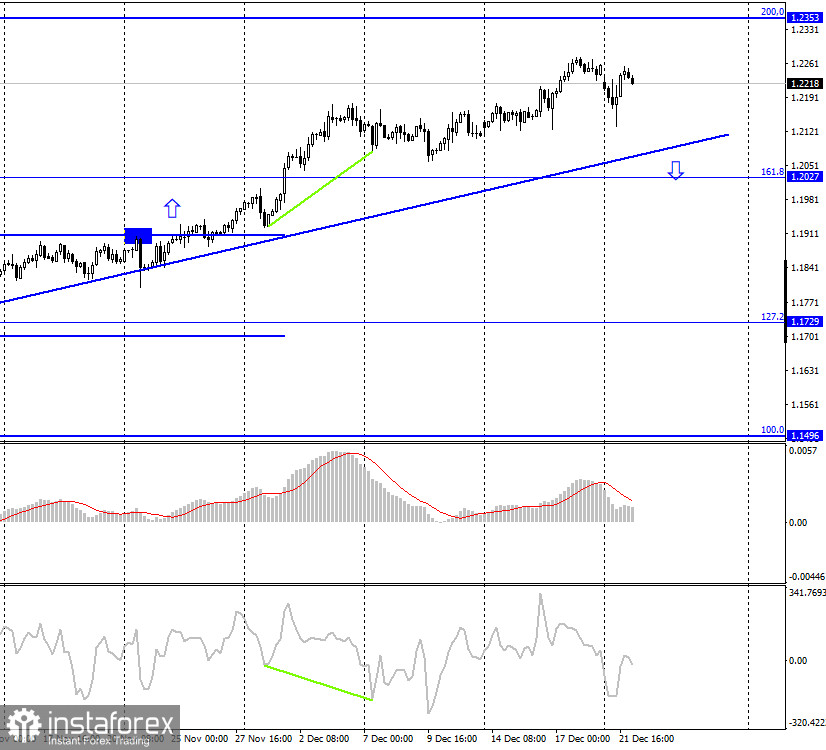

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency, but in general, they are trading between the corrective level of 200.0% (1.2353) and the upward trend line, which keeps the current mood of traders "bullish". However, I believe that it is better now to pay more attention to the hourly schedule, where you can track changes more quickly.

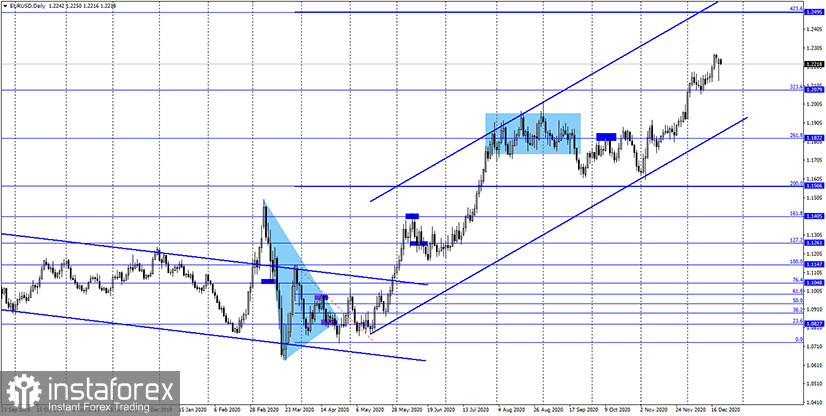

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth.

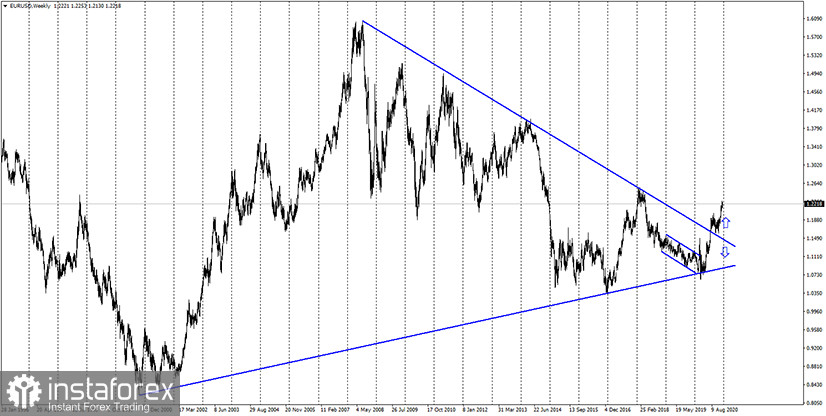

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 21, the European Union and the United States did not have a single important economic report or event. However, there was a lot of news that was not on the calendar, and traders reacted very actively to this news.

News calendar for the United States and the European Union:

US - change in GDP for the quarter (13:30 GMT).

US - consumer confidence indicator (15:00 GMT).

On December 22, a GDP report and a consumer confidence indicator will be released in America. Not the most important data in the current environment. Traders may trade less actively today than they did yesterday.

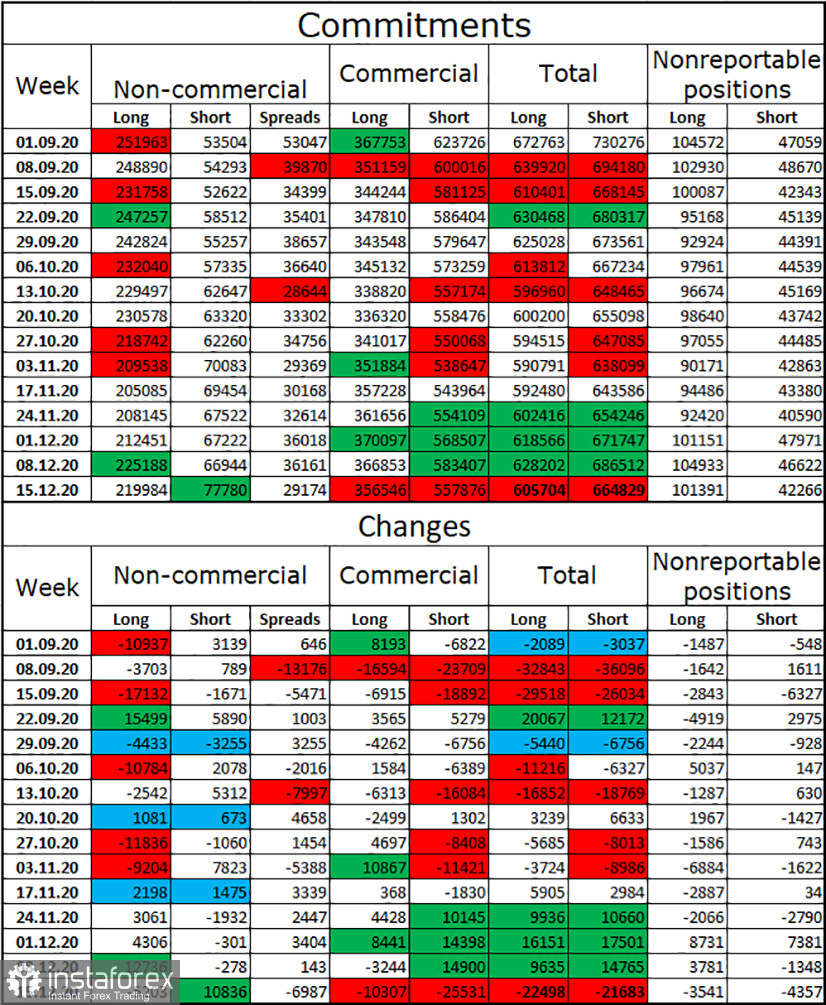

COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately collapse. The latest COT report shows that speculators are once again preparing for the fall of the euro currency, or at least for the end of its growth.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with a target of 1.2201, as there was a rebound from the trend line on the hourly chart. If it is fixed below the level of 1.2201, the pair may fall by another 40-50 points today. New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.