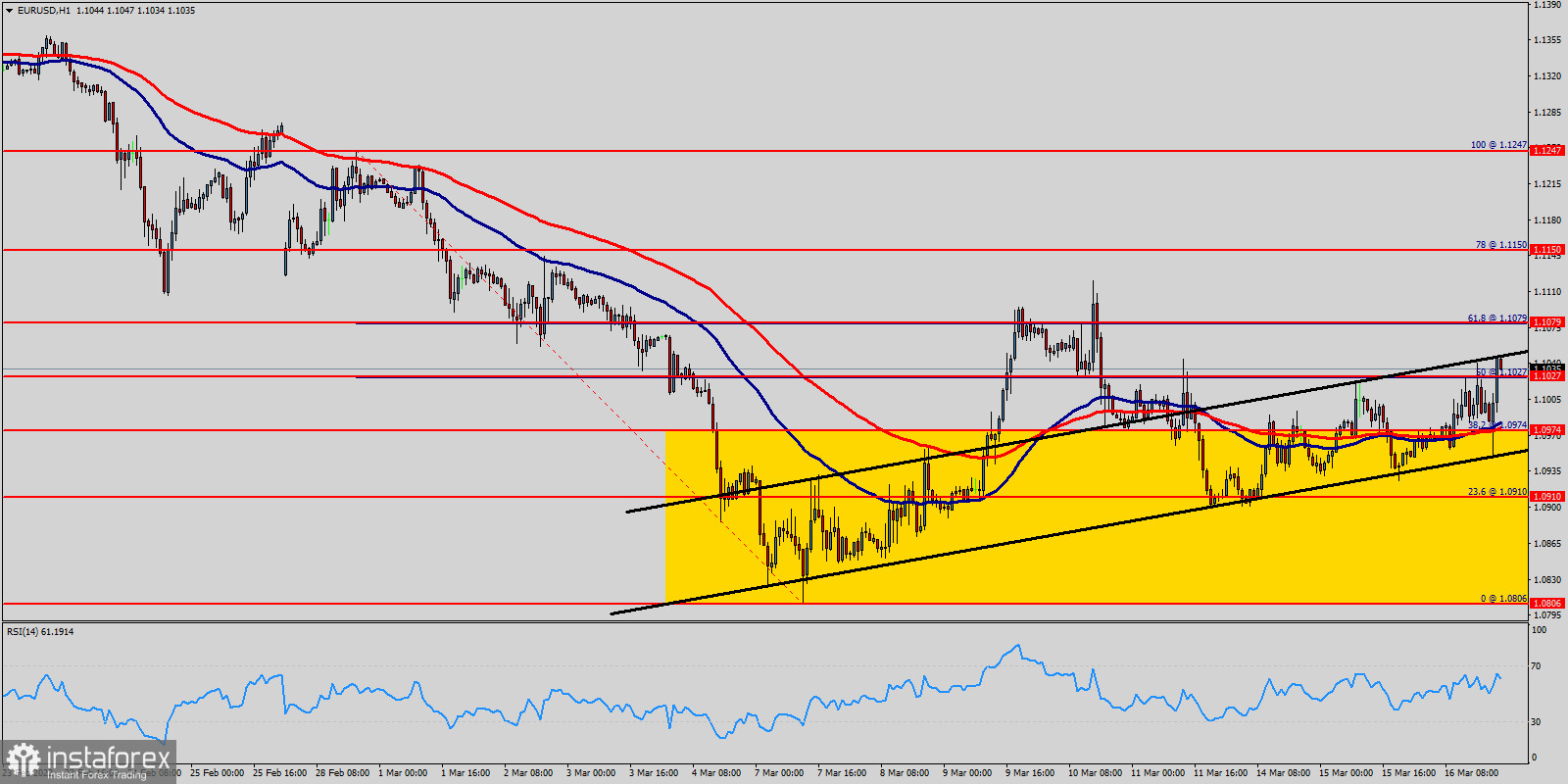

The EUR/USD pair continues to move upwards from the level of 1.0910. Yesterday, the pair rebounded from the level of 1.0910 to a top around 1.1030.

Today, the first support level is seen at 1.0910 followed by 1.0806, while daily resistance 1 is seen at 1.1150.

According to the previous events, the EUR/USD pair is still moving between the levels of 1.0910 and 1.1247; for that we expect a range of 337 pips (1.1247 - 1.0910) this week.

On the one-hour chart, immediate resistance is seen at 1.1079, which coincides with a ratio of 61.8% Fibonacci retracement.

Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100) and (50) since yesterday.

Therefore, if the trend is able to break out through the first resistance level of 1.1079, we should see the pair climbing towards the daily resistance at 1.1150 to test it.

Then, the pair is likely to begin an ascending movement to 1.1150 mark and further to 1.1247 levels. The level of 1.1247 will act as strong resistance, and the double top is already set at 1.1247.

On the other hand, the daily strong support is seen at 1.0910. If the EUR/USD pair is able to break out the level of 1.0910, the market will decline further to 1.0806 (daily support 2).