Once again, market participants are focused on information about the COVID-19 pandemic. A new one this time. As already known, the United Kingdom of Great Britain and several European countries, namely the Netherlands, Belgium, Denmark, Italy, and Australia, identified a new strain of coronavirus, which is supposedly 70% more dangerous than the usual strain of COVID-19. Let me remind you that this information appeared over the weekend and trading on the main currency pairs yesterday opened with a price gap in favor of the US dollar. I had to remember the dollar as a safe asset, which was preferred by investors in the situation with the aggravation of the coronavirus epidemic. However, such demand for the US currency was short-lived and soon gave way to its sales. This is especially evident in the price charts, which we will discuss a little later. In the meantime, let's talk about the macroeconomic events of yesterday and what reports can affect the course of trading on EUR/USD today. Yesterday can not be called rich in terms of important macroeconomic events, thus, there is nothing to highlight. Today's reports are also not full of their abundance, however, they are much more important than yesterday's statistics. So, at 14:30 (London time), final data on US GDP for the third quarter will be published. And at 16:00 London time, the indicator of consumer confidence will be published. Today's macroeconomic data from the United States seems to be quite important, however, it is another matter whether market participants will react to them.

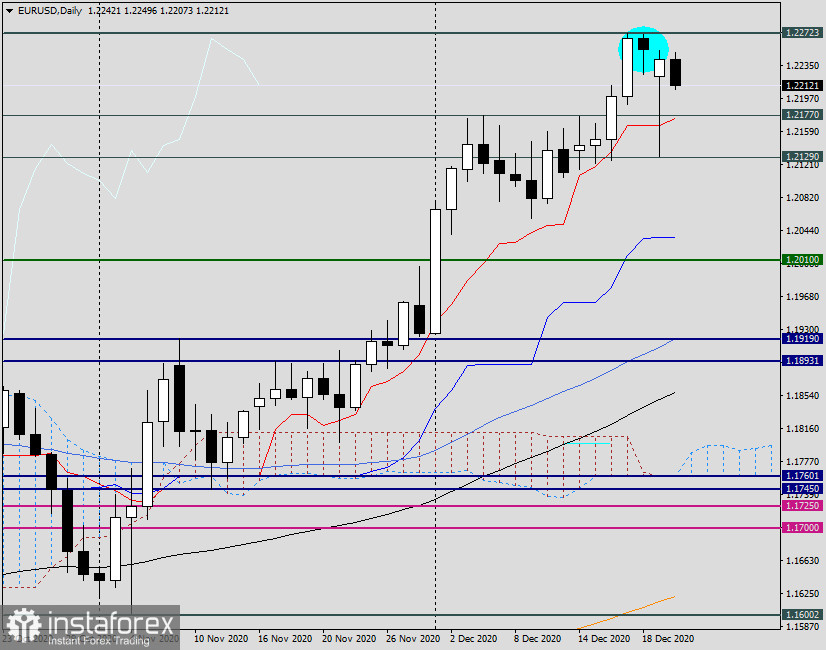

Daily

Looking at the daily timeframe, we see that an attempt was made to work out Friday's "hanged" candlestick analysis model, as a result of which the market was given a fairly decent pullback to 1.2130, where the pair found strong support and sharply turned on the rise. As a result, the price returned above the red Tenkan line of the Ichimoku indicator and the previously broken resistance of sellers at 1.2177. Moreover, Monday's trading closed at 1.2242, well above another important, strong, and significant level of 1.2200. Even though at the time of writing, the euro/dollar again shows negative dynamics and is moderately declining, yesterday's candle with a huge lower shadow leaves no doubt that the market is still set to move in a northerly direction. This assumption will be confirmed by a true breakdown of the sellers' resistance at 1.2272. The truth of the breakdown, in this case, implies a confident closing of the daily session above 1.2272 and the subsequent consolidation of the quote above this broken mark.

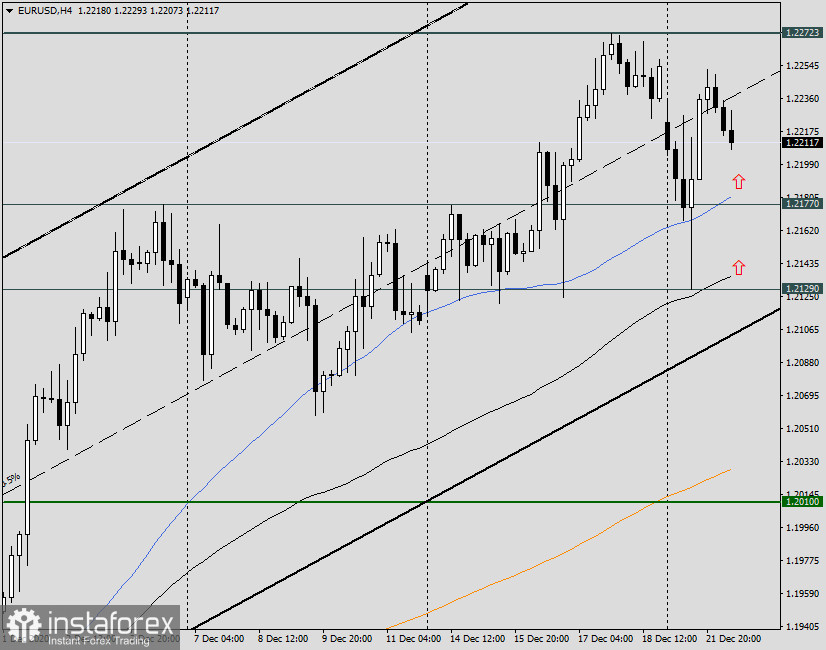

H4

On the four-hour chart, the pair moves in the ascending channel 1.1600-1.1800 (support line) and 1.1919 (resistance line). Since now trading is slightly below the middle line of this channel, there is a possibility of another decline to the broken support level of 1.2177 and to yesterday's lows in the area of 1.2130, where the lower border of this channel is not far away. Thus, according to the trading recommendations, I consider the most interesting purchases after the decline of the quote in the price zone of 1.2180-1.2135. If the expected pullback does not occur and the pair rushes to storm the resistance of 1.2272 from current prices, purchases can be tried on the breakout of this level or after its true breakdown, on the rollback to the area of 1.2280-1.2270. Given the market sentiment and yesterday's daily candle, it is better to hold off on selling for now.