EUR/USD

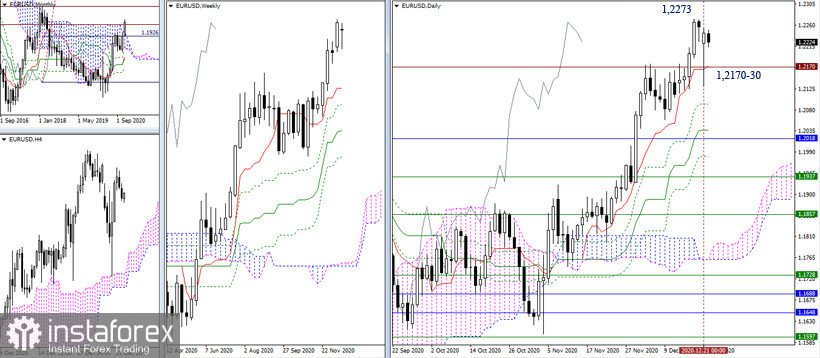

Yesterday's movement confirmed the hard struggle and the presence of someone's advantage in dominance of the current upward trend. Despite the impressive decline, the bulls managed to return and close the downward gap of the week's opening. So, the movement is underway again on the support of 1.2170 (historical level + daily Tenkan). Now, updating last week's high (1.2273) and consolidating above which will restore the upward trend. The task is not easy, but quite possible.

Another option is also likely in the current conditions. The pair may take a wait-and see-attitude soon and consolidate, which will lead to the formation of some variation of the weekly trend. If the bears still manage to break through the long lower shadow of yesterday's daily candle and consolidate below the support level of 1.2170 and the low 1.2130, then it will be possible to return to the option of continuing bearish mood.

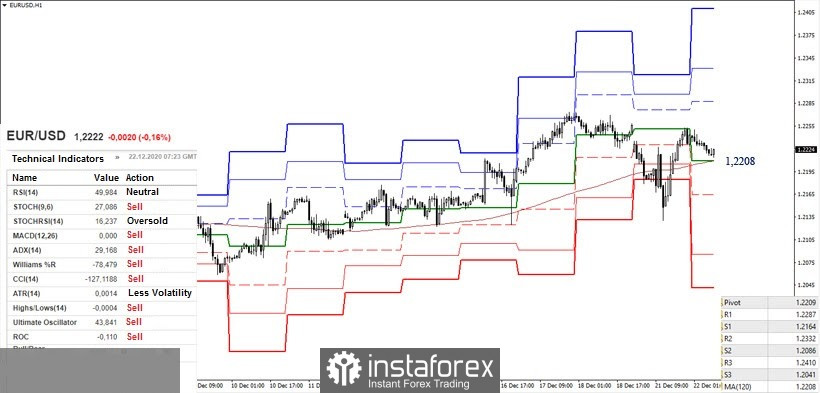

There is currently no clear predominance of forces on one-hour chart. However, the pair is above the key levels of the smaller time frames, which are now joining forces in the area of 1.2208 (central pivot level + weekly long-term trend) and acting as supports, so the bulls still have some predominance. The upward targets are 1.2273 (high) and 1.2287 - 1.2332 - 1.2410 (resistances of classic pivot levels). The loss of key level (1.2208) and consolidation below will swing the favor towards the bears. The possible downward targets are 1.2164 (S1) - 1.2130 (low) - 1.2086 (S2) - 1.2041 (S3).

GBP/USD

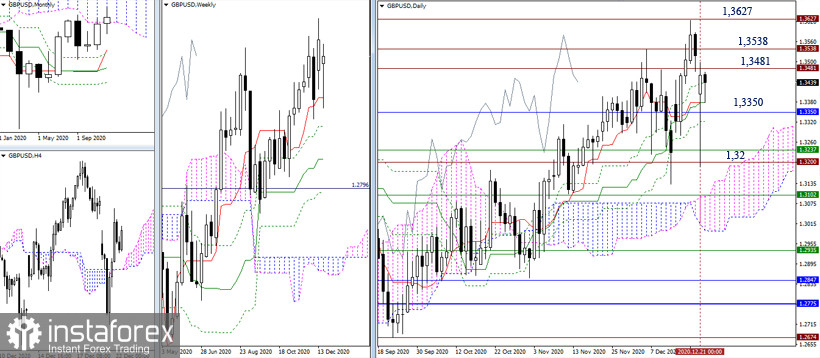

The historic level of 1.32, which has long served as resistance, is now helping bulls and acting as support. The pair returned to the monthly Ichimoku cloud (1.3350). As a result, the previously noted resistances 1.3481 - 1.3538 - 1.3627 are separated from the recovery of the upward trend, which led to the emergence of new bullish prospects. As for the bears, everything still rests on the support levels of 1.3350 and 1.32. Now, there is a high possibility that the situation will be delayed, resulting in some wait-and-see position.

The pair in the smaller time frame is between the key levels of 1.3382 (central pivot level) and 1.3466 (weekly long-term trend). In case of formation of uncertainty and persistence of instability, it is possible to move to the attraction zone. To reliably change the situation, it is necessary to go beyond the limits of the last movement – the high (1.3624) and the low (1.3187). Today, the resistances of the classic pivot levels are located at 1.3577 - 1.3693 - 1.3888, while the support levels are at 1.3266 - 1.3071 - 1.2955.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)