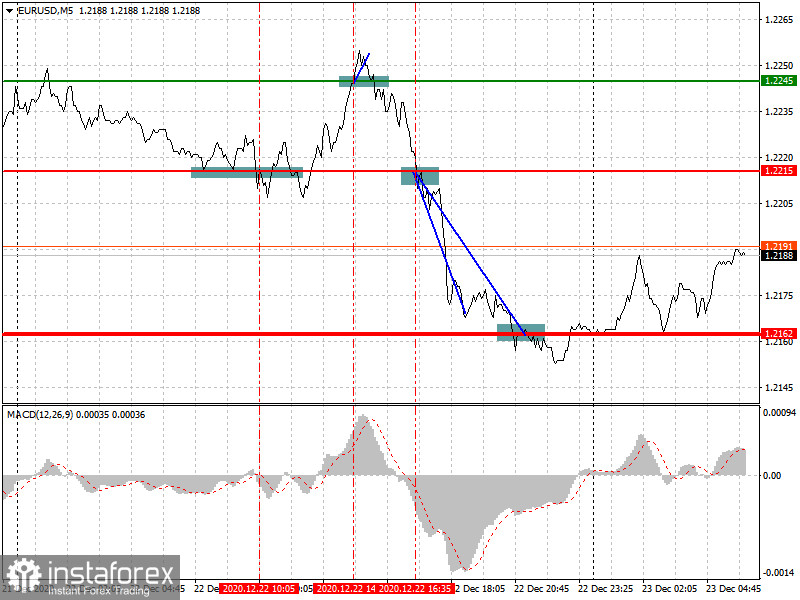

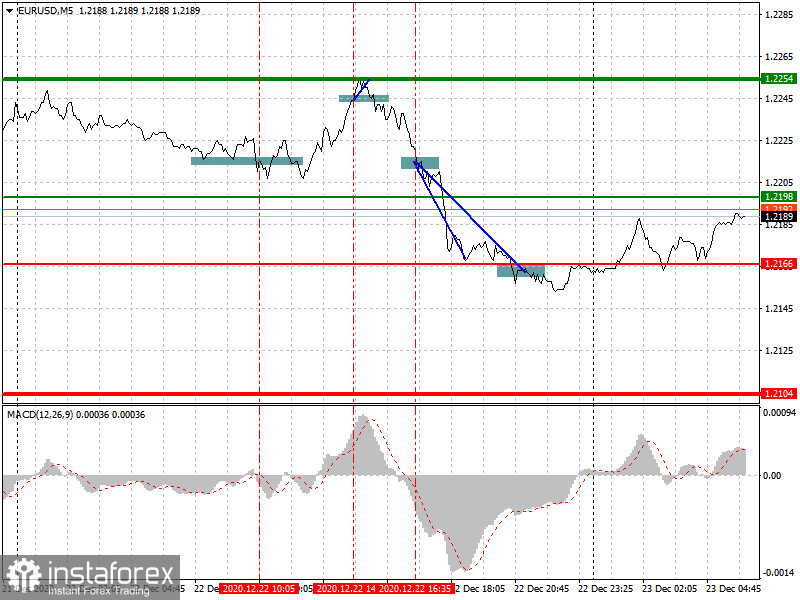

Analysis of transactions in the EUR / USD pair

There were three deals in the euro yesterday. The first one are short positions from 1.2215, which were quite promising. However, each time that the market went down, euro bulls were able to win back the whole movement. Meanwhile, the second deal are long positions from 1.2245, which were initially unpromising, since the signal was formed after a fairly large rise in the MACD indicator, which suggests that the euro is already overbought in the market. The third and most promising deal was short positions from 1.2215, which led to a large drop towards 1.2162. More than 50 pips were taken because of this transaction.

Trading recommendations for December 23

The movement of EUR / USD will depend on the situation regarding the new strain of coronavirus, on the upcoming data for jobless claims in the United States, and on the data on the level of income and expenses of Americans, which may fall sharply this November ... A weak report will most likely lead to a drop in the US dollar. However, no serious demand for risky assets will be observed.

For long positions:

Buy the euro when the quote reaches 1.2198 (green line on the chart), and then take profit around the level of 1.2254. However, growth can only happen if the data from the US come out worse than expected. A stronger upward move may also occur if a Brexit trade agreement was signed.

Also, keep in mind that before buying, make sure that the MACD indicator is above zero and is starting to rise from it.

For short positions:

Sell the euro after the quote reaches 1.2166 (red line on the chart), and then take profit at the level of 1.2104. Many are expecting a decline in EUR / USD because of the new virus in the UK and controversy over Brexit.

But keep in mind that before selling, make sure that the MACD indicator is below zero and is starting to move down from it.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR / USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR / USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD indicator - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

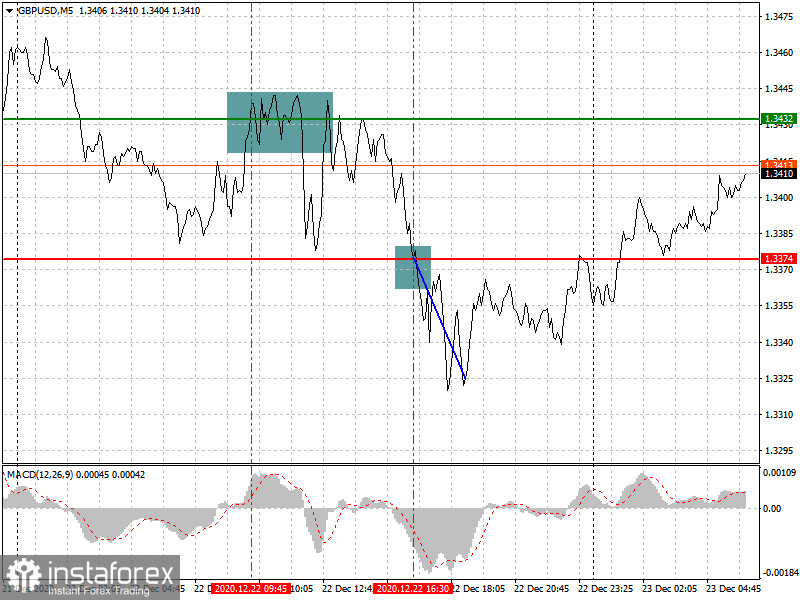

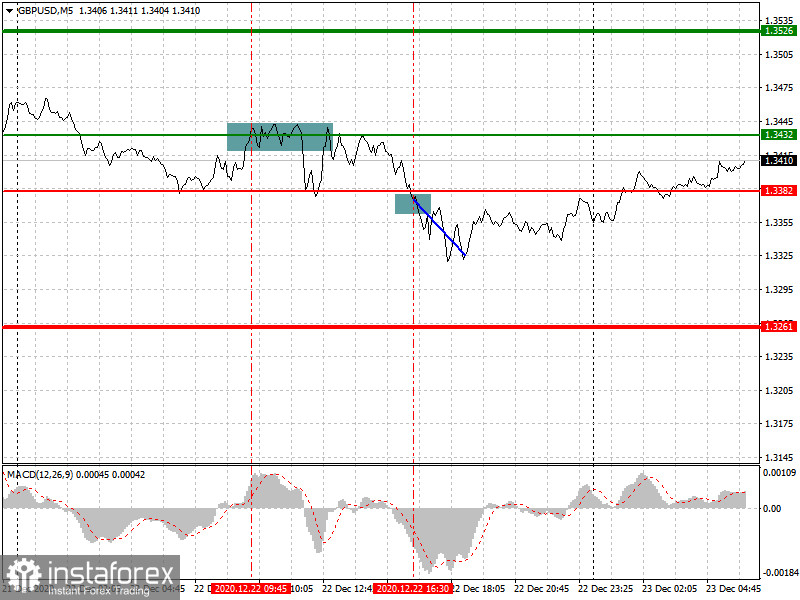

Analysis of transactions in the GBP / USD pair

Long positions did not lead to huge price jumps in the GBP / USD pair yesterday, even if there were prerequisites for it. Movement at 1.3432, plus the beginning of the recovery of the MACD indicator, formed a good buy signal in the pound, but after 5 unsuccessful attempts to continue the growth, pound bulls left the market. As a result, the GBP / USD pair declined and dropped to 1.3374. All in all, the downward move to 50 pips.

Trading recommendations for December 23

Despite the introduction of strict quarantine measures in the UK, the pound remained trading in a sideways channel in anticipation of Brexit news. Yesterday, the UK put forward a new proposal regarding fisheries, to which no response has been made yet. Therefore, the pound may continue trading in a sideways channel today, but in the afternoon, it may change direction because of the upcoming data on US jobless claims and level of income and spending of Americans.

For long positions:

Buy the pound when the quote reaches 1.3432 (green line on the chart), and then take profit at the level of 1.3526 (thicker green line on the chart). Good news on Brexit may lead to a price jump in GBP / USD.

But keep in mind that before buying, make sure that the MACD indicator is above zero and is starting to rise from it.

For short positions:

Sell the pound after the quote reaches 1.3382 (red line on the chart), and then take profit at the level of 1.3261. Bad news on Brexit, as well as on the situation with the coronavirus, will resume the downward trend in the GBP / USD pair.

Also, keep in mind that before selling, make sure that the MACD indicator is below zero and is starting to move down from it.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP / USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP / USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD indicator - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.