Demand for risky assets dropped sharply on Tuesday amid fears of rising COVID-19 incidence and the discovery of a new strain of coronavirus in the UK. Many EU countries have tightened their quarantine measures and closed their borders in response to this, in particular, transport links with the UK are now limited. At the same time, UK itself is in strict quarantine restrictions, which has led to the paralysis of a number of companies. If this new strain is also detected in other countries, authorities may follow the measures of UK, which will hinder the recovery of the global economy.

At the moment, it is not clear whether the current COVID-19 vaccines are effective against the new strain. Yesterday, BioNTech said that in two weeks, after all the research has passed, they will be able to conclude if their vaccine is capable of withstanding the new strain. But aside from that, they can also develop a new vaccine that will protect against the next strains. These statements, although not much, reassured investors and led to the strengthening of the euro and pound this morning.

But in the EUR / USD chart, it is clear that the euro is one step away from having a new wave of decline, in which the breakout of 1.2160 will most likely lead to a sharp drop towards 1.2080 and 1.2040. But if the euro bulls managed to consolidate the quote above 1.2210, the EUR / USD pair may move towards 1.2275 instead.

With regards to the highly-anticipated $ 900 billion bailout bill in the US, it failed to be enacted yesterday, as US President Donald Trump did not sign it.

Instead, Trump called on the Senators to increase direct benefits to $ 2,000, and said the $ 600 that the Congress has approved is absurdly small. According to him, the payment needs to be increased to $ 2,000 per person, or $ 4,000 per couple. Legislators were clearly not prepared for this, which led to the strengthening of the US dollar against the euro and the British pound.

GBP: The British pound declined on news that the European Union has rejected the UK's latest proposal on fishing rights. This dealt a blow to all the efforts the negotiators made in order to conclude a trade deal.

This week, UK Prime Minister Boris Johnson spoke with European Commission President Ursula von der Leyen twice in an attempt to break the existing deadlock in the negotiations. The UK put forward a proposal that the production volume of EU vessels (in UK fishing waters) should be reduced to 30%, which is significantly less than the 60% that the UK initially insisted. However, the bloc still refused to accept the cut.

And since Brexit is only days away from occurring, many have given up hope that a deal will be signed.

At the moment, the GBP / USD pair is still afloat, and the euro bears are attempting to bring the quote below 1.3350, as such will lead to a further decline towards 1.3240. The further targets of the bears are 1.2190 and 1.2135. But if the pound returns to 1.3445, the quote may be able to rise to 1.3525 and 1.3620.

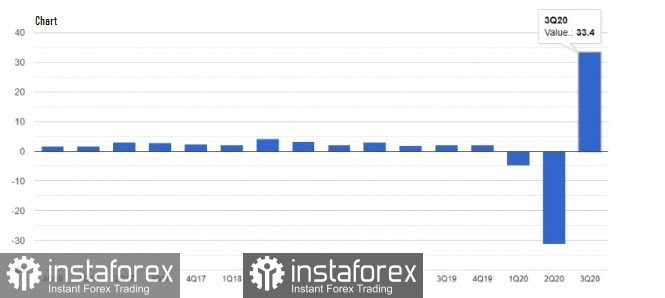

In another note, the third quarter US GDP report has been revised upward, which is a good signal for the US economy, but is unlikely to help in the future. According to the data published by the US Department of Commerce, GDP in the 3rd quarter grew by 33.4% per annum against the previous estimate of 33.1%. The growth was due to an increase in consumer spending and capital investment of companies

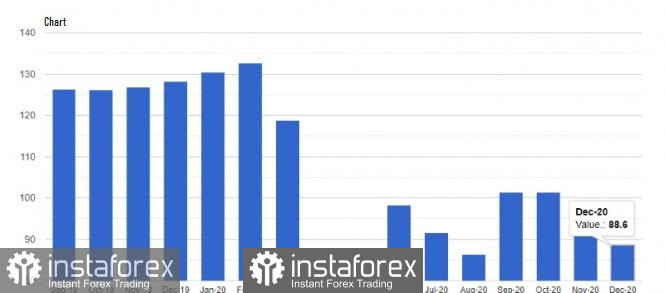

Meanwhile, consumer confidence in the US deteriorated sharply this December, as reported by the Conference Board. The persistent rise of COVID-19 cases, plus the tightening of quarantine restrictions, greatly affected the indicator. As a result, the index plummeted to 88.6 points in December, from its 92.9 points in November. Economists had expected the index to increase to 97.5 points. Consumers do not expect the economy to pick up in early 2021, therefore, the index will remain at fairly low levels in January.

Data on US home sales are also down, and this is clearly seen from the figures published by the National Association of Realtors. The report indicates that sales in the secondary housing market fell by 2.5% in November, and fills to 6.69 million homes per year. If compared to the same period of the previous year, sales increased by 25.8%.

Meanwhile, the median home price in the secondary market rose to 14.6% and to $ 310,800.

Today, a report on sales in the primary housing market will be published, where record low interest rates may lead to another increase in the indicator.

As for economic activity, the Richmond Fed said its Manufacturing PMI rose to 19 points in December, up from its 15 points in November.